Courtesy of Declan.

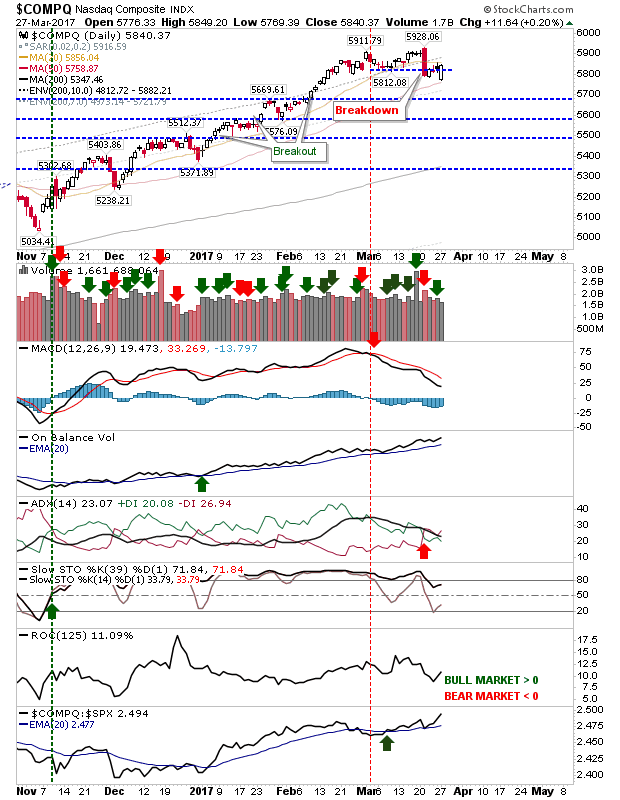

The damage was done premarket and value buyers were quick to take advantage. The index which benefited the most was the Nasdaq. It started today just above the 50-day MA and rallied off that. Volume wasn’t great and the technical picture didn’t really improve, but action like today’s can prove to be a good starting point for a swing low.

Despite the gain in the Nasdaq, Breadth metrics are weakening but are neither overbought nor oversold. The next strong swing low will likely take a tag of the light green line.

The S&P actually held to a small loss, but it made a firm defense of its 50-day MA. The intraday spread was not as great as for the Nasdaq, but the 50-day MA test is a working point for a swing low.

The Russell 2000 also staged a recovery, but not enough to make it above resistance. Today’s closing hammer is an opportunity to mount a rally tomorrow, with a stop on a loss of today’s lows.

Today’s actions fit with a swing low, but confirmation is needed with a series of higher closes over the next few days. Shorts were left hanging in a day were prudence proved to be the better course of action.

You’ve now read my opinion, next read Douglas’ blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.