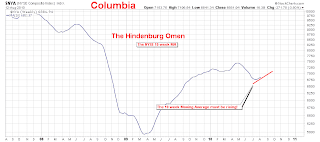

The Hindenburg Omen was triggered today!

Courtesy of MICHAEL ECKERT

Courtesy of MICHAEL ECKERT

The Omen finally got triggered today, first, a quick refresher of what the Omen is:

It is a set of conditions that, when met, greatly increases the odds of a large sell-off or crash of the markets. In fact no crashes in the last 22 years have happened without a confirmed Hindenburg Omen. Nevertheless, a confirmed Hindenburg Omen does not guarantee a crash. It only increases the chances of a severe market correction. The probability of a crash since 1985 after two or more HO signals are confirmed is 27%. On the other hand, without a confirmed HO, Bulls can sleep better at night knowing that most likely they will not awaken to the market being down 10%.

According to the traditional definition, a "Hindenburg Omen" occurs when the daily number of NYSE New 52 Week Highs and the daily number of New 52 Week Lows are both so high that the lesser of the two is greater than 2.2 percent of total NYSE issues traded that day. Why is this negative? Under normal conditions, there can be large number of stocks, setting new 52 week highs, or a large number setting 52 week lows, but not both. Things become out of balance when large numbers of stocks are setting new highs and new lows at the same time. Having one sector soaring, and another setting new lows is not good in the balance of a healthy market.

Two other sets of conditions have been added to the HO definition to filter out false readings. Here is a summary of what traders look for in identifying a HO signal:

1-The daily number of NYSE new 52 Week Highs and the daily number of new 52 Week Lows are both greater than 2.2% of total NYSE issues traded that day.

- The smaller of these numbers is greater than 69. This is a function of the 2.2% of the total issues (as of 7-12-2010, 69 issues are required for the 2.2% rule). Thus if 69 issues are making both new highs and lows, then the 2.2% rule has been satisfied.

2-The NYSE 10 Week moving average is rising.

3-The McClellan Oscillator is negative on that same day.

4-The new 52 Week Highs cannot be more than twice the new 52 Week Lows (but the new 52 Week Lows can be more than double new 52 Week Highs).

The 10 week Moving Average is trending upwards, satisfying rule #2.

The McClellan Oscillator is below "0", satisfying rule #3.

The McClellan Oscillator is below "0", satisfying rule #3.

The number of new 52 week highs today closed above 69, satisfying rule #1.

The number of new 52 week highs today closed above 69, satisfying rule #1.

The number of new 52 week lows surpassed 69 today, and closed at 76, satisfying rule #1. Because the number of new highs are not twice the number of new lows, rule #4 has been satisfied.

The number of new 52 week lows surpassed 69 today, and closed at 76, satisfying rule #1. Because the number of new highs are not twice the number of new lows, rule #4 has been satisfied.

So, the four conditions are met, now what?

We have an unconfirmed Hindenburg Omen, In order to have a CONFIRMED Hindenburg Omen, we need more than one unconfirmed Hindenburg Omen, or signal, within 36 days.

Once you get two confirmed Hindenburg Omens in a 36 day period, the probability of a severe decline does not seem to increase with more Omens. Multiple signals are telling us things are not getting better, that something continues to be out of balance in the markets. After confirmed Omens, market plunges can occur anytime between the next day and four months later.

Things are going to be very interesting now that we have a signal.

Source: Wikipedia.