Courtesy of Declan

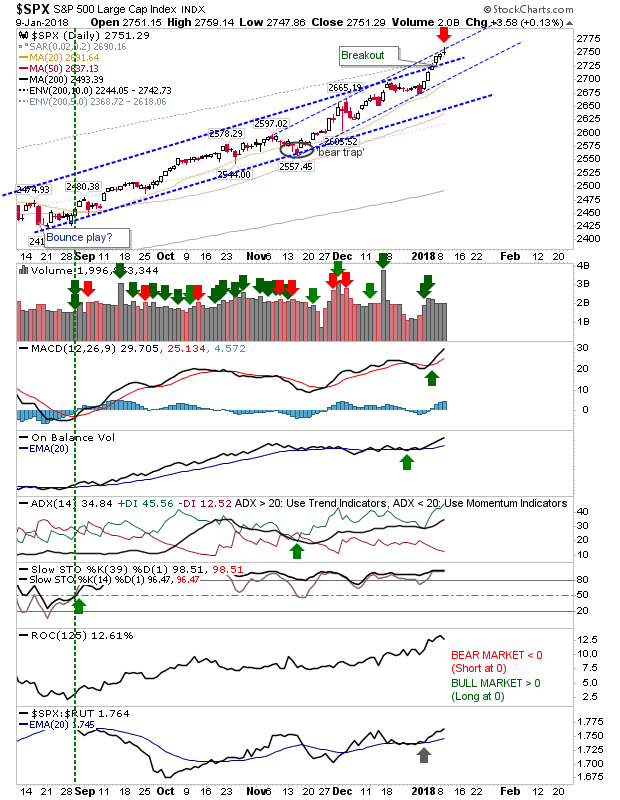

Since redrawing channel resistance the S&P, Nasdaq and Nasdaq 100 now find themselves up against (accelerated) channel resistance. This may be viewed as an opportunity to take (partial) profits and/or sell covered calls.

Buying volume for the S&P was modest and technicals remain strong but some pause in the buying would look preferable at this point.

The Nasdaq and Nasdaq 100 were a little more bearish given they both finished with bearish black candlesticks on higher volume 'selling'. Again, with the channel acceleration in play and a six-day sequence of gains, some profit taking would appear favored.

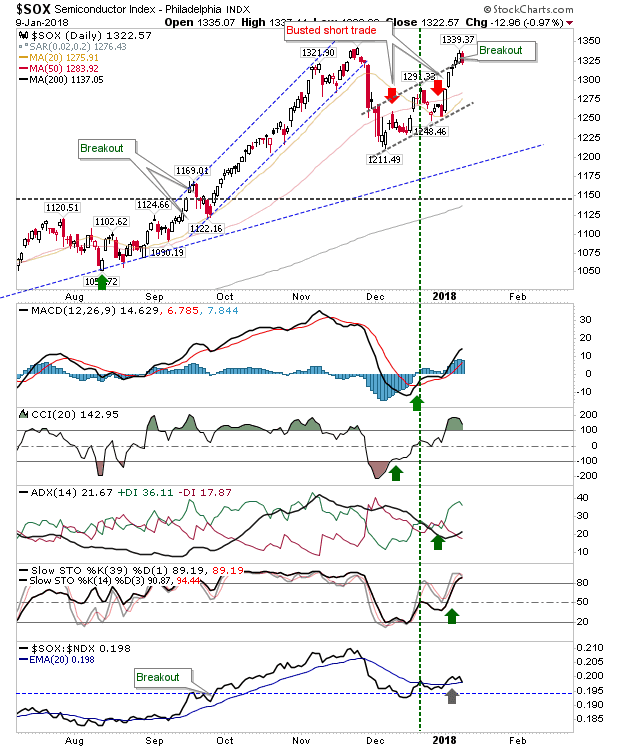

The Semiconductor Index popped its head above the 'bear flag' but the breakout looks to have failed. Shorts with a stop above 1,340 is looking like a good trade here. Technicals are firm although the index is again underperforming against the Nasdaq.

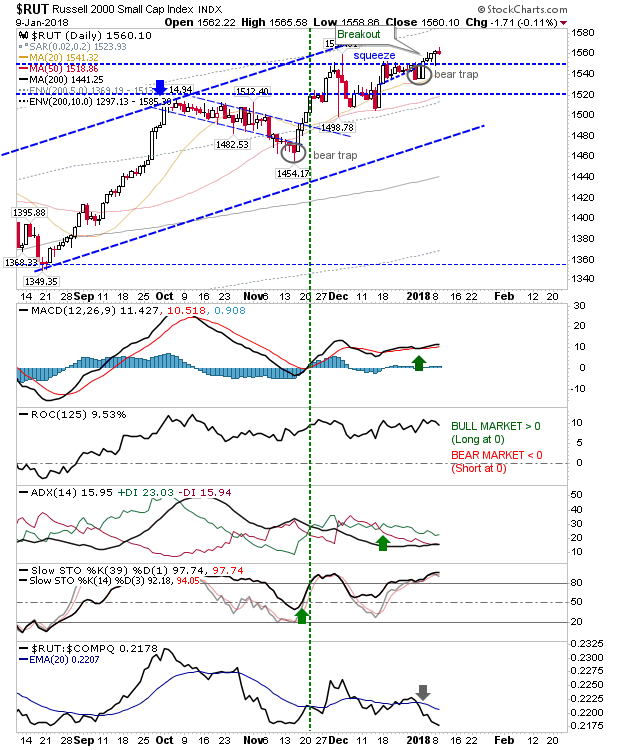

The Russell 2000 was the most boring of the indices. It has yet to kick on from its breakout – trading within its broader channel and has suffered a large relative loss in performance. This index sits in neutral territory; a drop below 1,545 would kill the nascent breakout and in itself open up a shorting opportunity.

For tomorrow, watch for a retreat from channel resistance for Tech and Large Cap indices.