Courtesy of Declan

Two days of selling has finally put a stop to the accelerated gains from December but it should also provide an opportunity to shake the weak hands out of their positions and set up a more sustainable rally.

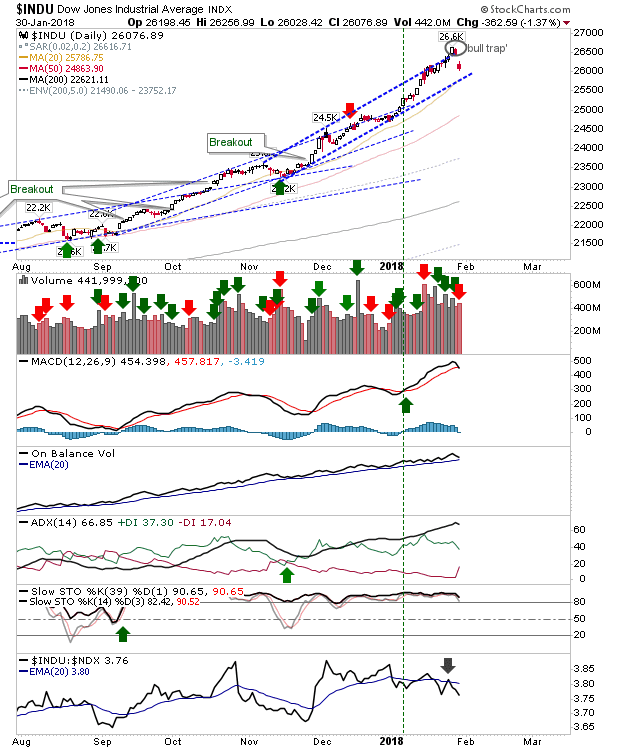

The nascent breakout in the Dow has been undone by the fall back inside the prior channel, leaving in its wake a 'bull trap'. Shorts will use the 'bull trap' highs as a place for stops. Typically, 'bull traps' from channel breakouts go all the way and drop out the other side – this would be a secondary shorting opportunity but we are not there yet.

The S&P made a clean break of the narrow channel from December returning to a slower channel support level (which was former channel resistance). Technicals remain bullish so the channel break doesn't suggest any larger deterioration other than a slow down of the existing advance.

It was a similar story for the Nasdaq – a channel break – with the option of former channel resistance turned support to lean on if needed.

The Russell 2000 will have rewarded persistent shorts but the bearish wedge has yet to confirm – a break of wedge support will be needed for this.

The coming days will be about confirming the channel breakdowns, the 'bull trap', and potentially a break of the bearish wedge (in the Russell 2000). The last two days are a start but there a long way from confirming a market top. Profit taking is always prudent after any period of sustained gains – helping to free up funds to buy (back) stocks at a discount.