Courtesy of Declan.

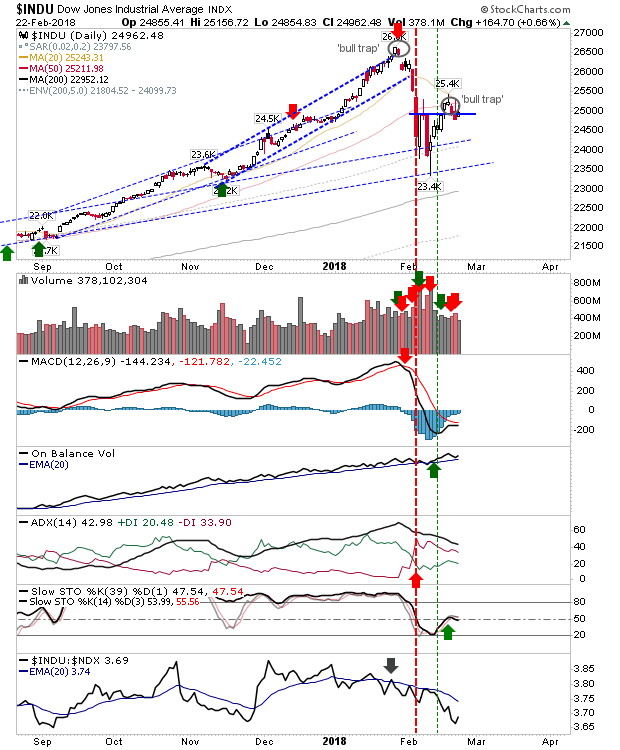

Starting to see evidence that the February bounce in markets is fading. The Dow Jones Industrial Average finished with a ‘bull trap’ as it ducked below breakout support despite finishing above yesterday’s close. Volume dropped as relative performance against tech indices took a marked step lower. Troubling times for the ‘flight-to-safety’ route.

The Semiconductor Index had looked like it was ready to mount a challenge of the January ‘bull trap’ but the last couple of days have seen a second attempt at a reversal off resistance. Technicals are very close to turning net bullish but haven’t done so yet. For now, shorts are ready to mount a new challenge with a stop above 1,350.

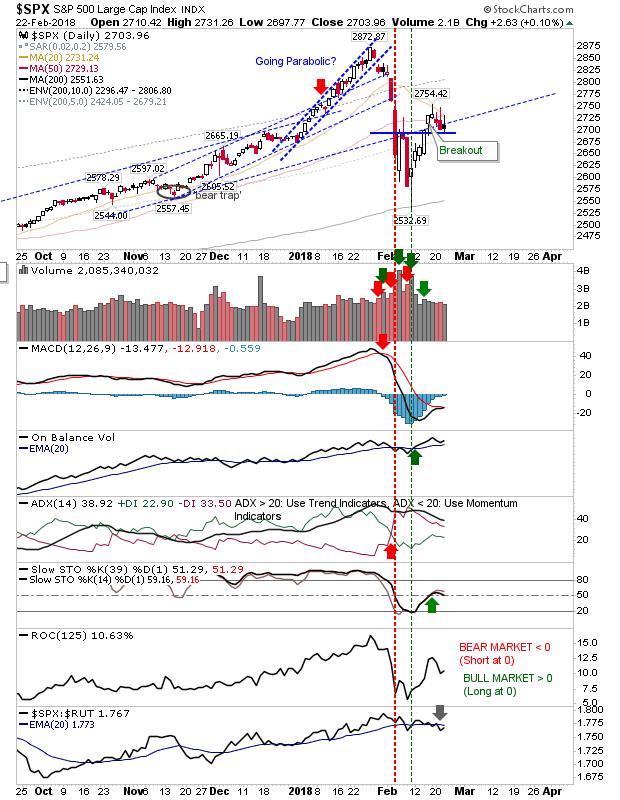

The S&P hasn’t quite succumbed to the same level of selling as the S&P but the series of upper candlestick spikes suggests further weakness is favored.

The Nasdaq finished a little lower but maintains a strong relative advantage. However, if Semiconductors do make a larger move lower it will drag the Nasdaq and Nasdaq 100 with it.

The Russell 2000 was another to post a spike high with 1,550 again playing as resistance. Technicals are a mix of bullish/bearish but the picture suggests this is a relief bounce; a solid move above 1,550 would be required to negate (not to mention a bullish cross in relative performance).

February’s bounce is under threat and this week’s action has not suggested bulls have full control. A retest of the February swing low looks necessary before prices can move higher. Shorts probably have the best play here for any of the aforementioned indices with a stop above this week’s highs.

You’ve now read my opinion, next read Douglas’ blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.