Courtesy of Declan.

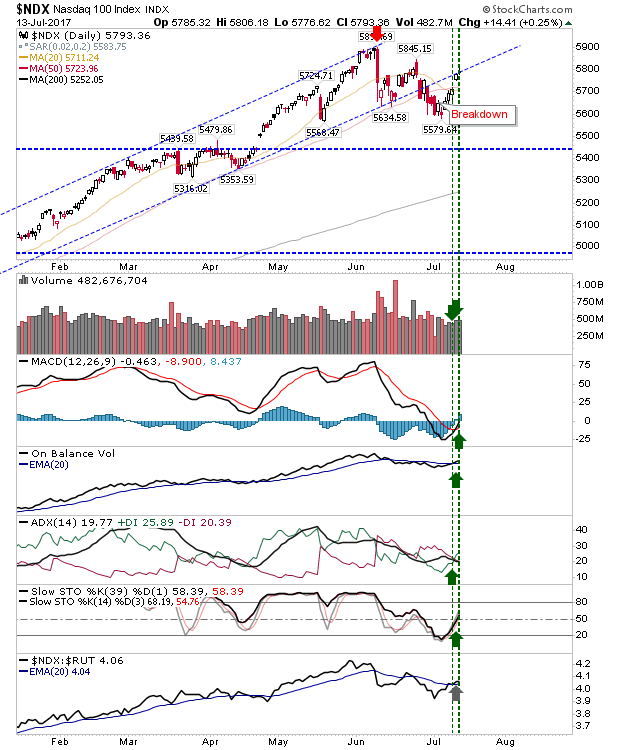

Two days of gains have helped re-establish the bullish technical picture for tech indices, Nasdaq and Nasdaq 100. While the improvement was welcomed it didn’t come without a price.

The Nasdaq broke through declining resistance but also left it itself wedged beneath the former rising channel. If there is a chance for shorts, then tomorrow could be it.

The Nasdaq 100 has also touched on former channel support – now resistance – offering a chance for shorts to launch an attack.

The Dow Jones continued its good form, albeit on a small gain as it shapes a bullish handle (off an earlier handle). While above the breakout resistance level of 21,550 it will need more volume to confirm whether the move is valid.

The Russell 2000 continues to be the index with the most potential energy to drive the next major market rally. Today’s ‘hammer’ next to 1,430 sets the tone for a strong Friday. Momentum players should take note.

Tomorrow will either prove to be a victory for shorts with channel resistance reversals for the Nasdaq or Nasdaq 100 or a win for the Russell 2000 and an opportunity for a solid 1%+ breakout style gain. Those are the indices and trades to watch.

You’ve now read my opinion, next read Douglas’ blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.