Courtesy of David Grandey.

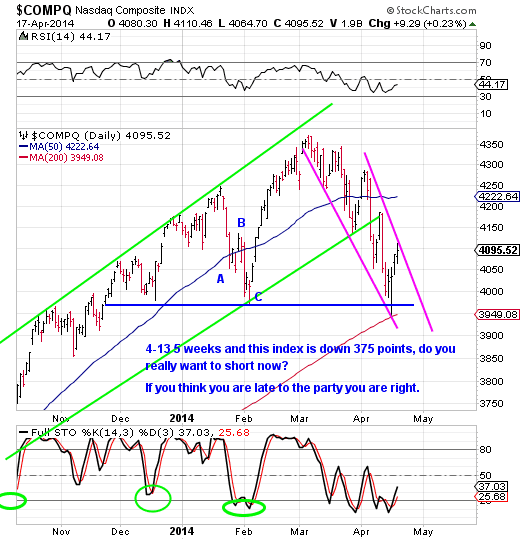

Last week, we said:

“However, both indexes are at or near MAJOR support levels. That means that we are ‘in the zone’ for a bounce of some sort in the next couple of days.”

And a bounce is exactly what we got:

But as you can see even with last week’s bounce, we are still locked in a downtrend.

As we look ahead to next week, should we break out of the downtrend to the upside, we’ll want to take advantage of buying stocks doing the same. And should we remain in a downtrend, we want to short stocks that are also locked in downtrends.

As we’ve said before: Success in the market comes from trading stocks in tandem with the indexes.

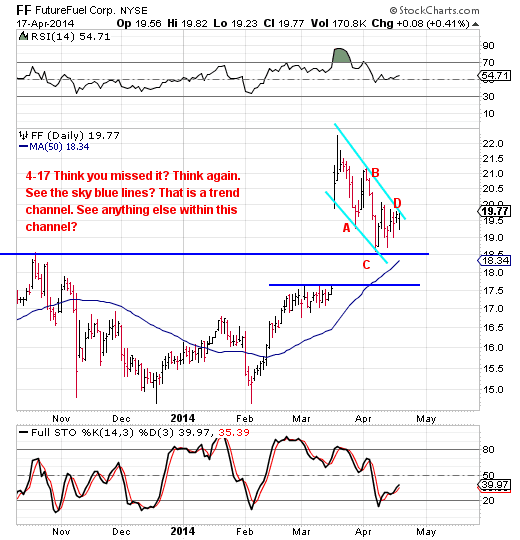

Should the markets break higher, then FF is an excellent long side candidate:

Here we have a leading stock that like the Nasdaq is in a mini-downtrend and pulling back to a prior breakout level. Think: “As go the indexes, so goes FF!” Ideally, we’d like to see FF continue to pullback to retest support at the blue line one more time. A break above the light blue line to the upside is your long side trade trigger.

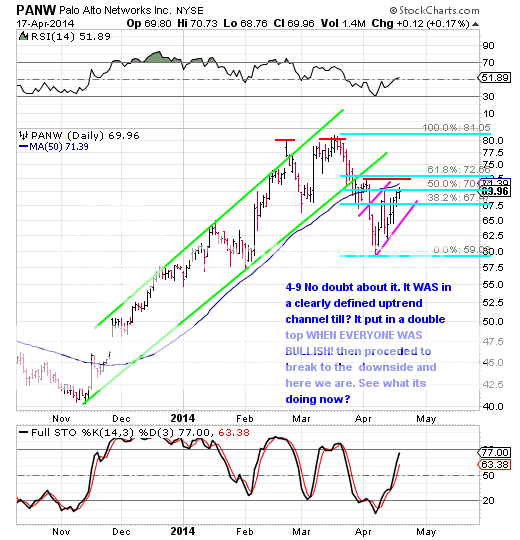

But should the indexes continue to be in a downtrend, then we’ll want to take short sell positions in stocks that are in downtrends like PANW:

This stock has rallied off of recent lows up to an area where it could easily find resistance — the 50-day moving average. A break of the pink line to the downside is your short sell trade trigger

Either way — whether the indexes go or down, we have set-ups for our members to enjoy profits.

To learn more, sign up for David's free newsletter and receive the free report from All About Trends – "How To Outperform 90% Of Wall Street With Just $500 A Week." Tell David PSW sent you. – Ilene