This is NOT good.

This is NOT good.

Not only are rates spiking 20% since the election but we just had the worst Treasury Auction since 2009 – indicating that investors are quickly losing faith in the US's long-term economic prospects. And, keep in mind that's WITH expectations that the Fed will tighten in December and WITH a strong Dollar, which is usually a factor when deciding what currency you'd like to tie you money to for 5-30 years.

We are, of course, shorting the markets again this morning. Yesterday's watch levels didn't fail so today we raised them in my morning note to our Members and we're focusing on Russell (/TF) short below 1,250 and the S&P (/ES) below 2,160 confirmed by the Dow (/YM) failing 18,700 and Nasdaq (/NQ) below 4,700. Trump may make America great again – but he doesn't get to change anything for 2 more months so I think the market is getting a bit ahead of itself.

While quite a lot of money poured into the market on Wednesday, the volume yesterday was still 70% over average but the S&P only went from 2,163.26 to 2,167.48 – up just 4.22 (0.2%). If it takes 70% over average volume to buy us 0.2% – it seems to me that a lot of people must be heading for the exits.

The Dow burst higher yesterday but 4 companies (GS, JPM, UNH and IBM) were 180 (75%) of the 240-point rally – that is NOT broad-based! In fact, the entire rally of the past two days has been centered on Pharmaceuticals (no more Obamacare – charge whatever you want!), Oil, Gas & Coal (drill baby, drill), Defense (who hasn't he threatened?) and Financials (repeal regulations helps the little guy how?).

Yesterday we got the first inkling of money going the other way as investors began to rethink their Tech Sector investments under an anti-science administration. Alternative Energy stocks have been a cornerstone of investments in tech for most of the past decade and that's the kind of unwind that won't play out over just a couple of days.

In fact, when you consider that the 5% run in the Energy Spider (XLE) coincides with a more than 10% drop in the price of oil (USO) – you have to think one of these groups is getting the wrong message here.

Some of this may have to do with the looming rollover of the December oil contracts (/CLZ6) on the 18th and we had long planned to go long on the end-of-contract dip in November so we're almost at the point where we do want to be long on /CL and USO but we'll have to wait until next week to see if there's really a bottom to this thing.

Copper also blasted higher this week, gaining 20% but is now pulling back a bit as it's one thing to promise people a chicken in every copper pot but it's quite another thing to deliver 330M chickens and 330M copper pots and do you wait until the pots are delivered before delivering the chickens and how long does it take to breed 330M chickens and what about the handles on the pot – who's making those. If we can't at least buy the handles in China – this may take a while…

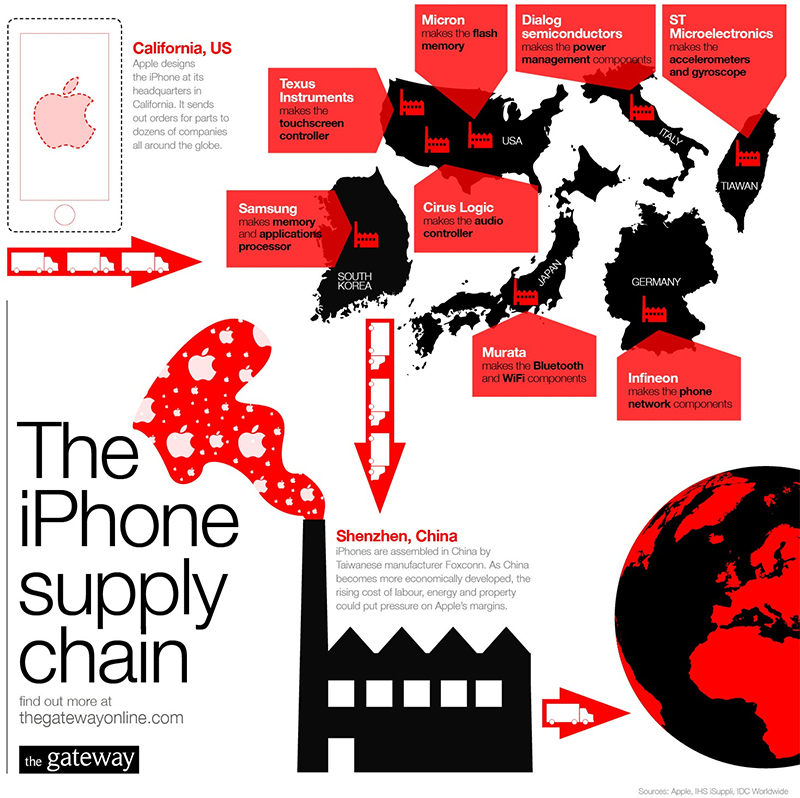

That's right, economics are hard but, sadly, slogans and campaign promises are easy. As our soon to be ex-President likes to say "you didn't build that alone" and what happens to companies like AAPL who rely heavily on those "foreign imports" to make their products? That's why we're seeing the Nasdaq lead the sell-off but, as the uncertainty spreads – so will the selling.

Have a good weekend,

– Phil