Well, yesterday and today so far have been pretty solid days for The Oxen Report. Yesterday, we picked up some shares of DIG in the morning at 32.50 and were looking to sell at 33.15 – 33.47. We were not able to reach 33.47 but sold at the end of the day for 33.30 for a solid 2.5% gain. On the Short Sale side, we were looking at SRS for a short sale. The housing industry was a laggard yesterday, which did keep SRS up. We got into it at 8.12, looking for 7.96 – 7.88 for a sale. The ETF hit 7.96 briefly, and we did not sell. We got out at the end of the day at 8 for a solid 1.5% increase after covering. THE REAL GEM THOUGH is our Long Play of the Day from Friday with M/I Homes. We got into this one for an earnings boost coming in tomorrow. I said, however, if we got 5-6% before that, we should sell. Well, today the stock is up over 13%. We got in on Friday at 10.35. we were able to sell out at 10.97 for a 6% gain today. Pretty great trades.

Well, yesterday and today so far have been pretty solid days for The Oxen Report. Yesterday, we picked up some shares of DIG in the morning at 32.50 and were looking to sell at 33.15 – 33.47. We were not able to reach 33.47 but sold at the end of the day for 33.30 for a solid 2.5% gain. On the Short Sale side, we were looking at SRS for a short sale. The housing industry was a laggard yesterday, which did keep SRS up. We got into it at 8.12, looking for 7.96 – 7.88 for a sale. The ETF hit 7.96 briefly, and we did not sell. We got out at the end of the day at 8 for a solid 1.5% increase after covering. THE REAL GEM THOUGH is our Long Play of the Day from Friday with M/I Homes. We got into this one for an earnings boost coming in tomorrow. I said, however, if we got 5-6% before that, we should sell. Well, today the stock is up over 13%. We got in on Friday at 10.35. we were able to sell out at 10.97 for a 6% gain today. Pretty great trades.

3/3!!!

Let’s get into today’s Overnight Trade of the Day…

Overnight Trade of the Day: Pioneer Natural Resources Co. (PXD)

Analysis: Oil companies have across the board been doing fairly well this earnings season both on the main line and on the independent side. This has mostly been not to exceptional quarters but because of the fact that they were majorly undervalued in the Q4. Nearly every company to report has beat earnings. Yet, the market downturn over the prior few  weeks has made for some great buying opportunities on surprises.

weeks has made for some great buying opportunities on surprises.

Pioneer Natural Resources (PXD) is one of these companies that I am expecting a pop from after reporting earnings this evening. The company is expected to report an EPS of 0.05 vs. one year ago’s EPS of -0.15. Last quarter the company turned its first profit since 2007, reaching an EPS of 0.02. Two consistent quarters in the green will be pretty huge for PXD. Looking at their peers, I am confident in the estimates. All independent oil and gas companies in the past month that have reported have beat earning estimates. On the major side, we saw good beats by XOM and COP but Chevron was a miss. Overall, though, we are seeing that beats are much larger on the independent side.

Close competitors of PXD have not for the most part reported. One leader, though, is Anadarko Petroleum (APC), which beat EPS estimates by 0.33%. That was an almost 400% increase quarter to quarter. Oil industries, seeing stable oil prices, in most of Q4 were able to adjust business well.

The company is not expected to do much because it had a significant miss last quarter, but it was in the same boat as many in its industry that expected too much. That helps to create low expectations. So any beat, even a penny or two, will seem like such a large gain, and it will definitely provide a major boost to the stock price.

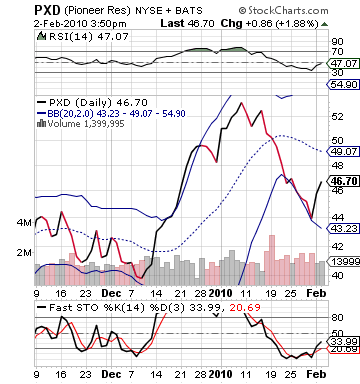

Technicals also make PXD extremely attractive to me. The stock has dropped more than 10% in the past two weeks, which creates a sexy buy. The stock jumped up of its lower bollinger band on Monday with the ExxonMobil results, but it still has a lot of upside to its upper bollinger band. In the short term, we can see buyer interest with fast stochastics. Despite the pop on Monday, fast stochastics are just turning upwards, which means a lot of buyers still have not gotten back involed. They are awaiting the results. We can beat that crowd by entering today.

I like a beat here. Get involved and watch for this one to pop.

IN PROGRESS

Entry: We want to enter today between 46.60 – 46.70.

Exit: We are looking to exit tomorrow morning on any increase. If decrease, we will have more information as to what to do.

Stop Loss: None.

Good Investing,

David Ristau