Courtesy of Declan.

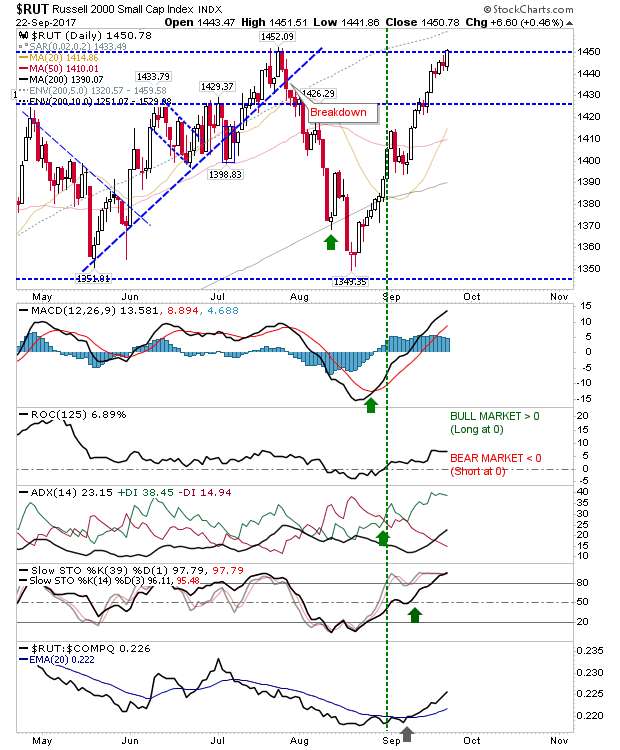

Friday delivered the upside target of 1,450 I was looking for in the Russell 2000. Next will be some follow through in line with the S&P and Dow breakouts, but this will require a resistance break which will be harder than a resistance tag. Technicals are healthy and relative strength is working strongly in Small Caps favour.

The S&P had a quiet Friday; volume was lighter, technicals are strong, and Thursday’s sell off was stalled by Friday’s recovery. However, the S&P continued its relative underperformance against the Russell 2000. With the breakout intact the next target is resistance from the rising channel.

The Nasdaq stalled its loss and prevented a stop whip-out as it mounted a recovery at its 20-day MA. However, Thursday’s loss was enough to see a ‘sell’ trigger in the Nasdaq and bearish cross in -DI/+DI.

The Semiconductor Index came back to positively test breakout support at 1,150. This is good news for this index, Nasdaq and Nasdaq 100. If Semiconductors can hang on to 1,150 then there is a good chance Tech averages will deliver the much-anticipated breakouts.

The Nasdaq remains primed for a breakout with a ‘sell’ trigger in the MACD.

For Monday, keep an eye on Tech indices; breakouts still look the most likely option here.

You’ve now read my opinion, next read Douglas’ blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.