Courtesy of Declan.

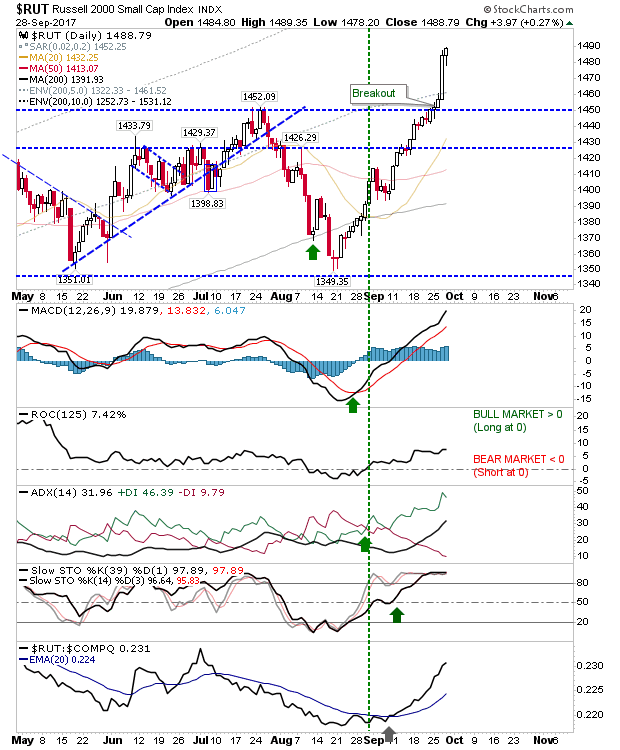

Yesterday saw big gains for the Russell 2000 as it accelerated past breakout support. A large part of this buying was likely driven by short covering but today’s defense of those highs is a vote of confidence by buyers who are looking to hold for longer than a few days. The target of 1,560 is the first overbought target to aim for at the 85th percentile rising to 1,637 for the 95th percentile (of historical prices going back to 1987).

The Nasdaq is back on the breakout watch after an earlier scare in the move back to the 50-day MA / rising support channel.

The Nasdaq 100 is lagging a little behind the Nasdaq and isn’t as well set for a breakout but from a risk:reward perspective it’s offering the best value for buyers.

The S&P maintains its steady trend higher with little reason for holders to sell or for shorts to jump in. Technicals are also in a healthy state – another good sign for longs.

For tomorrow it’s mostly a watch-and-wait. The Nasdaq is the index best placed to deliver momentum traders a reward. Value players may want to take a punt on the Nasdaq 100, especially if the Nasdaq makes a genuine push to break resistance.

You’ve now read my opinion, next read Douglas’ blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.