Courtesy of Benzinga.

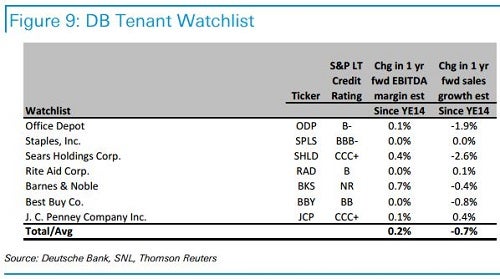

On March 24, Deutsche Bank published a quarterly update of the retail sector, including a watch-list of retail tenants viewed as posing higher risks for bankruptcy and store closures for REIT landlords.

Spoiler Alert: Top Malls – No Worries

One key investor takeaway from the report, was that troubled mall anchors Sears Holdings Corp (NASDAQ: SHLD) and J C Penney Company Inc (NYSE: JCP), do not pose a major risk to the top mall REITs.

In fact, General Growth Properties Inc (NYSE: GGP) and Taubman Centers, Inc. (NYSE: TCO) have zero exposure, while Simon Property Group Inc (NYSE: SPG) and Macerich Co (NYSE: MAC)'s base rent risk is just 0.5 percent and 1.3 percent, respectively.

Additionally, these mall landlords have zero exposure to the five other watch-list retailers detailed below.

Retail Environment – Big Picture

- DB expects U.S. retailers to benefit from lower unemployment and energy prices, but the strong dollar remains a headwind for tourist generated sales.

- DB noted positive trends continuing in Q4 2014, "…with rent spreads remaining solidly positive in the mid-to-upper teens range for Malls and near 10% for the Shopping Center REITs under coverage."

- Overall strong occupancy with the Malls at 96.5% and Shopping Centers at ~95% range.

- "The DB Shopping Center universe remains well-diversified from a tenant perspective, with the top 10 tenants accounting for about 21% of rent and only 4 tenants accounting for >2% each on average."

- Top 4 Mall REIT portfolios "are also well-diversified with the top 10 tenants also accounting for 21% of rent on average and an average of only 5 tenants per company accounting for >2% of rent."

DB Watch-List

DB believes that for the REITs it covers, these watch-list retailers embody highest near term risk, "based on bankruptcy and store closure risk and where widespread closures have either been announced, [or] are expected…"

Paper Cuts – 2 DB Holds

- Office Depot Inc (NYSE: ODP): During Q4 2014 results management "reiterated their expectation of difficult market conditions, the negative impact of the stronger dollar, and the impact of store closures to weigh down results."

- Management withdrew previous guidance for 2015 "given uncertainty with vendors, customers, and employees".

- Office Depot "had previously expected to close at ~400 stores in the US by the end of '16, with ~165 in '14, 135 in '15 and at least 100 in '16."

- Staples, Inc. (NYSE: SPLS): As of December 31, 2014, Staples had "closed 169 stores in North America as part of a plan to close 225 stores by the end of 2015."

Glass Half Full – 1 DB Buy

- Rite Aid Corporation (NYSE: RAD): DB noted its single-B credit rating as a significant risk factor.

- While "4Q14 sales comps missed consensus," DB analyst George Hill noted that "RAD is still booking higher growth than other chain pharmacies and appears to be taking share in pharmacy dispensing."

Ecommerce Threat – 1 DB Buy

- Barnes & Noble and Best Buy Co Inc (NYSE: BBY) "continue to be under pressure from ecommerce impacting sales and margins."

- Barnes & Noble is not under coverage by DB.

- However, appliance and electronics stalwart Best Buy continues to be a Buy rated bricks and mortar retailer at DB.

- DB analyst Mike Baker cited that Best Buy's "4Q results reflected the improvement with comps up 2%.," while also noting Best Buy's success in gaining market share and cutting costs.

Dual Edged Sword

These three shopping center REITs have the largest exposure to DB watch-list tenants, as a percentage of base rent:

- Retail Properties of America, Inc. (NYSE: RPAI) 8.9 percent; DB – Hold

- DDR Corp. (NYSE: DDR) 5.4 percent; DB – Buy

- Kimco Corp. (NYSE: KIM) 5.2 percent; DB – Hold

- Given the current high occupancy levels and positive lease spreads enjoyed by these REITs, getting back a few empty stores to re-lease could easily be viewed as a net positive.

- However, if the pace of store closures were to accelerate, or become complicated by bankruptcy proceedings, DB believes that could result in a negative impact to the bottom line for the REITs with the greatest exposures.

DB – Bottom Line

"REITs, broadly-speaking, have limited exposure to individual tenants and, in the absence of widespread Chapter 7 bankruptcies, are well-equipped to handle store closures, given what appears to be still good demand for space, as evidenced by solid operating metrics."

Latest Ratings for DDR

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2015 | Baird | Initiates Coverage on | Outperform | |

| Mar 2015 | Citigroup | Maintains | Neutral | |

| Mar 2015 | Goldman Sachs | Downgrades | Buy | Neutral |

View More Analyst Ratings for DDR

View the Latest Analyst Ratings

Posted-In: Deutsche Bank JCPenny Sears HoldingsAnalyst Color REIT Reiteration Analyst Ratings Real Estate Best of Benzinga