Courtesy of Benzinga.

Shares of Caesars Entertainment (NASDAQ: CZR) are spiking on volume. The New York Post is reporting Caesars is in talks with senior creditors to restructure its debt.

Talks are rumored to be aiming at allowing senior debt holders to take positions Caesars most promising assets.

Imperial Capital cut its price target on Caesars by roughly 50 percent, issuing a new price target of $9. Analyst Gregg Klein has a Hold rating, writing, "…the 1st lien bonds will likely remain volatile as the company attempts to address its debt, particularly the 2nd lien notes. We would hold the 1st lien bonds at this time". AS for the 2nd lien bonds holders, Imperial believes "…bondholders could be swapped into equity at CEOC, or possibly at CZR, likely at a significant discount".

One of Caesars well-know creditors is David Tepper's Appaloosa Management, who is owed a payment of $400 million from Caesars in December, The Post noted. Tepper was one of two second-lien bondholders reported by Barron's to have issued a reversal request through a representative attorney seeking to have Caesars reverse "various asset sales and transfer from CEOC to other Caesars entities in the past year…".

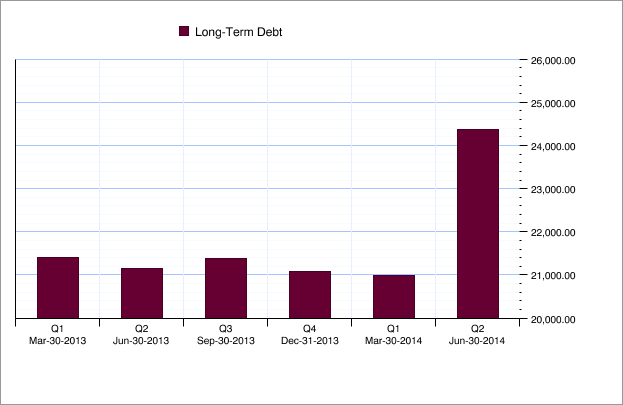

Caesars has long-term debt north of $24 billion after taking on roughly $4 billion during Q2 2014.

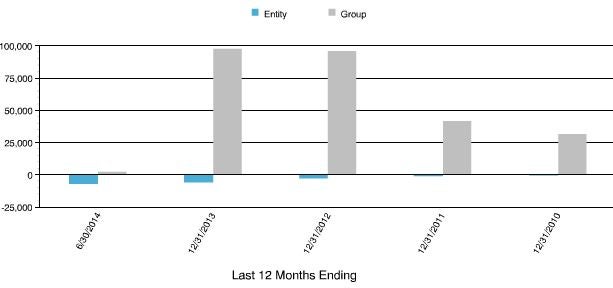

Capital IQ highlights the nearly obsolete Total Equity available in Caesars compared with its industry group:

Shares of Caesars traded down roughly one percent during Thursday's session to $13.23.

Posted-In: Analyst Color News Legal Analyst Ratings