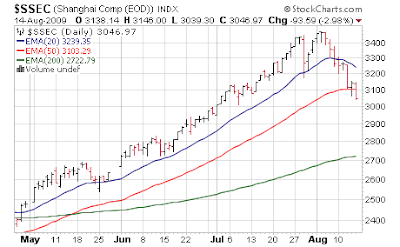

Fibonnaci Stops Rally in China?

Courtesy of Trader Mark at Fund My Mutual Fund

I asked an online buddy, Jeff over at Zentrader.ca, to post a Fibonnaci chart for Shanghai. For those unfamiliar with the mathematician and how it affects stock trading please see [Aug 5, 2009: Fibonnaci Calls: The 38.2% Retrace is Approaching]

Since the main Chinese market dropped 10% from its high, bounced for 1 day (Thursday), and then fell through the 50 day moving average Friday with another 3% loss, I was curious to see what sort of pullback the Fibonnaci "method" would call for.

My request was not specific enough and he actually posted 2 charts, with some quite amazing results.

Here is the chart I actually had been asking for with my vague request for a Fibonnaci chart… after spiking close to 3500, the 3 levels of retrace would show as below. So "best case" if this works out, from the close of 3047 Friday China potentially has another 8.4% to fall according to the Italian methodology. Obviously the pullback could of be of the 50% or 61.8% varieties as well but we’re looking for "best case".

There was nothing amazing about that data… but the other chart he posted, which was not my original request actually makes one shake their head. Remember in that August 5th piece we said the US markets had retraced 38.2% of their 1.5 year drop (October 2007 – March 2008) and it would be a sensible place to pullback if indeed Fibonnaci still rules over HAL9000. Here is what the chart looked like at the time – since then we’ve made a 2nd run at the 38.2% level (1014) middle of last week and then pulled back yet again Friday.

There was nothing amazing about that data… but the other chart he posted, which was not my original request actually makes one shake their head. Remember in that August 5th piece we said the US markets had retraced 38.2% of their 1.5 year drop (October 2007 – March 2008) and it would be a sensible place to pullback if indeed Fibonnaci still rules over HAL9000. Here is what the chart looked like at the time – since then we’ve made a 2nd run at the 38.2% level (1014) middle of last week and then pulled back yet again Friday.

Now for the amazing… China pulled back exactly at its 38.2% retrace as well. Compare this chart below to the one above… striking similarity with about a 2 week lag. (note the US chart is a weekly chart, whereas the Chinese chart is daily – hence why the US one is so compressed)

And after the original pullback (see chart at very top of page) China made a 2nd run at Fibonnaci – and failed. Which is what the US did late last week. Then China plunged 12% in short order. Which means the US will…. ? Apparently Italian is spoken even in China. As for US markets – is China foreshadowing a similar fate? Or can the printing presses of America overrule mathematical equations? Inquiring minds want to know…

And if you are curious how the Fibonnaci pullback (if indeed we can swamp Goldman Sachs, and Larry Summers) would play out in the US, we’ve gained approximately 350 S&P 500 points since the March 6 bottom

- 38.2% retrace = 134 point drop, or S&P 880ish

- 50% retrace = 175 point drop, or S&P 840ish

- 61.8% retrace = 216 point drop, or S&P 800ish

Even the 38.2% retrace would do a great job of filling in the 2 gaps we keep pointing to: S&P 906 and NASDAQ 1800. Now of course China has some country specific issues, with a government who admits money meant for banks and loans is going into the stock market, and they are trying to pull that back. No such admissions in the much more "transparent" US of A.

I know those numbers above seem impossible considering we are not even allowed to drop 1% nowadays without a "post 3:30 PM" buying spree from parts unknown (note the 0.6% rally on the S&P 500 in the last 25 minutes Friday after 5 hours of no movement on a sleepy Friday summer afternoon – shocking of course) but if Italian math can overpower the Chinese, there might be some chance he can take out Mr. Summers. Because I do believe HAL9000, once the switch is turned will be more than happy to rampage through the golden fields on the short side as well….

I will say for the 4th or 5th time, I do find it interesting that the market that led the world up is now being ignored as it turns back down sharply… as if it’s the white elephant in the room.

Photo: White elephant Doi Suthep, original uploader was Kyle sb at en.wikipedia, license here.