New World Disorder – Watch the Stock Market

Courtesy of Allan of Allan Trends

Ironic, isn’t it? That the New World Order that been the source of so much fear and distress over the past decade finally makes its appearance as not the The World Order, but instead, The New World Disorder. It’s enough to long for the days of the Cuban Missile Crisis, Watergate, or Monica Lewinsky. At least then, we knew who the bad guys were. These days, they all are. This game is being played initially on "the Continent" but rippling across the sea in a smoke and mirrored morass of global debt and deceit.

Pan to Bill Griffith on CNBC ten minutes before the close. "The market is down 400 points," he bemoans, but in his own branded sparkling thumbs-up air of optimism finishes with, "But its well off of its low of -408 points just 20 seconds ago." Do I still have time to GO LONG?

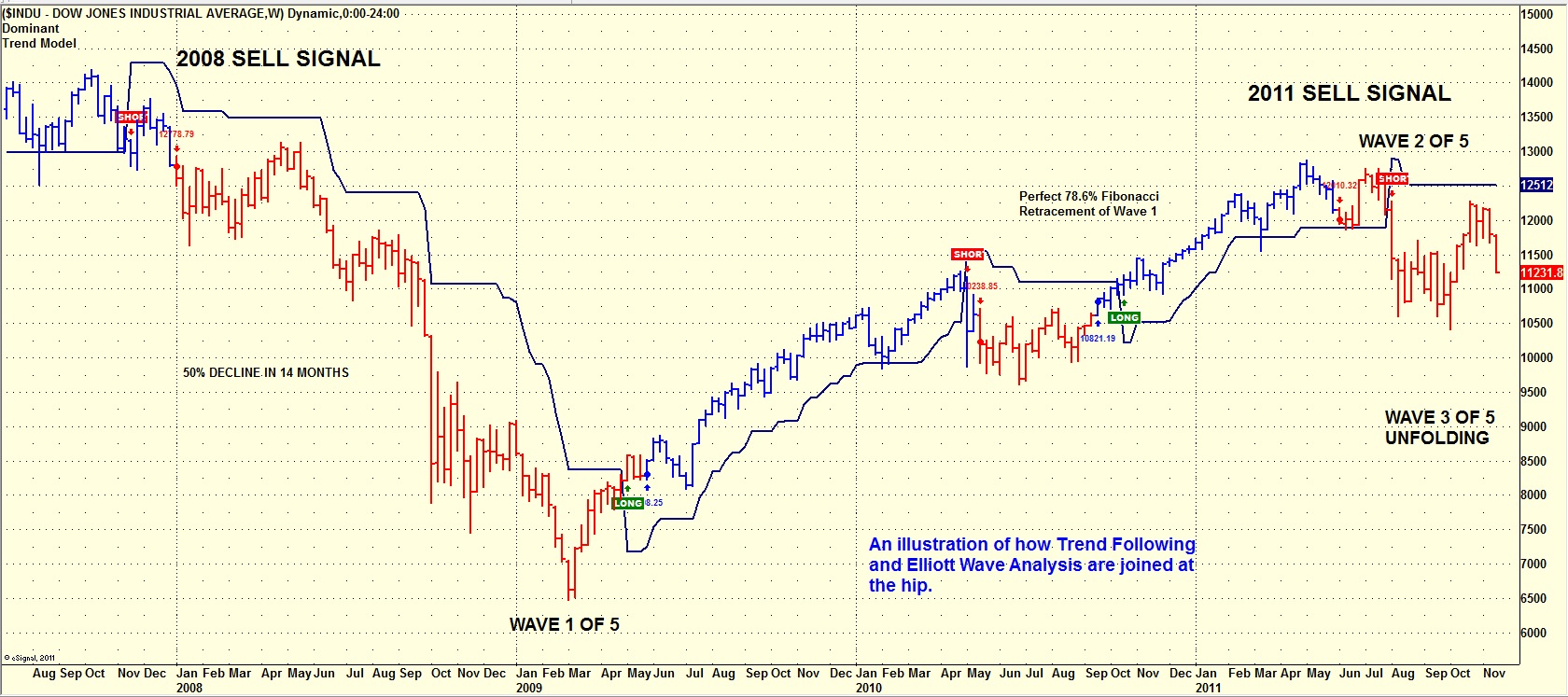

I eschew fundamental considerations, events, analysis in my trading. It’s much too random, short-term, arbitrary and oftentimes comical to add any insight into current and future price prediction. The disembowelment of the eurozone is already baked in cake and the cake is a chart of the US stock market. The chart below shows the Dow with my trends lines and sell signals, and my preferred Elliott Wave count. If the mid-summer sell signal of 2011 plays out similarly to the one in 2008, there may be a long, dramatic decline straight ahead.

In my weekend summary, I wrote, "IWM leads this Weekend Commentary because it generated a preferred wave count, the first of the major indexes to do so in their weekly models, and because of the dire implications of that count. The Wave 5 target for IWM is under 30. That is over a 50% decline in the Russell 2000, which would pretty much extend to all other indexes. Or, this past week could have been a major bottom and the market goes to new all time highs. However, the trends are all down, which the Elliott Wave count confirms, Europe confirms, the financials confirm, Iran confirms, MF Global confirms, shall I go on? If you’re in the business of gambling trading, these opportunities are few and far between, but are not slam dunks by a long shot (three cliches in one sentence). Nonetheless, this one is here now. Govern yourselves accordingly.”

The classic conundrum is what comes first, the chicken or the egg? Asked another way, what comes first, the financial shenanigans or the bear market? Or, appropriately for these times, what comes first, the breakdown of the global financial system, or a gut-wrenching stock market crash? Historically, the stock market skis down the hill first.

Argue all you want about who started the fire, I’m riding this trend to its ultimate destination.

Learn more about AllanTrends here. For a 30-day risk free trial, click here. >