Courtesy of Declan.

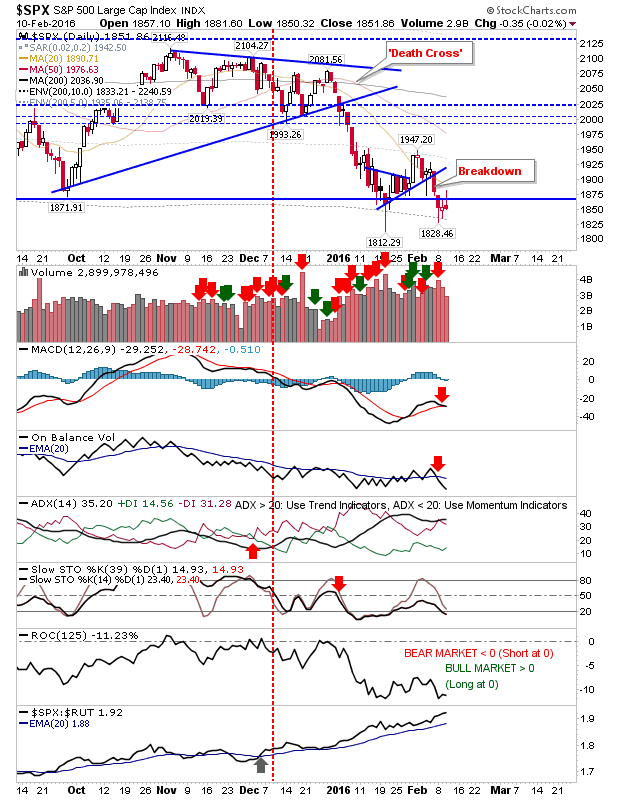

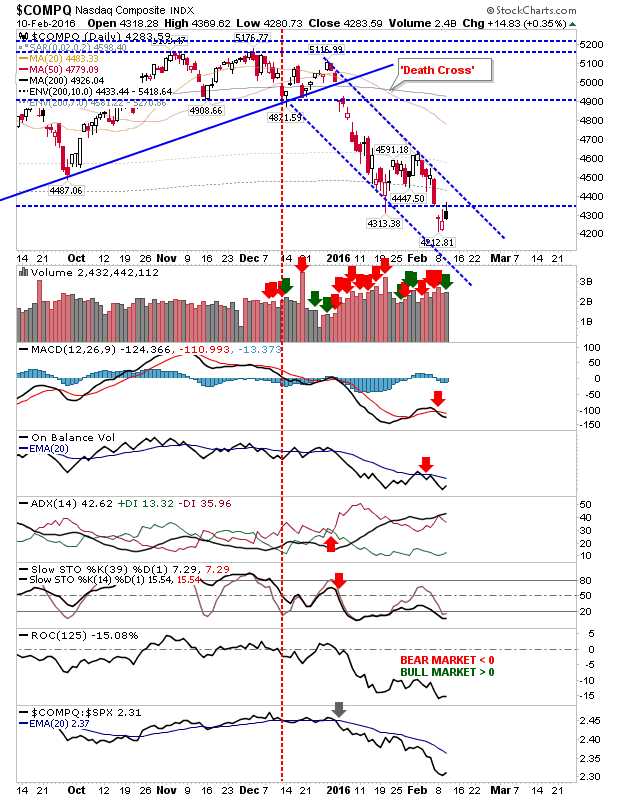

There wasn’t a whole lot of change by the close of business, but intraday strength was clawed back in worrisome fashion. The end result was to leave spike highs in markets.

The S&P finished with a MACD ‘sell’ trigger, but on lower volume. The ‘sell’ trigger was below the bullish zero line, which makes it a strong signal.

The Nasdaq closed with a ‘black’ candlestick, which would be more bearish if it occurred at a swing high, but it’s still a warning. Technicals are all in the bear camp.

The Russell 2000 also closed with a spike high and a MACD trigger ‘sell’. The index had attempted a relative advance against the Nasdaq, but this looks ready to turn south. And as the lead index for bears, having touched the January low, it could get ugly real quick.

The semiconductor index lost almost 1%, but it hasn’t yet tagged the August low. As with other indices, it registered a strong ‘sell’ in the MACD, but it also registered a ‘sell’ in the relative performance.

For tomorrow, it will probably come down to the Asian session. A weak overnight with a gap down could see a difficult day ahead. Fresh, strong ‘sell’ triggers in the MACD add to the trouble.

You’ve now read my opinion, next read Douglas’ and Jani’s.