Courtesy of Declan.

It wasn’t a particularly exciting Friday but there were some points-of-action of interest. I had tweeted about the weakness in the Russell 2000 but there wasn’t much satisfaction for either side. The Russell 2000 finished with a narrow doji at the 50-day MA. As it failed to close below the 50-day MA bulls will be satisfied with a successful defense of the 50-day MA but the narrow intraday range offers a bigger swing trade off a break of the high/lows from Friday. There is still a chance a break below the 50-day MA will kickstart an acceleration towards the 200-day MA and this still looks like the preferred outcome. Any move back inside the ‘bull flag’ will open up for a ‘bear trap’ and a likely break of 1,500 – a move above 1,480 will open up a long trade opportunity.

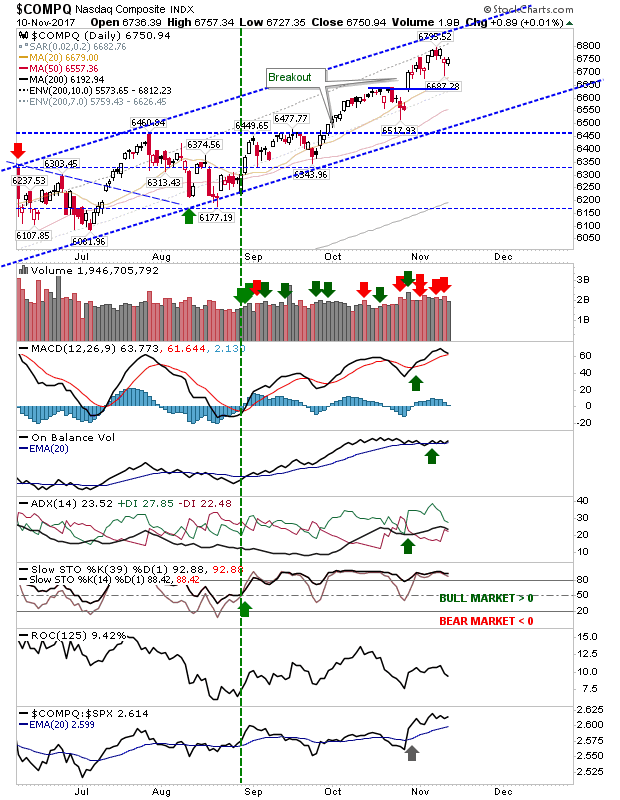

Tech indices held on to Thursday’s recovery and then managed to post a small gain (or at least a higher open). The Nasdaq is holding to its rising channel which keeps the broader bullish picture intact.

The S&P stuck to upper channel resistance (now support). Volume was down so no real switch to selling/profit taking. If the Russell 2000 can post a bounce then I would look for a fresh run to new all-time highs in the S&P; looks like traders need Small Cap leadership at this time.

The Nasdaq Summation Index doesn’t look like it’s suggesting we are at a bottom yet; significant market lows for the Nasdaq require an upturn (and cross of 5-day EMA) with the index below -500. This is clearly not the case yet.

The Percentage of the Nasdaq Stocks above the 50-day MA are also in a scrappy bearish decline; nothing suggesting a swing low yet.

Bullish Percents are attempting a low but well away from oversold levels; for this index I would want to see sub-30s for long term buys. At best, it’s a short term buying opportunity if there is a close above the 5-day EMA.

The one chart which did catch my attention was the relationship between Dow Transports and the Dow Industrial Index. The break below support is bearish for all markets as Transports are a critical barometer of economic health. Supporting technicals are also bearish.

For Tuesday, play for further losses in the Russell 2000 and Dow Transports. Rallies at this point will be chasing highs.

You’ve now read my opinion, next read Douglas’ blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.