Courtesy of Declan.

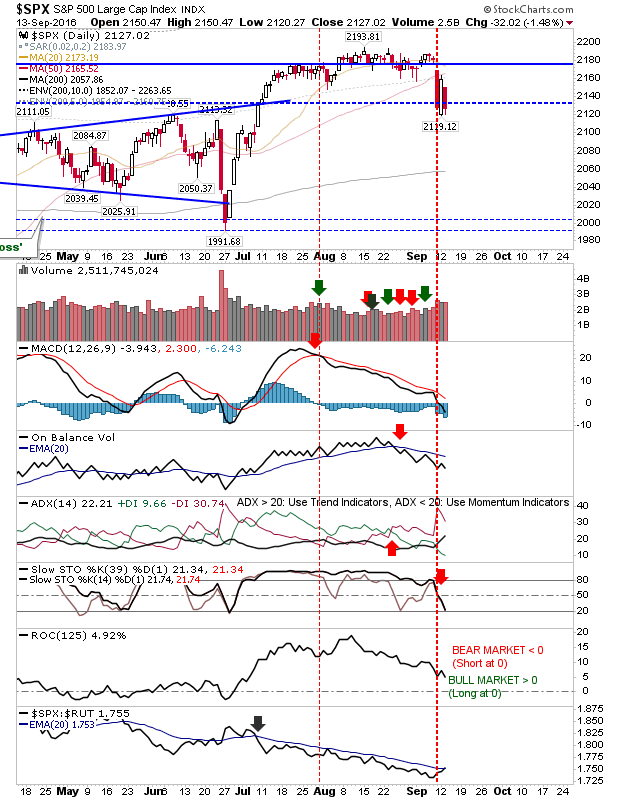

After yesterday’s blast, bears took another chunk out of the recovery. Bulls might actually get more joy with a small position at the lows of the last three days in Large Caps. Pre-market action will be key; should it look like the market will open below the 3-day low then there could be a runaway lower. In such case, waiting for things to settle after the first 30 minutes of opening trading may offer a better entry.

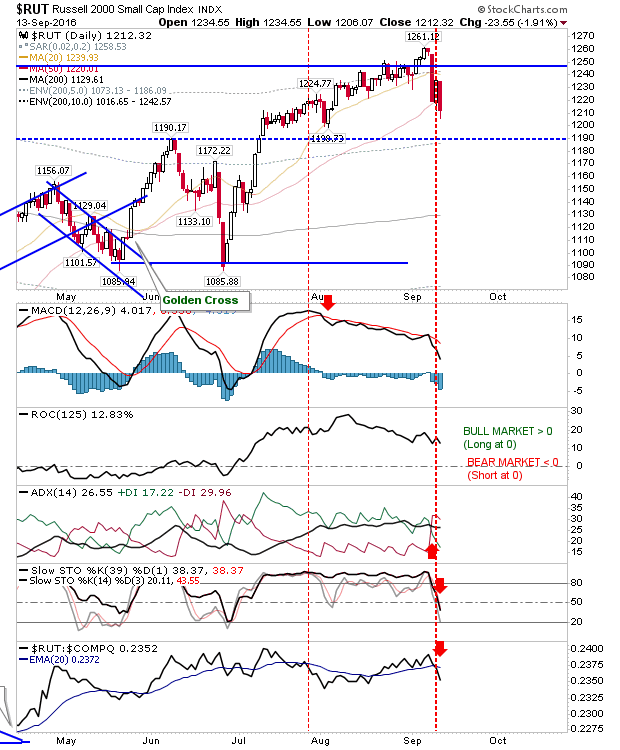

What will give bears hope is the Russell 2000. This index is finding itself under increased pressure. What ‘hope’ the 50-day MA gave bulls yesterday was dashed by today’s close. Technicals are now net bearish, joining those of Large Caps. This has the makings of a breakaway move lower. If there is going to be a panic move, Small Caps could be the one to suffer the most.

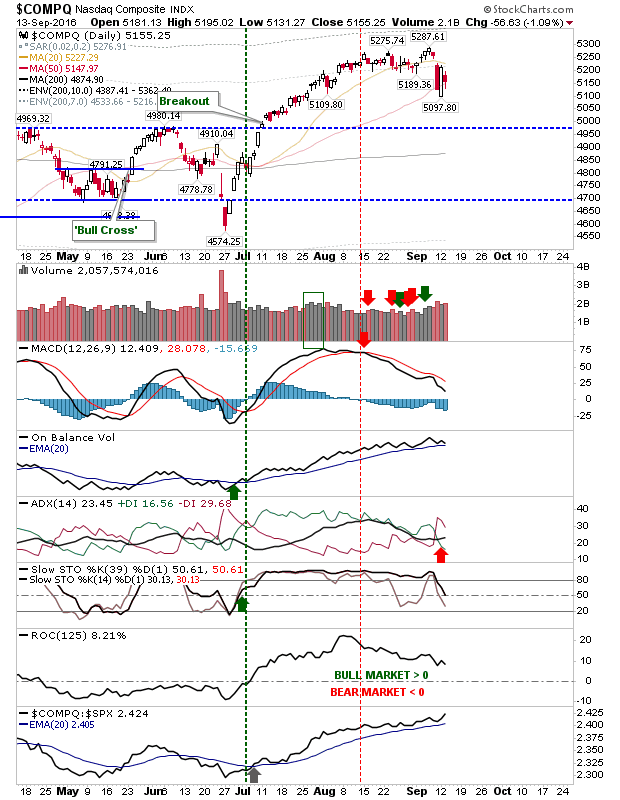

The Nasdaq is playing a far quieter game. Under different circumstances, today’s action might be viewed as much more bullish. The two-day pattern is a ‘bullish harami’ and despite distribution over two of the last three days, there is a chance bulls could deliver a nice upside kick. Watch pre-market for leads; stops go on a loss of 5,097.

For tomorrow, bears should watch the Russell 2000, bulls the Nasdaq. Volatility is picking up nicely and money is to be made over the near term.

You’ve now read my opinion, next read Douglas’ and Jani’s.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.