Courtesy of Benzinga.

Stocks moved sharply lower in early action Thursday as investors continue to contemplate guardedly upbeat comments from Federal Reserve Chair Janet Yellen peppered with her concerns that financial turmoil overseas could reach the U.S. She also didn’t step back from the Fed’s current policy of considering interest rate hikes.

Aside from Yellen, who testifies again today, traders were keeping a close eye early Thursday on the bond market, where 10-year Treasury yields plunged below 1.6%, a sign of continued expectations for economic weakness and of some investors seeking relatively “safer” places than the stock market to put their money. Gold—another safe haven—soared overnight, and oil continued to move lower. Yellen said U.S. financial conditions have become “less supportive of growth,” and cited oil prices, weakness in overseas markets, and pressure on inflation. But she also highlighted what she said is strength in hiring, something the Fed will have to watch going forward as it looks for any sign of incipient inflation.

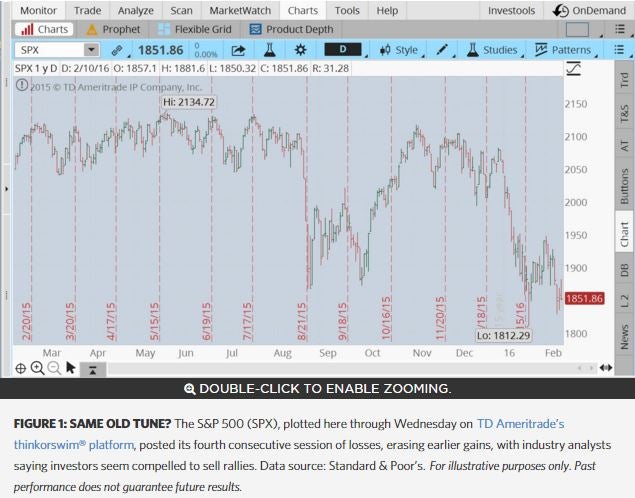

The Fed had gone into 2016 contemplating four rate hikes, but investors have become much less certain of that over the last few weeks. Some had hoped Yellen would discuss possible rate lowering or take future hikes off the table. Yellen did neither, and now bullish traders seem disappointed. Stocks initially rallied Wednesday as Yellen spoke, but fell by the end of the day, with the Dow Jones Industrial Average ($DJI) and S&P 500 (SPX), in figure 1, now down four sessions in a row. The NASDAQ Composite (COMP) eked out a small gain, led by rallies in Netflix, Inc. (NASDAQ: NFLX) and Google-parent Alphabet, Inc. (NASDAQ: GOOG, GOOGL).

Post-Holiday Hangover. Hong Kong’s Hang Seng index, which had been closed earlier this week for a holiday, re-opened Thursday and quickly joined the general worldwide trend toward weakness, sliding more than 3.5% to a four-year low. Japan was closed for a holiday, but markets in Europe followed Hong Kong’s lead. The focus overseas was on Yellen’s remarks, and on a continued plunge in European banking stocks, which on Wednesday had staged a short-lived rally. Markets in mainland China re-open Monday.

Tesla Electrifies. Shares of Tesla Motors, Inc. (NASDAQ: TSLA) soared in post-market hours Wednesday despite heavy Q4 losses for the company. Investors were cheered by the company’s guidance, which forecast strong demand for the company’s electric cars. Tesla shares, down sharply so far this year, posted double-digit gains overnight. In other earnings news, Cisco Systems, Inc. (NASDAQ: CSCO) reported stronger-than-expected Q2 profit, sending its shares climbing after hours.

Oil Misery Continues: U.S. oil futures fell overnight to new 12-year lows below $26.50. The complex had rallied for a short time on Wednesday after a weekly supply report showed a surprise draw in U.S. oil stocks, but then tumbled to close at three-week lows as worries persisted about U.S. and global demand. Some market watchers noted that even though the report showed U.S. oil supplies down, total oil supplies, which include products like gasoline, actually rose during the week to all-time highs, while U.S. imports fell sharply, all signs of lagging demand. Yellen’s testimony about global economic weakness and a bearish oil outlook released by Goldman Sachs also played into oil’s losses.

JJ Kinahan and Craig Laffman will be chatting about the market turmoil next week.

Inclusion of specific security names in this commentary does not constitute a recommendation from TD Ameritrade to buy, sell, or hold.

Market volatility, volume, and system availability may delay account access and trade executions.

Past performance of a security or strategy does not guarantee future results or success.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Options trading subject to TD Ameritrade review and approval. Please read Characteristics and Risks of Standardized Options before investing in options.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

The information is not intended to be investment advice or construed as a recommendation or endorsement of any particular investment or investment strategy, and is for illustrative purposes only. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

TD Ameritrade, Inc., member FINRA/SIPC. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company, Inc. and The Toronto-Dominion Bank. © 2016 TD Ameritrade IP Company, Inc. All rights reserved. Used with permission.

Posted-In: Analyst Color Economics Analyst Ratings