Click here for a FREE, 90-day trail subscription to our PSW Report!

Trend Days

I want to explain the concept of trend days, v churn days that I’ve been mentioning of late. I’ve noticed these patterns over the past few quarters, but have only in the past 4 weeks or so tried to take advantage of it. So far, with good success. What has really stood out aside from the fact what happens yesterday has nothing to do with today (the market has no memory) is how few reversal days we have anymore. I am not sure the cause of this; I am sure part of it is the dominance of program trading over humans with momentum based strategies but who knows how much. All I know is it has continued repeatedly and while obvious to me (and I assume others) it keeps repeating. So until the pattern ends, there is no reason not to take advantage of it – there are actually some low risk strategies that keep your cash protected overnight but allow you to allocate capital via the levered ETFs (long or short) or even calls or puts (which I’ve started doing); and you can be done by the end of the day and have that money cozy under your mattress.

By a reversal day I just mean a very choppy day where we start the day up by a significant margin and then go down significantly later in the day, or vice versa. Those happen occassionally but seemingly far less than in the past. Instead, we have had a dominance of 2 kind of days: (a) churn days or (b) trend days. Most of the time you know by 10:30 – 11:00 AM what it is going to be.The churn days have also been remarkable of late – we had a few examples last week during the downturn… immediately after a huge swoon the very next day (remember, the market has no memory from day to day) we get an almost silent day. The market will essentially ping pong back and forth in a very small range, from top to bottom of the range but never making a new high or a new low. Shape wise it looks like a rectangle. It’s as if once a churn day has been recognized, computers are selling the top of the range, and buying the bottom and we don’t even press the edges of the range to make traders reconsider that it might not be a churn day after all. That ping pong pattern will repeat all day. If recognized this pattern can be gamed as well, but its a less profitable foray, and you have to be making a lot of trades for the constant flips – some of our churn days have been in very narrow bands of 4, 5, 6 S&P points. I don’t have any charts for you but you probably will recoginize these days by the fact you are snoozing by noon. We’ve had 4-5 of these in the 2 weeks previous to this week.

More interesting, and potentially extremely profitable are the trend days. Wednesday off the Intel (INTC) news was a great example of a very easy trend day. To refresh on the changing character of the market, many times say even 2-3 years ago we’d gap up – go sideways for a bit and then perhaps trade down to give people something to think about. (did I get caught? should I be chasing? will this reverse on me?) But it is rare nowadays.

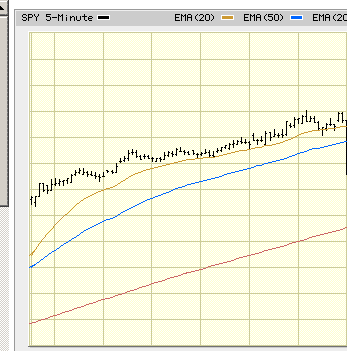

Apologies but the chart is terrible for this first example but this is Wednesday’s (Intel aftermath) charts but here is a SPY ETF (SPY = S&P 500) chart for the day. (this is a 5 minute chart meaning each "bar" is 5 minutes of activity, and each major tan gridline is an hour)

[click to enlarge]

Notice, after the gap up on the open – to about 91.75 (the prices were chopped off on this chart, sorry) we remained in trend all day. Not 1 single real test of the support lines except some minor sweat at 3:30PMish. I don’t like to hang around for the last 5-10 minutes most days anymore because the action is volatile and volume explodes (I could not fit volume on this chart but it is 4x the volume in a normal 5 minute period from 3:55 PM to 4:00 PM) So effectively excluding that last 5 minute bar we touched 93.50 multiple times in the 3:45 to 3:55 PM time frame. Which is just under 2% gain if you jumped in at the open. Use the 2x ETF = double. Use the 3x ETF = triple. Use calls = multiples of that… and your mettle is never really tested. We’ve had MANY days like this – it works identically on the down days, our rallies are so weak and they almost never threaten to reverse trend and cause you to sweat.

So let’s go back to yesterday which was a mix of the two days (churn and trend); a rare case but an easy one to profit from again one we began to trend… using only intraday tactics and getting your

But the one difference is most (all?) of our churns are rectangles in shape – we go up to almost the same intraday high of the day, and go back down to the same intraday low. I thought between 10 AM and 11 AM that was the type of day we were getting – you can see the ping pong pattern from 9:30 AM to 11:30 AM. But it was a unique day in that after 11 AM and through 1 PM the range narrowed considerably. Heck we flatlined in the noon hour. And did again for most of the 1 PM hour. I drew 2 black lines to show you the shape – it was a triangle. A triangle that was narrowing rapidly…

So usually this sort of setup will lead to a significant move once we move "out" of the triangle – but you have to wait to see which way it resolves. Around 1:45 PM you can see the S&P jump over the top edge of the triangle and lo and behold, what does it turn into? A trend afternoon. From that point forward – no choppiness, no scary reversals, no real test of any of the support lines that mark the average day from 2-3-4-5 years ago. Computer buying begets computer buying and HAL9000s all jump in. Once the trend starts, you are set. So we broke out of our triangle below $93.50, and we made a new day high by 2:00 PM – again, I didn’t have room to smush volume in here but we had a volume spike as a new day high was reached post 2 PM, and the rest of the day you sit in your Lazy Chair and the trend carries. As I stated above I don’t mess with the last 5-10 minutes because so much volume hits and the price movement is incredibly fast (and again that happened, as the last 5 minute bar was 3-4x the volume of the average 5 minute period the rest of the day – I assume a rush of sell orders were thrown at the market) so if you mosy on out 5-10 minutes before the end of the day (as we did) you were able to ride at worst from $93.50 (if you waited until 2 PM) to as high as $94.50. That’s a 1% move in the index in under 2 hours. Again, with the leveraged ETFs you can get double that, or triple that – or with calls much more and you only need to risk a portion of your capital to manufacture a lot of gains. Now in this specific case the last 5-10 minutes featured a tiny sell off so don’t read into any great trading on my part for avoiding that – I am just by rote avoiding those last moments of the day.

I have been using anywhere from 5-10% of the portfolio for this type of work, since we have so much cash and it has been working consistently. It’s a nice way to supplement the core positions without a lot of risk capital involved, and we’re back to cash by the end of the day with that portion of the portfolio. Since the holding periods are short term and this is not a daytrading service, I am not going to post these trades – but instead thought it worthwhile to show you what I am seeing. So far so good, but now start the problems. This is incredibly obvious to anyone who really watches the market. Things that are this obvious and frankly this "easy" cannot keep working. "Easy" usually blows up on Wall Street. But I thought that a few months ago and it simply repeats week after week. Judging by the huge volume spikes we are getting in the last 5-10 minutes on so many days, I think a lot of people (computers) are doing this strategy. I am not sure why the intraday action works like this; and why we have so few reversals or even "threats" of reversal, but for now – it is what it is. If you are not churning in a narrow range, you almost always are trending without typical volatility.

It’s a profit center, and until it fails we’ll continue to exploit it as a supplement to core strategy.