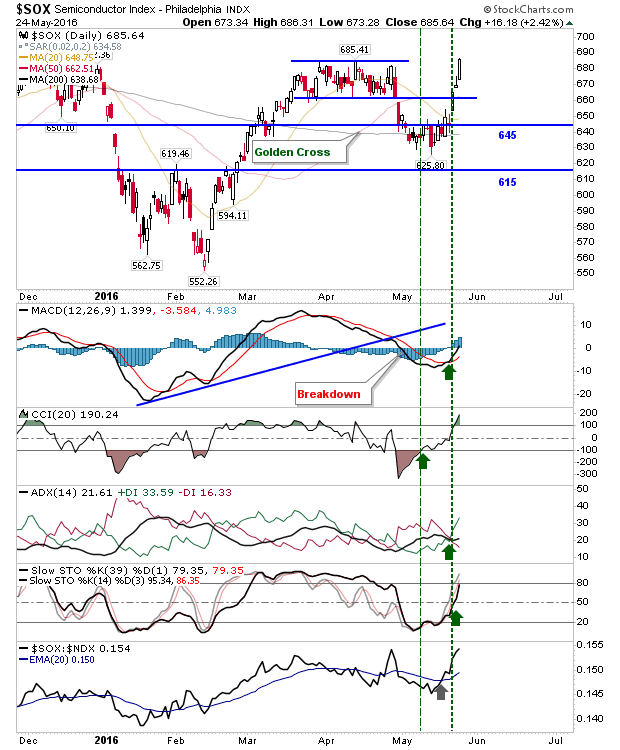

Courtesy of Declan.

A big day for Semiconductor Indices has finally boosted other indices. Semiconductors finished above March/April highs on new near term highs in relative performance. It has been a big week for this index and this could set a positive tone for the rest of the summer.

The Nasdaq broke out from consolidation, safely clearing converged 20-day and 50-day MAs. This is setting up nicely for a challenge of 4969, and could easily go on to challenge 2015 highs. Technicals delivered a positive MACD trigger ‘buy’ and ADX ‘buy’.

The Russell 2000 made a clean break of the downward channel and now finds itself up against former rising channel support turned resistance. The technical picture is a little different with ‘buy’ trigger in Stochastics and ADX. It also delivered a break of 20-day, 50-day, and 200-day MAs. Relative performance has picked up and if this can be maintained it will re-affirm the secular rally from March 2009 (long in the tooth this rally is); long term rallies require Small Caps leadership.

Large Caps were least effected by these gains. The bearish head-and-shoulder pattern in the S&P is not negated, but it is under pressure. The only technical change was a bullish cross in ADX.

Bulls look to have cracked the code. The failure of the head-and-shoulder patterns to follow through on what were managed breakdowns is a big hit to bears. Tomorrow, assuming action quietens, then it will be important indices finish near today’s highs.

You’ve now read my opinion, next read Douglas’ and Jani’s.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.