Now what?

Now what?

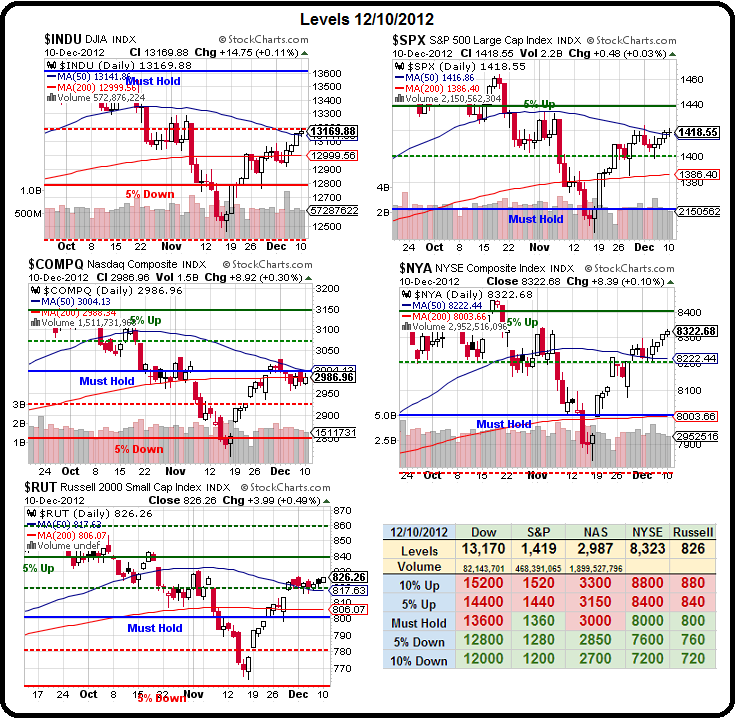

Suddenly we're heading back over our 50 dma lines and all that "death cross" talk is getting questionable (although the Nasdaq still needs an impressive recovery to avoid making theirs). As you can see from our Big Chart – we've wiped out most of that drop below our Must Hold lines and now, in the bigger picture, we're back to consolidating for what could be a big finish to the year.

Much of that, of course, is up to the Fed tomorrow and expectations are high for a big boost in QE to make up for the termination of Operation Twist. Anything less than an additional $45Bn a month pledged in tomorrow's statement will be disappointing enough to reverse us yet again so it's a little early to go gung-ho bullish – just in case the Fed disappoints.

We have no need to chase as we did our buying at the bottom – like HOV, which was our bullish featured pick in the morning post on November 16th, when the stock was at $4.30 (now $5.38 – up 25%). Like the trade ideas I've been posting this week, we found a way to make an even lower entry by buying the 2014 $4/7 bull call spread at .75 and selling the $4 puts for $1.40 for a net .65 credit that gave us a net $3.35 entry in the worst case. Not even a month later, the bull call spread is $1.10 and the short puts are .80 for net .30 – and that's in addition to the .65 original credit so .95 gained already.

These are nice, sensible ways to play stocks in a choppy market. We give ourselves 15-25% hedges to the downside – built into the spread – and we leverage our upside considerably so a 25% gain in the stock returns 146% on our investment. That same day, in Member Chat, we had additional bullish trade ideas on AAPL, IMAX, CLF, FAS and ABX – just a typical day of bottom-fishing at PSW.

These are nice, sensible ways to play stocks in a choppy market. We give ourselves 15-25% hedges to the downside – built into the spread – and we leverage our upside considerably so a 25% gain in the stock returns 146% on our investment. That same day, in Member Chat, we had additional bullish trade ideas on AAPL, IMAX, CLF, FAS and ABX – just a typical day of bottom-fishing at PSW.

We were fortunate, so far, to have made a pretty good bottom call at Dow 12,500 and now we just have to keep an eye on that 13,100 line and make sure it doesn't fail us. Once we get past the Fed tomorrow, we could be set up for a move back to 13,600 – if Bernanke can manage to instill a bit of investor confidence going into the close of the year.

There are still plenty of good opportunities out there. Just yesterday we still had plays on IMAX and AAPL in the morning post and, during Member Chat, we added bullish trade ideas on NOV and GDX early in the morning – in anticipation of another bullish day. GDX took off so tough luck if you are not a Member but NOV is lying flat so far and our trade idea on that one was an artificial buy/write, selling the 2015 $55 puts for $7.40 and buying the $60/82.50 bull call spread for $10, which is net $2.60 on the $22.50 spread that's currently $8.44 in the money so this trade gains 224% on cash if NOV simply flat-lines for 2 years. Any move up is just a huge bonus.

Of course, we have other strategies that let us generate a cash income while we wait for this position to mature and we discussed that in chat yesterday. Early this morning we discussed yet another bull call spread on AAPL, which has a 122% upside over 24 months with no margin requirements – these are the kind of opportunities we can take advantage of – even in this very choppy market.

Of course, we have other strategies that let us generate a cash income while we wait for this position to mature and we discussed that in chat yesterday. Early this morning we discussed yet another bull call spread on AAPL, which has a 122% upside over 24 months with no margin requirements – these are the kind of opportunities we can take advantage of – even in this very choppy market.

Asia was generally flat but Europe is up 1% this morning, mainly on news of German Investor Sentiment (ZEW Survey) jumping to 6.9 in December, a big reversal from -5.7 in November. This is the fist time the index has been positive since May and, as we discussed on Friday – the German markets have been kicking our asses all year and we'd rather see them do well while we try to catch up than to see them pulled down to our level, which is less than 1/2 of their gains for the year.

So plenty of room to run if investors get in the mood and that mood will depend on the Fed tomorrow and whatever Fiscal Cliff pronouncements we get out of Washington this week. Small Business Optimism is dreadful at 87.5, now heading back to 2010 lows. It isn't just the hurricane or the fiscal cliff – optimism has been declining all year but the break below 90 is very serious and is something we do need to keep an eye on next month.