Courtesy of Declan.

Sellers swoop in afternoon trading to whip nascent demand built after a positive open. The sell off was attributed to an indecisive Federal Reserve, but profit taking can occur at any time when an extended series of small gains is undone by one big day of selling. Volume rose in confirmed distribution.

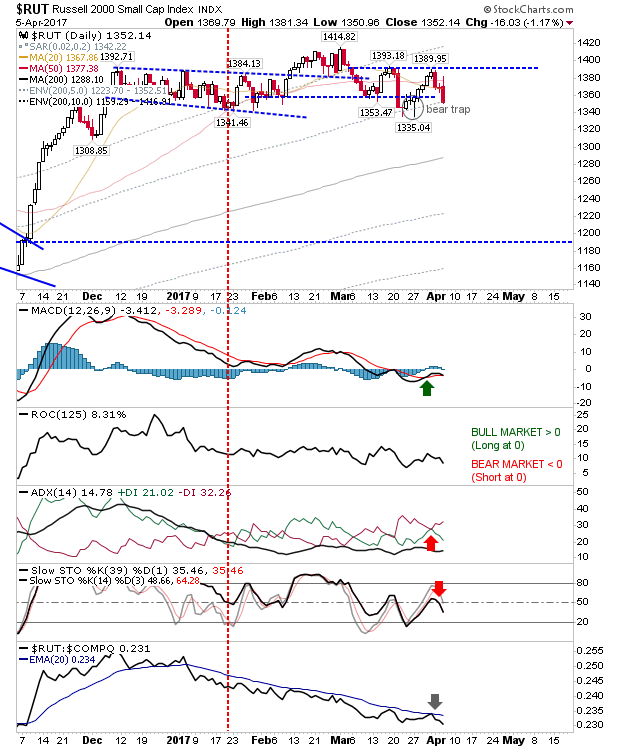

The index most vulnerable heading into today was also the one to suffer most at the hands of sellers. The Russell 2000 suffered a big hit as it dropped over 1%, moving away from its 20-day and 50-day MAs. The ‘bear trap’ hasn’t been negated, but it’s under pressure.

The Nasdaq came back off resistance without registering an attempted breakout. The potential MACD trigger ‘buy’ failed, although other technicals are still okay.

The S&P experienced a bearish engulfing pattern as it turned away from nearby resistance. It too registered distribution and technicals are weakening. Further selling is looking probable here.

Interestingly, the Nasdaq 100 did attempt a breakout, but it was pulled back below resistance – leaving a spike high. Its first test is the 20-day MA, then the 50-day MA. With the failure of the MACD to trigger a ‘buy’ it’s now a question in looking for bearish triggers, such as a possible ‘sell’ in On-Balance-Volume.

In the space of one day markets have gone from a probable breakout to at-risk of further profit taking. There is still plenty of support to work, and another sideways period as experienced during the latter part of 2016 is probably more likely, but as markets look to find support there may be an opportunity for shorts to take advantage with a quick trade.

You’ve now read my opinion, next read Douglas’ blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.