Business Loans Record Freefall

Courtesy of Jake at Econompic Data

We have detailed the deflationary pressures from low capacity utilization and high unemployment before, but John Mauldin details the deflationary pressure coming out of an area that was / is supposed to power the U.S. recovery… businesses. We have detailed the pullback in new loans to consumers, but below shows the reduction in business loans. First to John Mauldin:

Then we have Reduced Borrowing and Lending, as consumers are paying down debt and banks are reducing their lending. Both are necessary in a credit crisis-caused recession. Bank lending is basically back to where it was two years ago, and shows no sign off rebounding. Banks, as I have written, are buying US government debt in an effort to shore up their balance sheets. Lending to small business, the real engine of job creation, is sadly decreasing eachmonth.

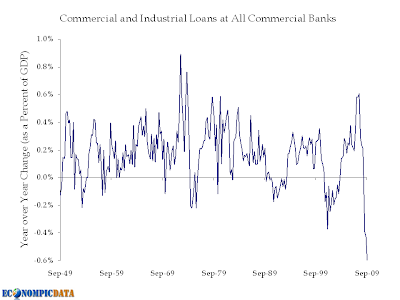

The chart below shows the year over year change in business loans as a percent of GDP going back 60 years.

A record drop and this one doesn’t yet appear to be slowing down.

Source: BEA / St. Louis Fed