Courtesy of Declan.

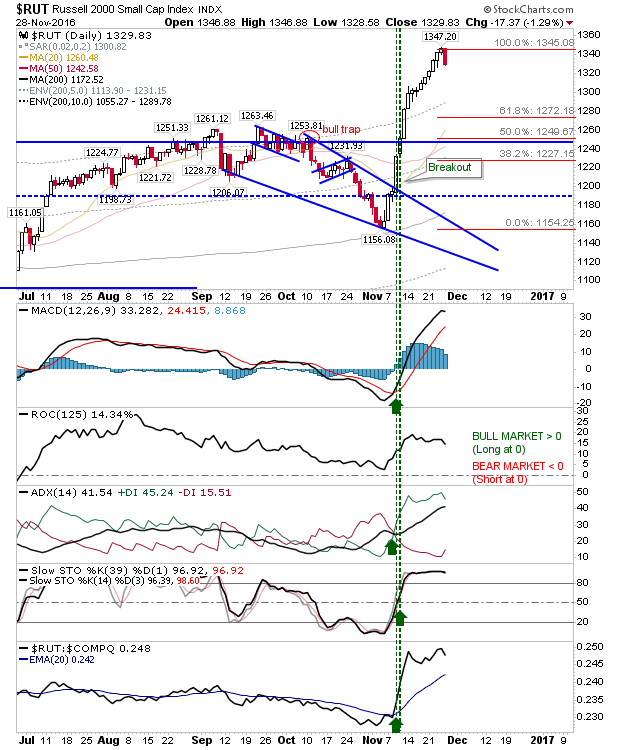

Friday’s partial trading delivered a final boost before holiday hangover selling kicked in. There is plenty of room for profit taking in the Russell 2000; look to Fib retracements for pullback opportunities. One thing I had missed was the profit take warning in this index; the Russell 2000 has tagged the 14.3% and 12.3% push above its 200-day MA which is in the 10% zone of historic price action dating back to 1987 (see table at the end of this post).

Other indices haven’t yet extended themselves so far. Profit Taking, while expected, isn’t as likely to be as extensive as for the Russell 2000.

The S&P has Fib retracements to look too.

The Nasdaq likely hasn’t driven far enough beyond resistance to encourage significant profit taking, but it can’t be excluded if sellers do make an appearance in other indices.

For tomorrow, look for additional profit taking in the Russell 2000 and other indices to follow.

You’ve now read my opinion, next read Douglas’ blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.