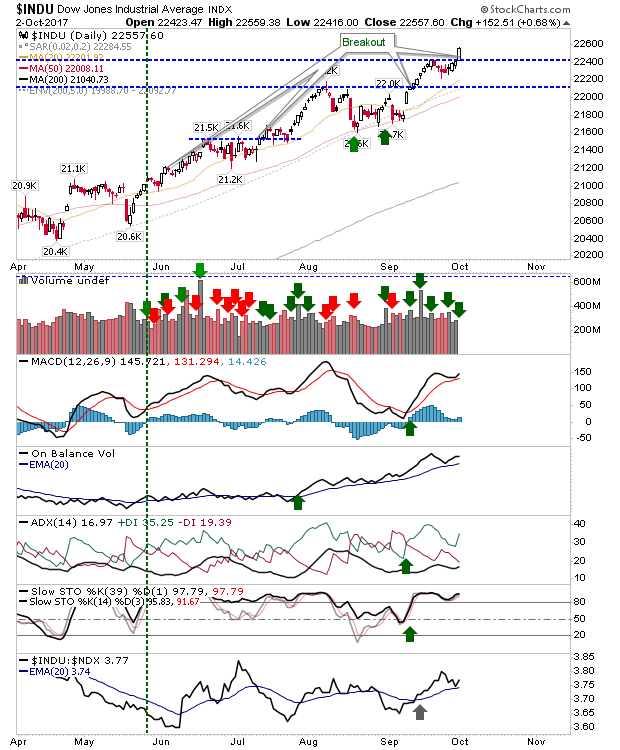

Courtesy of Declan.

The Dow followed in the footsteps of other indices by mounting a breakout but it was the Russell 2000 which stole today’s limelight.

Starting with the Dow, it made a straight-forward break to new highs on higher volume accumulation. Technicals remain in good shape.

But it was also a day where there is an acceleration in the gains in the Russell 2000; this is a rally which has gone from the lows of 1,344 in August, to 1,509 at the start of October and doesn’t look like it will be stopping anytime soon. Historic extremes for this index don’t kick in until the Russell 2000 gets to 1,560. Small Cap strength is important marker of economic strength and offers an opportunity for money rotation into Large Cap indices down the road (when bulls tire of chasing gains in the Russell 2000).

We are still watching for a breakout in the Nasdaq 100. Today came close to clearing 6,000 – a move likely to coincide with a new MACD trigger ‘buy’

Finally, the S&P remains on course to test channel resistance. Technicals remain firm.

For tomorrow, keep an eye on the Nasdaq 100. This is the index offering something for bulls.

You’ve now read my opinion, next read Douglas’ blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.