Courtesy of Declan.

The last few days have seen little movement in key markets. The one potential development to look to resolve tomorrow or Monday are rising wedges in certain markets. The advantage bulls have is that if markets can push above wedge highs (which are close), shorts will be squeezed in a buying scramble.

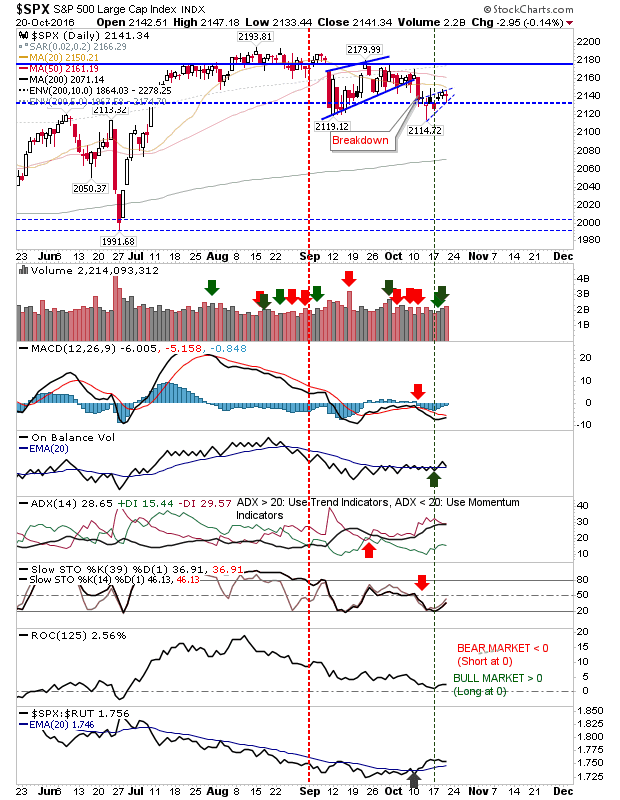

The S&P has a created a small, rising wedge off a larger rising wedge from September. The 20-day and 50-day MAs lend additional overhead resistance as does higher volume distribution for the index today (although the trading range for the day was very narrow).

The Nasdaq hasn’t got the earlier bearish wedge as evident in the S&P, but it is mapping a mini-wedge like the latter index. Technicals are mostly negative, although stochastics [39,1] are rebounding off a level typical of a bullish reaction.

The one index doing its own thing is the Russell 2000. After coming off what had the look of a very bearish ‘bull trap’ breakout, the index has been able to dig in at early September lows. There is a relatively low risk opportunity for longs with a stop on a loss of 1,200.

For tomorrow, bulls should keep an eye on the Russell 2000 – early strength could bring buyers back to this neglected index. Shorts will be looking to the rising wedges to jump on the quick if there is an early breakdown.

You’ve now read my opinion, next read Douglas’ blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.