Oil is not the first commodity to crash in the post-crisis period

Courtesy of Joshua M Brown

Courtesy of Joshua M Brown

Oil prices are now at their lowest level in five years, having sold off some 45% from their June peak, a scant five months ago. It’s a crash.

Lower oil and gas prices are good for the economy but an oil crash is probably not.

Let’s allow for some nuance in this discussion.

I believe that a sub-$3 dollar per gallon price at the pump is wonderful for the American consumer – and the American consumer is 70% of the economy. I am not so naive, however, to believe that a crash in oil and the subsequent rolling bankruptcies that would come from something like that would be a positive.

We live in a highly financialized society in which everything has become investable, tradeable, hedgeable and eligible for collateralization. This means that crashes of any kind can have reverberations throughout the system and engender new and unplanned-for risks that no one can see coming.

That being said, the economy and the stock market have endured through endless commodity sell-offs over the last few years. We’ve digested plunges in coal, copper, corn, wheat, iron ore, steel, uranium, fertilizer and natural gas during the post-crisis recovery period, just to name a few. None of these price implosions, whether demand-driven or supply-driven, have been substantial enough to derail the bigger picture, although each had it’s moment during which it captivated our attention and weighed heavily on sentiment.

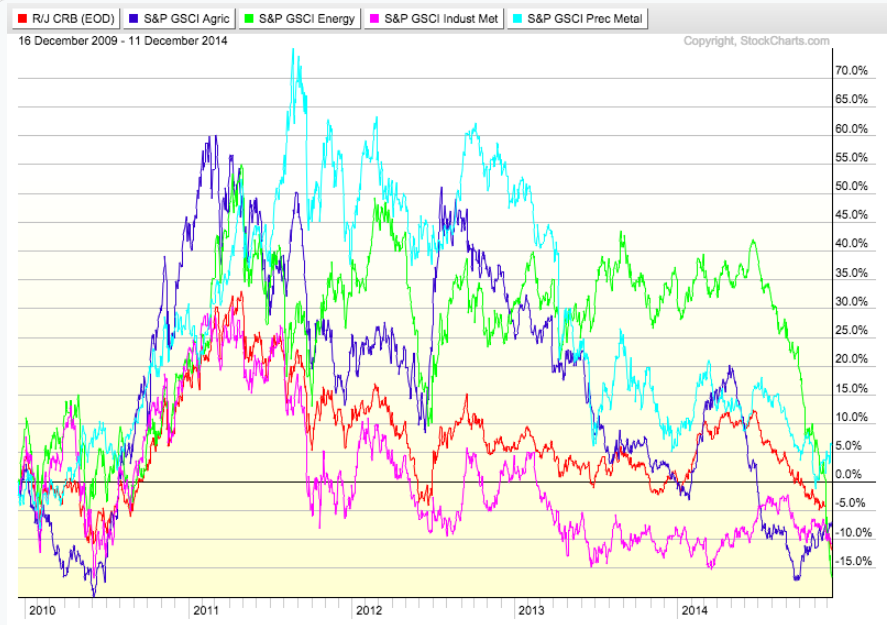

Have a look at various commodity groups and the crashes in each since 2010. The losses have been astounding and yet the economy and stock market have rolled on without a problem:

I agree that oil is bigger and, perhaps more important, to the economy and the financial markets than copper or corn. But I do not agree that a crash is assured and I certainly don’t think we’re going to stop driving our cars and trucks altogether in the next few years. There may be pain for some leveraged companies and producers in the sector, there may be stalled projects and layoffs and other strife. But the beauty of American-style capitalism is in its offsets. And so far, the benefits are outweighing the negatives.

Oil is not the first commodity to crash in the post-crisis period. It is worthwhile to be concerned but it is ahistorical to predict something much worse as a result.