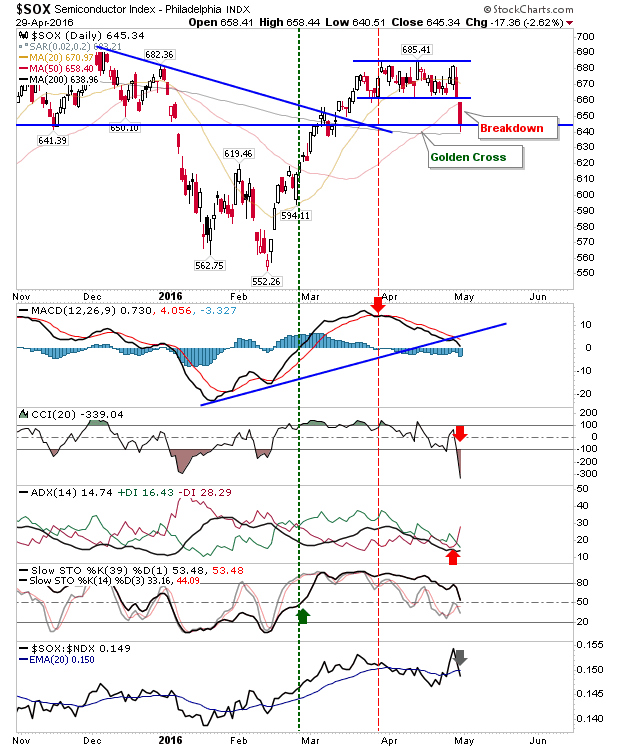

Courtesy of Declan.

Thursday’s reversal in the Semiconductor Index was followed with a breakdown from the consolidation. This will put pressure on the Nasdaq and Nasdaq 100 indices, the latter of which turned net bearish (in technical strength) on significant distribution.

The S&P was able to recover from afternoon selling on a bullish ‘hammer’. The index will soon been testing the 50-day MA, which recently ‘Golden Cross’ with the 200-day MA. Technicals are mixed, with the exception of On-Balance-Volume and Momentum.

Meanwhile, the Russell 2000 eased further away from channel resistance with a MACD trigger ‘sell’ as Rate-of-Change remained below the bearish mid-line. It will start Monday at its 20-day MA.

As a final point, the Percentage of Nasdaq Stocks above 50-day MA turned bearish in technicals. Should this spread to other Tech breadth metrics it will confirm an intermediate top.

Tech indices are the one to watch on Monday. The Semiconductor Index will have its work cut out to recover the prior consolidation, but a rally back to confirm would not be surprising for next week. The Russell 2000 is better set up for further losses, although converged 20-day and 200-day MA will be available to lend support on Monday.

You’ve now read my opinion, next read Douglas’ and Jani’s.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.