Courtesy of Benzinga.

Whole Foods Market (NASDAQ: WFM) traded down by 3.86 percent in the after-hours session.

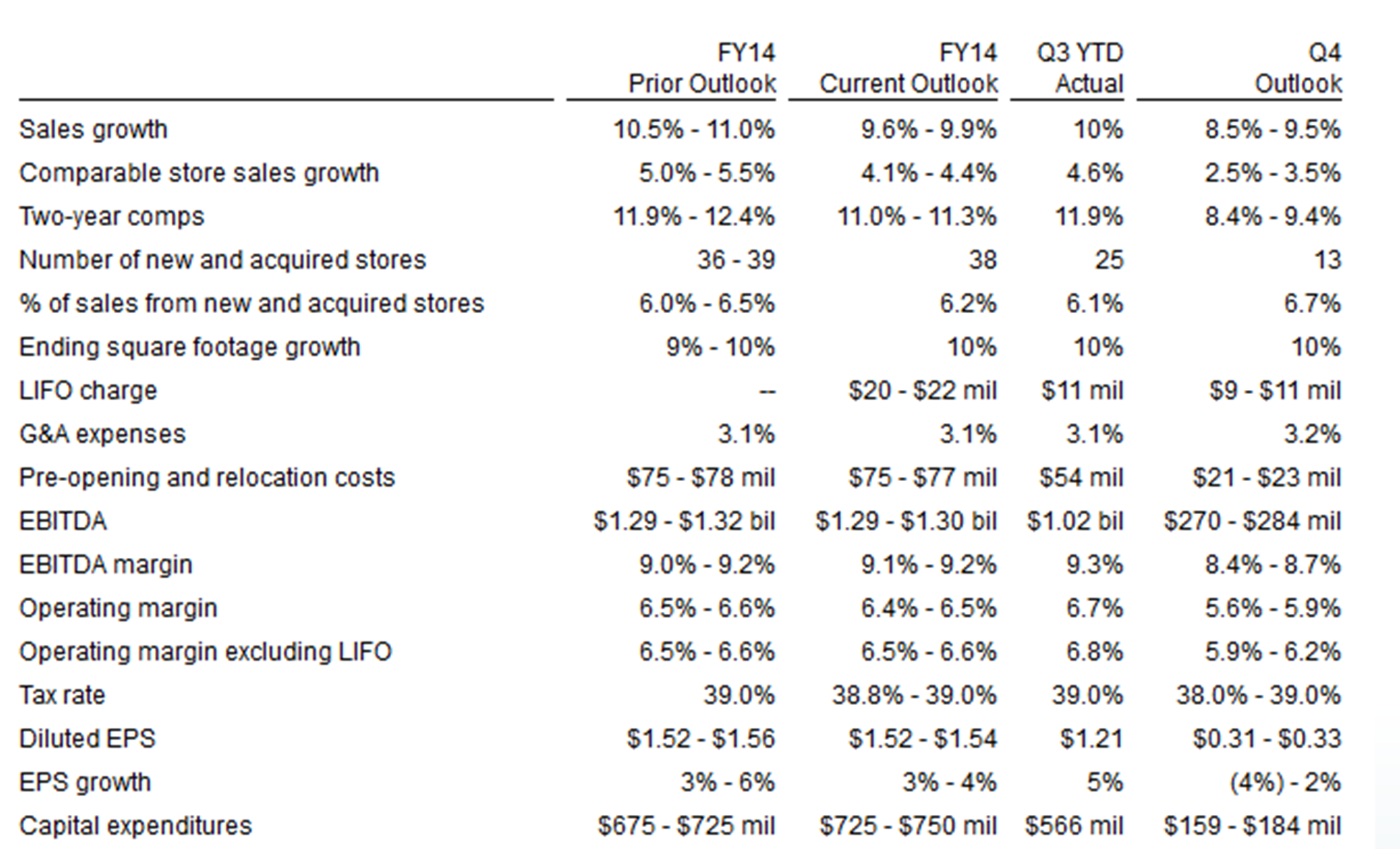

While top line and bottom line performance did beat for the quarter, the company’s downward revision on revenue, paired with upward revision to capital expenditure drove the price action in the after-hours.

Whole Foods Market reported Q3 EPS of $0.41 versus the estimated $0.39, beating by $0.02. EPS were up eight percent from the same quarter last year.

Source: Whole Foods Market

Prior outlook for FY 2014 was for 10.5 percent to 11 percent revenue growth; however current outlook was lowered to 9.6 percent to 9.9 percent revenue growth.

The decline in sales growth came from a more conservative outlook on comparable store sales growth 4.1 percent to 4.4 percent versus five percent to 5.5 percent for the full fiscal year. The decline in comp store sales may indicate that the high-end grocer is having difficulty with gaining new customers. Also, store square footage growth may not necessarily offset the impact from declining comp store sales.

On the bright side, the EBITDA margin range for FY 2014 increased from nine percent to 9.2 percent versus prior estimates of 9.1 percent to 9.2 percent. Despite a modest improvement in profitability, the decline in sales growth trickles down to a lower EPS growth outlook for fiscal year 2014.