Courtesy of Declan.

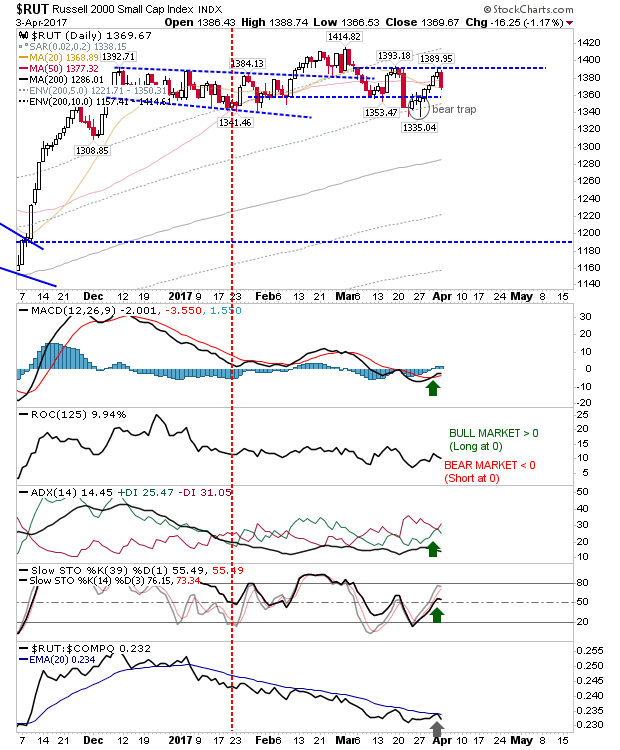

It was inevitable after a series of gains that sellers were going to make an appearance and today was the day that happened. The Russell 2000 took the brunt of the selling as it shed over 1% on a reversal off resistance. This brought the index back to converged 20-day and 50-day MAs, which may be enough to stem the loss, particularly as other indices were able to recover into today’s close.

The S&P was able to recover its losses, finishing with a doji after rebounding off the 50-day MA. Volume climbed in what would have been considered distribution had it not finished the way it did.

The Nasdaq was caught between the S&P and Russell 2000 in how it finished. It didn’t get past resistance but remains close enough to mount a challenge tomorrow.

The Nasdaq 100 is in a similar state as the Nasdaq. The 20-day MA is squeezing the index against resistance, forcing market participants to pick a side. Watch for leadership tomorrow.

Tomorrow is an easier play for longs; play resistance breaks and watch for the ‘bull trap’. Aggressive players may want to go ‘short’ given indices are trading below resistance, but should they do then a break of resistance becomes the short cover. The whipsaw risk is probably higher for shorts than bulls as buyers are required to push beyond resistance, but markets can fall simply on the absence of buyers (no active selling required).

You’ve now read my opinion, next read Douglas’ blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.