Courtesy of Declan.

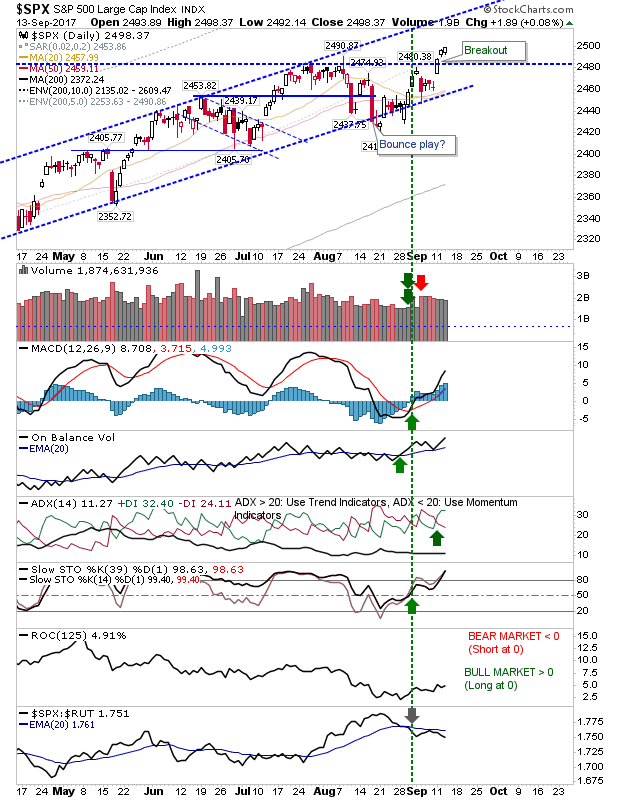

Large Caps and the S&P, in particular, has been leading the broader market with this week’s breakout. Technicals are all net bullish as the index looks to mount a challenge of rising channel resistance, which is still some distance away. Current momentum suggests higher prices are favoured and it will take a loss of the channel and a failed retest of the prior high to suggest bears have regained control – so shorts will have to wait longer before they can act.

The other Large Cap index, the Dow Jones, has nicked a small breakout but it hasn’t really cleared resistance. If the S&P can maintain breakout support then buyers will look to the Dow as a ‘cheap’ alternative to trade. The good news for bulls is that supporting technicals are strong and aligning in favour of buyers.

The Nasdaq is another index poised to break. Again, bulls probably have done enough to see a breakout; technical strength is good and today’s volume registered as an accumulation day.

The Nasdaq 100 is also ready to rise. If there is a concern (and it would apply to the Nasdaq too) it’s that relative performance has shifted away from Tech towards Small Caps.

Finally, the Russell 2000 continued its run of good form. It still has plenty of work to do to make it back to highs, but for those who bought the swing low or the fake out loss of the 200-day MA have little reason to sell. Better still, relative performance has started to pick up after months of underperformance – a key shift.

For tomorrow, look for a following breakout in the Dow Jones and new breakouts in the Nasdaq and Nasdaq 100.

You’ve now read my opinion, next read Douglas’ blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.