Courtesy of Declan.

In early morning action it was a clear swing to sellers after yesterday’s non-event. However, buyers came back and were able to make a good chunk of these losses into today’s close.

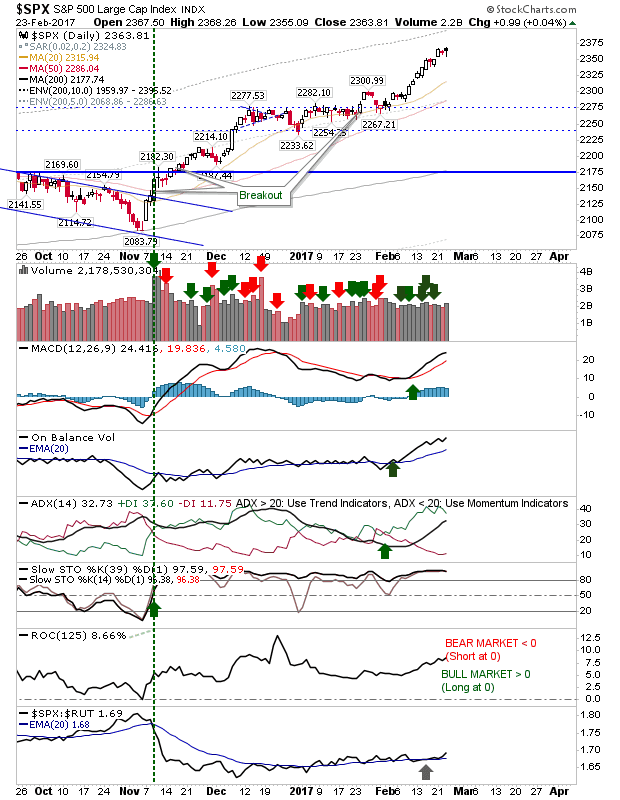

Large Caps remained the most attractive as defensive stocks often are during times of doubt. The S&P registered higher volume accumulation as intraday action proved to be relatively tight.

The Nasdaq suffered larger losses, but there was no distribution to go with it. Technicals were relatively immune to today’s action.

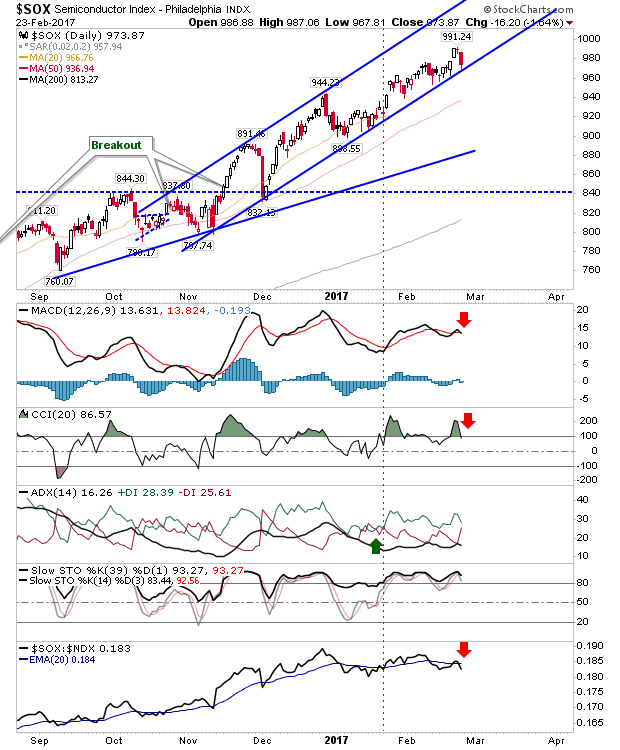

The Semiconductor Index suffered the largest loss as it found itself drifting back to channel support. Technicals are back on the defensive after today’s action which returned ‘sell’ triggers for the MACD, CCI and relative performance against the Nasdaq 100.

How will bulls defend today’s recovery? Watch for early selling in a repeat of morning action – particularly if it challenge’s Thursday’s lows (and therefore erases the losses from today). Shorts may even find an opportunity in the Semiconductor Index if it gives up loss from the rising channel.

You’ve now read my opinion, next read Douglas’ blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.