"You're on a suicide mission."

"You're on a suicide mission."

"No, you're on a suicide mission." "Rocket Man" "Dotard". That pretty much sums up the weekend tweet wars between fearless leaders Donald Trump and Kim Jong Un, who both finally found someone to play with that understands them. Nort Korea's foreign minister told the UN on Saturday that North Korea "will strike premptively if needed" and the US countered by sending bombers right to the edge of North Korean airspace in a massive escalation of events not seen since the Cuban Missile Crisis – yet the markets are just shrugging it all off this morning.

“None other than Trump himself is on a suicide mission,” Ambassador Ri said through the UN’s simultaneous translation. “In case innocent lives of the U.S. are lost because of this suicide attack, Trump will be held totally responsible.”

“The very reason the DPRK had to possess nuclear weapons is because of the U.S."

Ever the diplomat, Trump followed that up Saturday night on Twitter, posting: “Just heard Foreign Minister of North Korea speak at U.N. If he echoes thoughts of Little Rocket Man, they won’t be around much longer!” Trump's bombers, of course, flew out of Guam – effectively making North Korea's poiint that the base is a direct threat to them.

Ever the diplomat, Trump followed that up Saturday night on Twitter, posting: “Just heard Foreign Minister of North Korea speak at U.N. If he echoes thoughts of Little Rocket Man, they won’t be around much longer!” Trump's bombers, of course, flew out of Guam – effectively making North Korea's poiint that the base is a direct threat to them.

North Korea’s state media issued a statement Saturday from the National Peace Committee of Korea describing Trump as “wicked” and “a rabid dog.” U.S. analysts now estimate that North Korea may have as many as 60 nuclear weapons, according to a Washington Post report.

Of course, Trump is just following the grand tradition of name-calling practiced by all our greatest leaders, remember when Kennedy called Kruschev "Little Nicky"? No, of course, not, becasue President Kennedy wasn't a moron!

I know, it's almost hard to remember what a real President sounds like these days, right? So, it's easy to see why Oil (/CL) is blasting higher this morning ($51.35) and we're 4 short at $50.80 avg – so down about $2,000 so far and adding 2 more short here puts us in 6 short at $50.97 avg). We had several small drops (0.10) to $50.40 on Friday's play for small gains but the contracts we left open for the weekend burned us in this morning's sharp pop.

Not only are we under the threat of Nuclear War breaking out at any moment (who's less impetuous, Trump or Kim?), but Facism is on the march, with the far right parties scoring significant progress in elections in Germany and New Zealand over the weekend. While the US equity traders seem completely oblvious to the danger. Gold (/YG) is still up around $1,295 but Silver (/SI) is down at $16.90 and makes a nice long play down here. The Dollar is keeping them down at the moment but that's OK as we love the Dollar and, if you read the Friday Morning PSW Report (or Wednesday's) you know we were long at the 91.50 line and we just hit 92.40 there for $900 per contract gains – again – you're welcome!

Speaking of gold, one of my favorite penny stocks, Northern Dynasty (NAK), will be speaking at the Denver Gold Forum this week. We have been playing this stock since it was less than 0.50 at PSW and even my kids have this one as they are sitting on a massive gold reserve and at, in theory, have only been held back by environmental regulations which, of course, Trump is nuking.

To be very clear, this is a casino stock and we already cashed half out at $2 and half out at $3 and then doubled down at $1 and then half out at $2 again – and that was just this year! So it's a free ride for us and I generally hate to talk about small stocks but this one is so interesting and gold is likely to pop so I'll just say, at $1.88, they are worth checking out. On a more conservative basis, our Trade of the Year was Wheaton Precious Metals (WPM) and you can't get our trade anymore but, back at $19.23, you can play the following:

- Sell 5 WPM 2019 $20 puts for $3.30 ($1,650)

- Buy 10 WPM 2019 $17 calls for $4 ($4,000)

- Sell 10 WPM 2019 $22 calls for $2 ($2,000)

That's net $350 on the $5,000 spread that's $2,230 in the money to start so a very good chance to win as long as silver doesn't collapse over the next 16 months. The upside potential on the trade is $4,650 (1,328%) if WPM is over $22 in Jan, 2019. The put sale is aggressive and obligates you to buy 500 shares for $20 amd we're 0.77 away from $20 but I have faith. If assigned, you own $10,000 worth of WPM for $10,350 (the $350 you laid out, presumably lost as well). Ordinary margin on the trade is just $2,058 though, so a very margin-efficient way to make $4,650.

On the more conservative gold side, we like Barrick Gold (ABX) at $16.30 as the lowest-cost producer. As of last December's report, ABX had 85.9M ounces of gold in the ground, not to mention 11.1Bn pounds of copper but the Gold is more interesting, at $1,295 an ounce that's $111,240,500,000 worth of gold yet you can buy the whold company for $18.5Bn.

Of course, gold doesn't do them any good until they mine it but ABX has the lowest extraction costs in the business, down around $900 so they make $400 an ounce in profit and that times 85.9M ounces is $34.4Bn and we're not even counting the copper that's a "waste product" of their gold mining. What's cool about ABX is their low-cost extraction makes them a good candidate to weather a downturn in gold while an upturn in gold quickly drops right to their bottom line. We already have ABX in our Long-Term Portfolio as well as our Options Opportunity Portfolio but, as a new trade, I like:

- Sell 10 2020 $15 puts for $2.20 ($2,200)

- Buy 15 2020 $15 calls for $4 ($6,000)

- Sell 15 2020 $22 calls for $1.70 ($2,550)

That puts us in ABX for net $1,250 on the $10,500 spread so the upside potential is $9,250 (740%) if ABX is over $22 in Jan, 2020. The downside is being assigned 1,000 share of ABX for $15 ($15,000) plus the loss on the spread would be net $16.25/share – which is pretty much the current price so it's a bit aggressive but, as I said, this is a great long-term stock. Margin on the put side is a very skinny $1,424 so another very efficient trade.

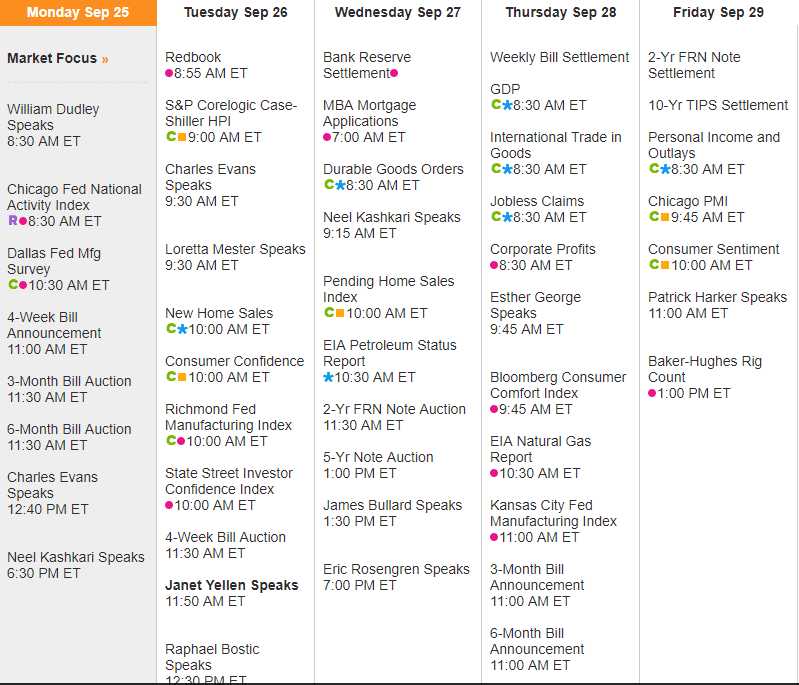

It's a busy data week, highlighted by an even dozen Fed speeches, including Yellen tomorrow at lunch in Ohio. The Fed National Activity Index weakened in August and we're wating on the Dallas Fed but that's likely to be down due to hurricanes and Consumer Confidence is iffy tomorrow and Durable Goods on Wednesday should be a miss and GDP on Thursday should be revised lower so, needless to say, we're still shorting the indexes!

We also still like Friday's long play on Volatility (VXX) and Thursday's hedge using the Russell Ultra-Short (TZA) and enjoy the free trade ideas while they last as the earnings are starting to come in and PSW does not give out free trade ideas during earnings season.

It's going to be an exciting week – be careful out there!