Courtesy of Declan.

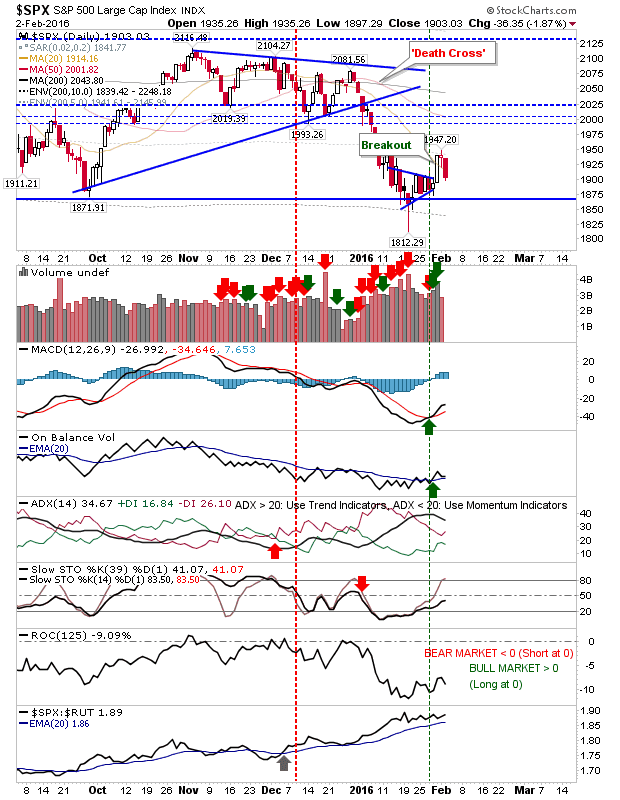

Last Friday saw a big swing in bulls favor as shorts were forced into covering and value players stepped in to buy the positive reaction to the swing low. Shorts look to have made a tentative return of the market as value buyers failed to follow through on Friday’s action. Volume climbed to register as distribution, but it was well down on Friday’s accumulation.

The Nasdaq fell back in a move which may see a retest of Friday’s breakout tomorrow. There was a bearish ‘cross’ in On-Balance-Volume after a respectable recovery to the 20-day MA. Relative performance against the S&P also ticked downwards.

The Russell 2000 moved back into ‘bear trap’ price congestion. The spike low should offer good support should prices continue lower. Note relative performance; this continues to improve and is near a ‘buy’ trigger (against rhe Nasdaq) despite today’s loss.

Wednesday will be about seeing the reaction of buyers when they appear (if they appear). Volume will need to rise if Friday’s low is to confirm as the swing low. The concern is that the last couple of weeks action will morph into a sideways consolidation from the current spike low. And if this was to occur, then the likely follow through would be down, not up.

You’ve now read my opinion, next read Douglas’ and Jani’s.