Courtesy of Benzinga.

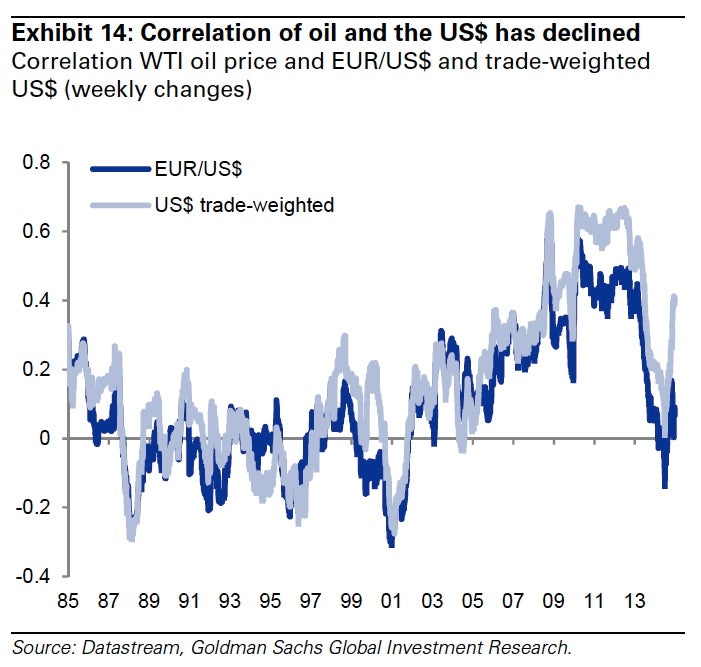

Goldman Sachs commented on the correlation between oil and the U.S. dollar in a report issued Tuesday.

Analysts led by Christian Mueller-Glissmann noted that a smaller U.S. trade deficit and “new oil order” is causing a “breakdown in the correlation between oil prices” and the dollar.

“In the 2000s, high oil prices resulted in a positive correlation with the US$, as the US was running a large petroleum current account deficit. Until the GFC, increasing oil imports saw a widening US current account deficit, which put depreciation pressure on the dollar (appreciation pressure on oil-producer currencies), which, in turn, added further widening pressure on the current account deficit (for any given volume of imports), causing additional dollar weakness,” according to the analyst report.

Due to increased production from shale and the following reduction in oil imports, the “dollar/oil correlation should remain low with lower oil prices, longterm surpluses, and a more flexible oil supply.”

Overall, Goldman Sachs has downgraded commodities to Underweight on a three-month basis and Overweight on a 12-month basis as lower oil prices drive cost deflation in the broader commodity complex.

The firm expected WTI oil prices to hover around $40/bbl for the first half of 2015, “which should slow supply growth and balance the global oil market by 2016” after which prices are expected to rise to the marginal cost of production which is $65 for WTI and $70 for Brent.

The United States Oil Fund LP (ETF) (NYSE: USO) recently traded at $16.77, down 2.53 percent. It has fallen 45 percent in the past three months as oil prices declined.

Posted-In: Christian Mueller-Glissmann Goldman SachsAnalyst Color Commodities Markets Analyst Ratings