Courtesy of Declan.

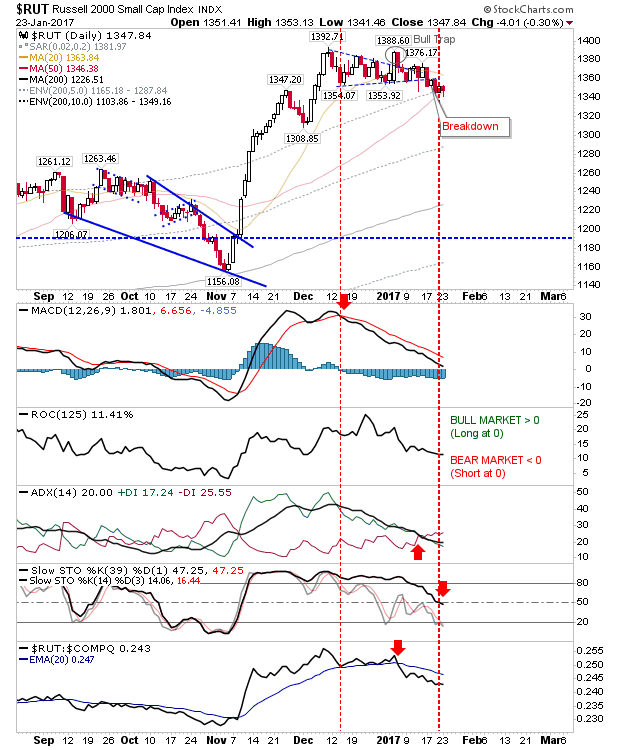

It was another day of modest change with little real turn in bullish/bearish outlook. The Russell 2000 was the only one index to mark a technical change with a net bearish switch in technicals (MACD, Slow Stochastics, On-Balance-Volume).

There wasn’t much to add for other indices. The S&P finished with a narrow doji on its 20-day MA. Technicals were little changed.

The Nasdaq also did little. It still has a MACD trigger ‘sell’ to work off, but other technicals remain positive, including excellent relative strength against the S&P.

For tomorrow, the same outlook going into today is still relevant. Bulls should watch for breakouts in the S&P and Nasdaq. Shorts need watch the Russell 2000.

You’ve now read my opinion, next read Douglas’ blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.