Courtesy of Declan.

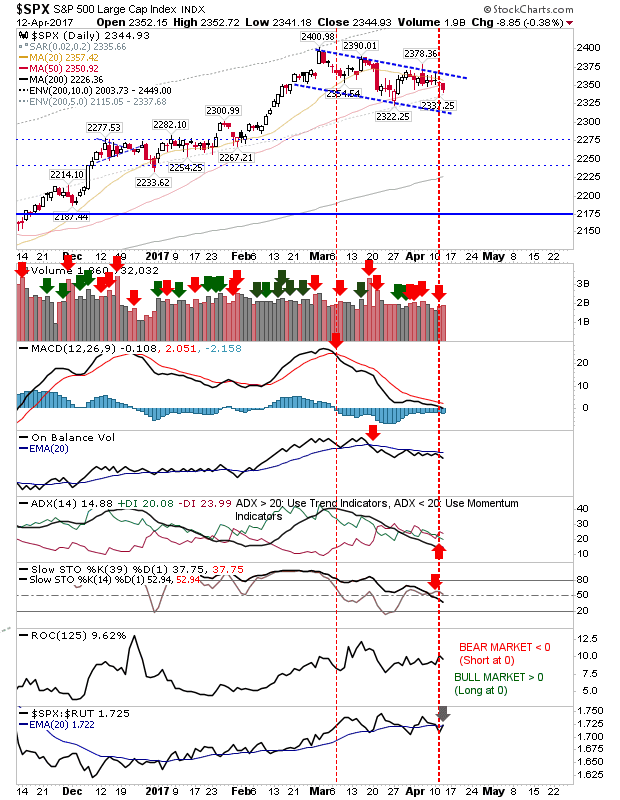

The good work from yesterday was undone with today’s selling. The S&P posted a clear break of the 50-day MA on modest volume and will next be heading to test support of the declining channel – which at the moment looks more like a ‘bull flag’. Technicals for the index are net bearish, but are close to a recovery. It might look worrying, but the index could benefit in the long run.

This selling was not limited to the S&P. Despite finishing on the 50-day MA after four days of gains, it wasn’t able to break through. Instead, another 1%+ loss was delivered. The Russell 2000 is in consolidation triangle, within which is a ‘bear flag’. The 200-day MA is the next target.

The Semiconductor Index was more decisive in its action as it made a clear cut break from its tentative rising channel. The index gave up nearly 2% on today’s sell-off, and this could have implications for the Nasdaq and Nasdaq 100.

The Nasdaq is coming back to the former ‘bear trap’ but hasn’t yet challenged. The 50-day MA is available to lend support, which also might encourage buyers. Selling volume was lighter, which may represent an easing in profit-taking, especially given support has held.

While today’s selling was worrying it’s still got a good chance of encouraging buyers to step in given the proximity of 50-day MAs (Nasdaq, Dow Jones) and support (Nasdaq and Nasdaq 100). Shorts might look for expansion of selling in the S&P given it’s not near support and the risk:reward is better.

You’ve now read my opinion, next read Douglas’ blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.