By Gabriel Thoumi, CFA, FRM. Originally published at ValueWalk.

Summary

- JBS corruption and a USD 3.16 billion leniency agreement by J&F

- JBS conduct raises concerns over implementation of its Corporate Social Responsibility policies

- JBS revenue and EBITDA may continue to be weak as 50 percent of customers might be sensitive to ESG concerns

- International investors may be hesitant to invest in JBSFI IPO amid growing allegations

- A risk of a larger-than-anticipated share-offering and/or low-priced divestments; both might dilute existing JBS equity

Note: JBS Investor Relations commented on this report June 20, 2017. JBS full comments are included in this report.

HSBC: These Companies Will Suffer From Rising Water Prices

[timekess]

Attend Our Free Webinar

Join Chain Reaction Research and others for our webinar on JBS: Financial Restructuring Could Be Delayed Due to Serious Allegations webinar July 11, 2017. Please register here for the free webinar July 11am EDT, 2017.

As written by Chain Reaction Research and Gerard Rijk, Profundo, Tim Steinweg, Aidenvironment, and Gabriel Thoumi, CFA, FRM, Climate Advisers, JBS (JBSAY) is the world’s largest meat company by revenues, capacity, and production including beef, poultry, lamb and pork. It is the largest beef exporter from Brazil. JBS sells its meat products under a range of brands including Swift, Friboi, Seara, Pilgrim’s Pride, Gold Kist Farms, Pierce, 1855, Primo, and Beehive. JBS has executed an aggressive acquisition strategy outside Brazil. As a result, it has high net debt and low equity valuation multiples and now the company lacks room for continued consolidation. Consequently, JBS planned an IPO in May or June 2017 of its activities outside Brazil. This planned IPO of JBS Foods International (JBSFI) represents 85 percent of JBS sales. Barclays PLC is lead underwriter.

In March 2017, allegations of meat contamination, corruption, and deforestation led to a delay of its IPO, which should have generated proceeds of at least USD 1 billion. On May 12, 2017, the Brazilian Federal Audit Court (TCU) released an audit of alleged fraud into Brazilian Development Bank (BNDES) loans used by JBS to finance its Swift & Company acquisition. Because of these allegations, JBS shares dropped. On May 26, 2017, JBS Chairman of the Board resigned. On May 31, 2017, family-controlled J&F Investimentos SA agreed to pay BRL 10.3 billion (USD 3.16 billion) over 25 years as part of a leniency settlement over bribery allegations. On June 6, 2017, JBS announced the sale of its beef operations in Argentina, Paraguay, and Uruguay to Minerva for USD 300 million. Further divestments were announced in June 2017.

Key Findings

- JBS corruption and a USD 3.16 billion leniency agreement by J&F are connected to financial and governance risks that may prevent the company from reaching its goals of reducing net debt and unlocking shareholder value.

- JBS conduct raises concerns over implementation of its Corporate Social Responsibility policies. Cattle ranching is a major driver of deforestation in Brazil. It has large a greenhouse gas emissions footprint requiring ambitious and transparent action to eradicate deforestation from JBS supply chains.

- JBS revenue and EBITDA may continue to be weak as 50 percent of customers might be sensitive to ESG concerns like corruption, contamination, deforestation and slave labor allegations. Waitrose, McDonald’s and Domino’s Pizza Brazil already have reacted. Assuming 33 percent revenue-at-risk in Brazil (USD 2.4 billion), this could affect more than 10 percent of JBS’ market cap.

- International investors may be hesitant to invest in JBSFI IPO amid growing allegations. Investors increasingly have ESG and zero-deforestation policies in place. The current allegations and investigations create a climate in which an IPO can only occur with a large valuation discount versus peers. JBS USA bondholders and investors holding Pilgrim’s Pride shares might also divest.

- A risk of a larger-than-anticipated share-offering and/or low-priced divestments; both might dilute existing JBS equity. To decrease its 4.4X Q4 2016 net debt/EBITDA ratio to 2X, JBS needs its JBSFI IPO to exceed USD 6 billion, probably with a valuation discount in that IPO. JBS equity dilution would be 30 percent if JBS would reduce its stake in JBSFI to 50 percent. This dilution considers lower interest charges due to the JBSFI IPO proceeds. In an alternative scenario if JBS continues with its divestments, its dilution might then be 63 percent.

JBS: JBS Foods International IPO Rationale

The Brazilian meatpacking company JBS is listed on the BM&F BOVESPA. The Batista family, via the holding company FB Participações, is the controlling shareholder of JBS. They own 42.3 percent while the Brazilian State Development Bank (BNDES) owns 21.3 percent. With 2016 sales of USD 49 billion, JBS is the world’s largest meatpacker by revenue, capacity, and volume.

|

Figure 1: JBS business units and contribution to net revenue 2016.

JBS is active in beef, poultry, lamb, and pork as well as in hides. Its operations cover a large part of the meat value chain from slaughtering and packaging to branding. The company has activities in Brazil, several other Latin American countries, the USA, Europe, and Australia. On June 6, 2017, it announced the sale of its beef operations in Argentina, Paraguay, and Uruguay to rival Minerva for USD 300 million. Minerva is also an important meat exporter to many countries, including China.

During the last decade, JBS executed an aggressive expansion strategy with the financial help of BNDES. JBS bought companies in neighboring Latin American countries and in Europe and in the USA. As shown in Figure 1 (above), this aggressive expansion strategy diversified its geography and revenue.

JBS North American subsidiary, JBS USA, has issued its own bonds. JBS USA has a 77 percent stake in Pilgrim’s Pride and a separate stake in JBS Canada. In 2016, JBS established its Dutch subsidiary JBS Foods International (JBSFI). JBSFI includes all activities except for the Brazilian beef and global leather business. The IPO of JBSFI in New York was originally planned for H1 2017. In May, JBS announced it was delaying its IPO due to investigations targeting JBS owners. According to the company, the new date will depend on market conditions.

JBS: Allegations of Contamination, Corruption, and Deforestation

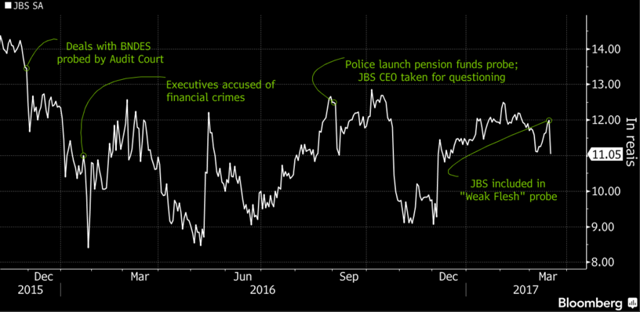

As shown in Figure 2 (below), JBS has been the target of investigations since 2015. Since 2015, JBS share price has been impacted by multiple allegations of wrong-doing.

Figure 2: JBS stock performance amidst investigations. Source: Bloomberg. Allegations include:

- Deals with BNDES probed by Audit Court & executives accused of financial crimes

- Pension fund probe

- Operation Weak Flesh

JBS: Allegations of Bribery

Allegation of bribery reported by Bloomberg March 17, 2017.

In March 2017, Brazilian federal police released results from their two-year investigation of pork, poultry, and beef meatpackers. They served hundreds of court orders and detention warrants against leading meatpacking companies. Meatpackers companies allegedly payed bribes to health inspectors to forego inspections. Tainted meat from Brazil was reportedly used in school meals and sold to retail chains including Wal-Mart Stores Inc. Countries around the world, including China, the largest importer of Brazilian chicken and beef, the EU, and Japan reacted by temporarily suspending or restricting shipments from Brazil.

JBS Investor Relations June 20, 2017 response to Chain Reaction Research coalition partners inquiry below:

The court order made no reference to product quality problems or any

The post JBS: Corruption And Deforestation Allegations Delay Financial Restructuring appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.