FANG Is So 2015… BARF In 2016

.jpg) By Darin Milmeister of Extract Capital, at Value Walk

By Darin Milmeister of Extract Capital, at Value Walk

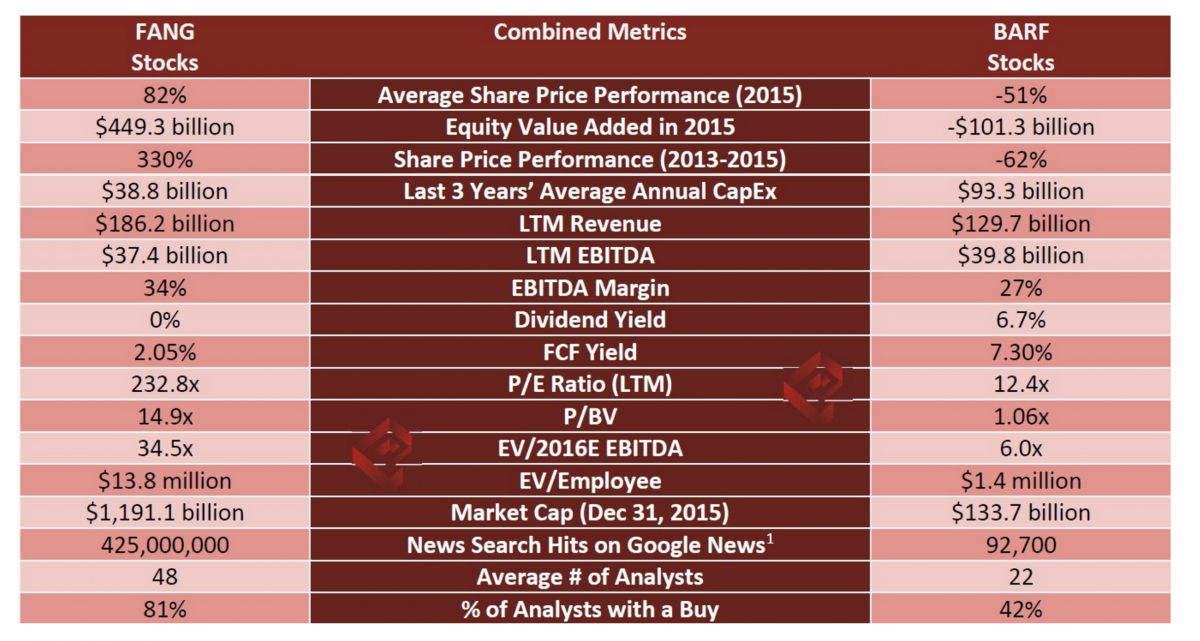

The world has been enamored by Facebook Inc (Nasdaq:FB), Amazon.com Inc (Nasdaq:AMZN), Netflix Inc. (Nasdaq:NFLX), and Alphabet Inc (Nasdaq:GOOG) – represented by the acronym, “FANG.” The four stocks gained an average of 82% in 2015 and collectively created more than $449 billion in equity value. These companies generated a combined $186 billion in revenue over the last 12 months.

We at Extract Capital wanted to create a meaningless acronym ourselves, “BARF.” These are huge, or relatively huge, well…. they were huge mining houses. BHP Billiton Ltd (ASX:BHP), Anglo American plc (LSE:AAL), Rio Tinto plc (LSE:RIO), and Freeport-McMoRan Inc (NYSE:FCX). The four stocks declined an average of 51% and lost $101 billion in equity value in 2015. The four companies generated a combined $130 billion in revenue over the last 12 months. YTD for 2016, these stocks have dropped another 22.9% on average through January 20.

We are not espousing or implying any investment advice as it relates to the FANG or BARF stocks and we currently have no positions in any of the eight companies. Please draw any conclusions from the table below at your own peril:

FANG vs. BARF

About Extract: Extract Capital Master Fund is a long/short natural resources equity fund primarily focused on the junior mining sector.

This material is licensed to the public under a Creative Commons Attribution 4.0 license. You are freely allowed to share, copy and redistribute the material for any purpose with full credit to Extract Capital. This content is provided “as is” without any expressed or implied warranty.