View Single Comment

Good morning!

Things are looking up so far (so that's my prediction, StJ – 8) ) as Turkey jackboots their way to stability.

The Nikkie popped a lovely 300 points over 13,200 (oops, so I guess I already did say up at 4:09) despite the fact that the Yen barely made 97 before getting pushback (now 96.63). The Dollar's at 81.43 and the Euro couldn't hold $1.33 (now $1.328) but the Pound is way up at $1.567 so could go either way on the Buck. I'd take the money and run on /NKD if you haven't already (+$1,500) as I think this is it for the pre-market run (goes for all indices).

Oil is $95.44 and can't get over $95.50 so far (a line we can play short on /CL), gold is $1,376 despite the sheeple being stampeded out of stocks by the WSJ:

Silver hit $21.28 but failed there, copper with a big move from $3.17 to $3.23 but now $3.22 , nat gas going nowhere are $3.72 and gasoline being kept around $2.815 for as long as they can. Meanwhile, the FT becomes the first publication to finally realize the VELOCITY of money is what's killing us (my first day lecture at the AC Conference), not the supply:

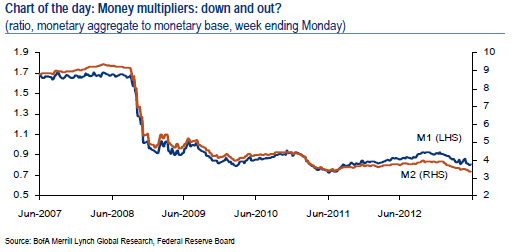

Want proof that monetary policy has reached the limits of its effectiveness? Look no further than the money multiplier, says BofA, whose research team amusingly notes that at 0.8, the M1 multiplier is "really a divisor." With the relevance of monetarist channels in decline, "it's all about fiscal policy now," says FT's Izabella Kaminska.

The channel through which money creation is expected to stimulate the economy is credit creation. However, not only has the money multiplier process broken down, but the linkages from money growth to credit growth are at best very limited, as Chart 2 reveals. Since the end of the Volcker disinflation, the correlation between year-on-year growth of M2 and credit (measured here as loans and leases by banks) is just 0.13%. Bank lending arguable is soft now relative to historical trends because both loan supply and demand are restrained — albeit gradually improving. High lending standards and regulatory uncertainty hold back supply, while slow growth, deleveraging and depressed collateral values keep demand low.

You can print infinite amounts of money but the practice of then giving that money to Banksters and the top 1% who use it only to create more wealth for themselves and don't "trickle down" to the bottom 90% gives you infinity times zero and your economy still sucks. Only when money makes it to the bottom 80% through job growth (300,000 – 400,000 a month, not 175,000, which barely keeps up with population growth), building and wage inflation can you have an expanding economy. Finally the FT gets it – let's hope some of our "leaders" begin to as well.

Same goes for Japan:

Although the chances are good that "the current economic upswing [will] gather further pace" in Japan, policies designed to alter demographic trends and boost the labor force participation rate are "unlikely to have a significant impact on economic growth," Credit Suisse says. As for boosting inflation, "there are a number of reasons to doubt that the BOJ … will achieve its target." The good news: Fears that inflation expectations combined with institutional selling could trigger a government bond (JGBL, JGBT, JGBS, JGBD) crisis are "probably exaggerated."

If all we do this morning is test 15,200 from the bottom on the Dow and 9,280 on the NYSE (weak bounce lines) and then fail those – that's going to be bearish so we'll key off those moves early on.

Wednesday's economic calendar:

7:00 MBA Mortgage Applications

10:30 EIA Petroleum Inventories

1:00 PM Results of $21B, 10-Year Bond Auction

2:00 PM Treasury Budget

Japanese shares (EWJ) have had another volatile day, falling as much as 2.4% before rebounding to close a mere -0.2%. European stocks (FEZ) have recovered a bit of poise after two days of declines, as has the dollar-yen rate (FXY), which is +0.75%. But the continuing theme of uncertainty about central bank stimulus is keeping markets on edge. Hong Kong and China closed. India -0.2%. EU Stoxx 50 +0.2%, London flat, Paris +0.2%, Frankfurt +0.1%, Madrid+0.65%, Milan +0.1%.

Japan's core machinery orders fell for the first month in three in April, dropping 8.8% on month vs +14.2% in March and consensus of -8.5%. On year, orders -1.1% vs +2.4% and -4.8%. The figures, which are a leading but volatile indicator of capex, show that companies are still reluctant to spend despite the government's and BOJ's stimulus policies. (PR)

The U.K.'s market supervisor, the Financial Conduct Authority, is reportedly considering opening an investigation into the alleged manipulation of WM/Reuters benchmark foreign-exchange rates, which are used to fix the value of trillions of dollars of investments. In a daily practice that has been continuing for at least a decade at major banks, traders front-run client orders and rig the rates by "pushing through trades before and during the 60-second windows when the benchmarks are set."

As expected, U.K. unemployment comes in at 7.8% in February-April, unchanged from November-January. The number of unemployed fell 5,000 to 2.51M. Inactivity rate +0.1 percentage point to 22.4%. Average weekly earnings excluding bonus in April +0.9% vs +0.8% prior and consensus of +0.7%. Claimant count -8,600 vs -11,800 and -5,000. Claimant count rate unchanged at 4.6%, as forecast. (PR)

First cut is the deepest: MSCI has cut Greece's classification to emerging market from developed market, making the country first to suffer such a demotion. MSCI attributed the move to Greece not meeting requirements related to securities borrowing and lending facilities, short selling, transferability and stock-index size. MSCI's decision follows similar action from Russell Investments in March.

Eurozone industrial production +0.4% on month in April vs +0.9% in March and consensus of -0.2%. On year, output -0.6% vs -1.4% and -1.2%. The highest increases in April were in Ireland (+3%) and France (+2.3%) and the sharpest declines were in Finland (-5.1%), the Netherlands (-4.3%) and Portugal (-3.6%). (PR)

Illinois had to pay a premium on the sale of a $600M 10-year sales-tax backed bond yesterday, with the yield of 2.94% 0.75 percentage point higher than triple-A-rated debt on a benchmark scale. The auction came after Fitch and Moody's downgraded Illinois last week due to its inability to address its growing unfunded pension liabilities. Next week, the state legislature is scheduled to hold a special session over the crisis, while in two weeks, Illinois is due to auction a $1.25B bond

Boeing's (BA) 787 jet has been hit by yet another glitch, with All Nippon Airways scrapping an internal Japanese flight after one of the engines failed to start. The cancellation is the third this week after Dreamliner services were recently renewed following a four-month grounding. Still, at least it appears that the battery wasn't the problem.

Wages going the other way at CAT: Caterpillar's (CAT) United Steelworkers employees have ratified a new six-year labor contract in what was described as a "very close" vote. The deal will freeze hourly wages for current staff for the lifetime of the agreement and pay new hires less. However, Caterpillar will hand out bonuses of $4,000 per worker in return for approving the contract, and it will pay veteran employees annual bonuses based on the performance of the company.

Amgen's (AMGN) blockbuster Enbrel drug for treating rheumatoid arthritis, which generated sales of $4.23B last year, is no more effective than a combination of three generic treatments, a study shows. While a regimen that includes Enbrel costs $25,000 a year per patient, the "triple therapy" costs just $1,000. The research didn't examine similar drugs from AbbVie (ABBV) or Johnson & Johnson (JNJ), although many doctors consider them to be equivalent to Enbrel. Despite the study, researchers feel that the branded treatments might be too well ensconced to be quickly replaced.

Institutional Shareholder Services has recommended that Sprint's (S) shareholders back SoftBank's (SFTBF.PK) latest $21.6B offer for 78% of the U.S. carrier. The proxy advisory firm also supported the Japanese company's $20.1B offer for 70% of Sprint. ISS ascribed its latest recommendation to the lack of other "firm competing bids" and improved terms. Dish (DISH) might have something to say about the first point, while Janco's Gerard Hallaren would disagree with the latter.

Vodafone (VOD) shares are -4.7% in London after its stock went ex-dividend today and following the company's confirmation that it is interested in acquiring Kabel Deutschland (KBDHY.OB). Vodafone has reportedly offered €10B for the German cable operator, whose shares are +7.4% in Frankfurt. That gives it a market cap of €7B.

- June 12th, 2013 at 5:58 am

![[image]](http://si.wsj.net/public/resources/images/OB-XU884_pageon_E_20130612004104.jpg)