Courtesy of Declan.

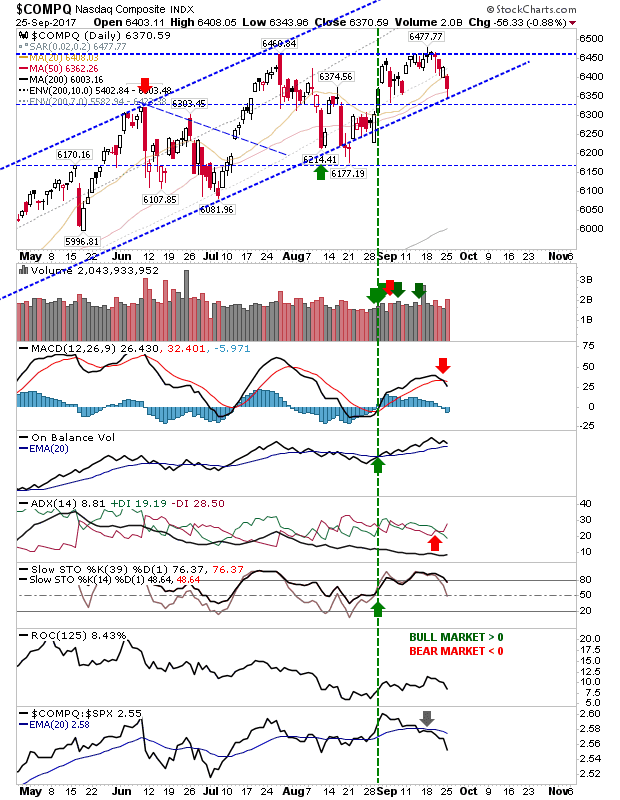

The squeeze set-up from last week which offered bulls a likely breakout has now fallen back inside the prior consolidation. Bulls now have a decision to make; do they defend the rising channel? Or let prices drift lower and risk a seller capitulation. A channel break at this stage would be very concerning and would open moves to test the June and August swing lows along with the 200-day MA – each a long way from current levels; in addition, a loss of the August swing low would effectively confirm a double-top.

The Nasdaq 100 is showing accelerated losses combined with significant technical weakness. If slow stochastics [39,1] cut below the 50-midline it will confirm a net bearish turn in technicals which is usually associated with a period of multi-month downward price action. I don’t want to kill the breakout chance here, but today’s action was particularly ugly. However, channel support is there to give bulls one last play for a push above 6,000.

The Russell 2000 got caught up in today’s Tech sell-off. There was a break of 1,450 which had the makings of a Small Caps breakout, but today wasn’t the day to deliver on this. However, unlike the Nasdaq and Nasdaq 100 there was no real selling tied to this index either. Honours even at resistance and a neutral finish for the day.

The S&P did get caught in the Tech selling but with a breakout in play it was able to recover by the close of business. Technicals are still bullish although relative performance remains bearish.

Tomorrow will again be about Tech averages, except this time it’s about defending support – not breaking resistance. If buyers defend support then look for this good-will to spread to the Russell 2000 with a breakout and a successful breakout support test for the S&P. If support fails, then the Russell 2000 is likely to fail at resistance and Large Caps will struggle to maintain theirs.

You’ve now read my opinion, next read Douglas’ blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.