What a crazy week!

What a crazy week!

I've been very busy updating the Buy List for Members so now let's turn to what, if anything, justifies this bullish posture now that we are finally over our breakout levels. I am DETERMINED to find good news to report so we'll see what I can dig up. Of course, our buying premise is based on my 2010 outlook that determined we don't really care about the Economy, not the one that affects the little people, the only ECONOMY the stock market cares about is the one that affects those of us in the top 10% of society as we are the only ones still playing the market anyway.

We hit the targets I laid out for this run back when I ran the "Last Charts of the Decade" back on Dec 30th. Those charts had the Fibonacci levels there so let's keep an eye on the next set of levels, assuming we get some follow-through next week (still uncertain) to confirm the breakout. Until we get that confirmation, let's augment our Buy List with the same hedges we used to protect our old bullish positions as I updated in our last hedging article:

- DXD Apr $26/33 bull call spread was net $2.40, now $2.20, down 8%. I still like this one as it's $2.31 in the money and that last 200-point run only cost us .20 so I think that's an acceptable loss against our long gains with the 300% potential upside return if the Dow does fall (about 10% should do it).

- FAZ July $20/35 bull call spread at $2.60, now $1.60, down 38% – these got murdered but XLF was one of our key long plays and they flew for us this month. When you get a spread that drops like this you can roll both ends lower and here we can drop to the July $15 puts for + $1.60, which puts us $1.80 in the money and is excellent protection against aggressive upside bets on the financials.

- FAZ July $15 puts sold for $2.10, now $2.45, down 16%. This is why we prefer selling premium for coverage – so much less damage on the same FAZ ETF in the same month. The only difference is one side we bought premium and one side we sold it. If FAZ breaks below $16, I think we can assume the financials aren't likely to run back down and this play becomes less desirable.

- SDS March $34/44 bull call spread $2, now $1.40 – down 30% – This was our high risk trade with a 5:1 payoff that fared no better than the FAZ spread. I still like covering the S&P with this until they break over 1,150 (now 1,144).

- SMN Apr $9 calls at .85 now .45, down 47% – it makes sense that if the economy begins to fall, materials will pull back but materials have instead been on a tear and this unhedged position suffered deeply. Not a problem if you were playing the steel makers and miners to the upside and we'll find out during earnings if the amazing run-up in that sector has been justified.

We experimented with a very bearish stance in the $100K Virtual Portfolio after we went to cash into the New Year and I decided it would be fun to be 100% bearish with 20%, using the $100KP to set up bearish positions. Well it turns out it wasn't fun at all and we lost almost 50% of that 20% playing aggressively for a downturn that didn't come. That's why we're now redeploying cash with our brains firmly switched off and just sticking to the charts, back to using the winning formula we followed last year of well-hedged bullish positions with disaster protection (that hasn't been needed yet!).

Remember, your hedges are supposed to lose money if the bulk of your virtual portfolio is flying. Allocating 5-10% of your virtual portfolio to hedges like these always makes sense, especially when allocated against our usual collection of buy/writes and other spreads that generate 5-10% per month in profits. Effectively, you are giving up about 1/4-1/3 of your returns in exchange for piece of mind – it's not a bad trade-off but it's hard to keep motivated to hedge when the market goes up and up and up and you begin to feel like it's throwing money down the drain.

I would caution that this attitude is like giving up on life or health insurance because you haven't gotten sick or died yet – eventually, there's always a downside and, when it comes, you will either be protected or you won't. The funny thing about stock insurance is that, unlike life insurance, you can actually use that money to take advantage of a dead market and BUYBUYBUY at the bottom. The difference between the money made by people who had cash at the March lows and the people who simply "rode it out" is astronomical. These major market corrections happen, on average, once every 10 years and hedging can turn market disasters into the opportunities of a lifetime – but only if you use them!

It's very important to read the comments under this post as we discussed virtual portfolio allocations and scaling in and there's an XLF trade and other fun stuff to consider. Now, on with the reading:

Rupert's NY Post has a good indictment on Tim Geithner. They quote a known troublemaker named Josh Rosner:

Rupert's NY Post has a good indictment on Tim Geithner. They quote a known troublemaker named Josh Rosner:

“We’ve seen an ongoing effort by Tim Geithner at the Federal Reserve and Treasury to do the public’s work out of the public’s view in ways that benefit the banking interest ahead of the public’s,” said Joshua Rosner, a managing director at Graham Fisher & Co. “It was under Tim’s direction that we were given stress tests that were less than transparent and less than credible,” he added.

Here's a good one from Bill Moyers, Barry posted the video HERE:

Ah, yes — Goldman Sachs, that paragon of profit and probity — which bet big on the housing bubble and when it popped — presto! — converted itself from an investment firm into a bank so it could get your bailout money. Now consider this: in 2008, Goldman Sachs paid an effective tax rate of just one percent. I'm not making that up — one percent! — while their CEO Lloyd Blankfein pulled down over $40 million. That's God's work, if you can get it. And, believe me, Wall Street bankers know how to get it.

What's their secret? How do the bankers pick our pockets so thoroughly with barely a pang of guilt or punishment? You will find some answers in this current edition of "Mother Jones" magazine, one of the best sources of investigative journalism around today. Most of this issue is devoted to what the editors call "Wall Street's accountability deficit."

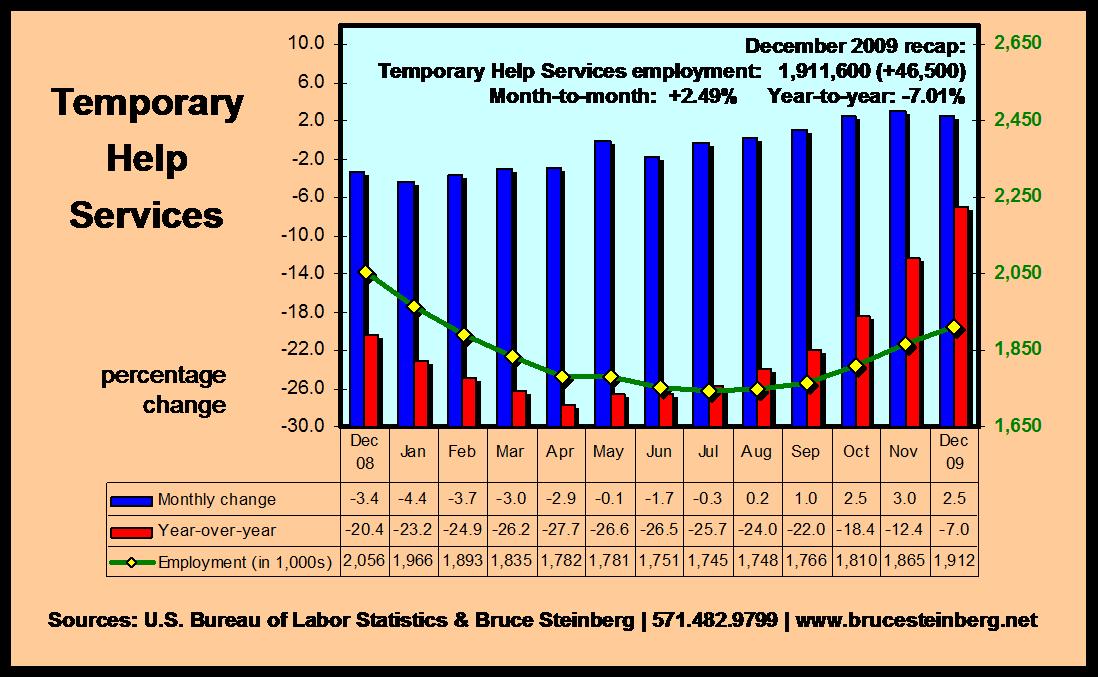

Here's a nice green shoot – Temporary help has really shot up with almost 200,000 more monthly hires than we had in April which means companies "sort of/kind of" want 200,000 more workers. That should really cheer up out 18M unemployed people, right?

Here's a nice green shoot – Temporary help has really shot up with almost 200,000 more monthly hires than we had in April which means companies "sort of/kind of" want 200,000 more workers. That should really cheer up out 18M unemployed people, right?

Unfortunately, 40% of the people who are unemployed have been unemployed 27 weeks or more and the chart showing that we have gained no jobs this past decade is shocking when viewed in the light of the 5 previous decades, where we averaged over 25% jobs growth for the decade. There has been noise this weekend about another jobs stimulus package coming out very soon and we do need something but I'm losing faith in this adminstration's ability to do anything other than lining Wall Street's pockets so I'm not putting a lot of faith in a new program actually helping anyone other than a few examples they'll need to prop up when it's time to get on TV and talk about what a great success the new program has been.

The NY Times has now featured in the Magazine Section (a big deal to us readers) the National movement of people just telling baniks to shove the mortgage up their asses. John Courson, president and C.E.O. of the Mortgage Bankers Association, recently told The Wall Street Journal that homeowners who default on their mortgages should think about the “message” they will send to “their family and their kids and their friends.” The Bankers are generally screwed when people simply decide to walk away so they are now pushing the "morality" issue of walking away from a bad home loan.

The NY Times has now featured in the Magazine Section (a big deal to us readers) the National movement of people just telling baniks to shove the mortgage up their asses. John Courson, president and C.E.O. of the Mortgage Bankers Association, recently told The Wall Street Journal that homeowners who default on their mortgages should think about the “message” they will send to “their family and their kids and their friends.” The Bankers are generally screwed when people simply decide to walk away so they are now pushing the "morality" issue of walking away from a bad home loan.

Mortgage holders do sign a promissory note, which is a promise to pay. But the contract explicitly details the penalty for nonpayment — surrender of the property. In some states, lenders also have recourse to the borrowers’ unmortgaged assets, like their car and savings accounts. A study by the Federal Reserve Bank of Richmond found that defaults are lower in such states, apparently because lenders threaten the borrowers with judgments against their assets. But actual lawsuits are rare.

Mortgage holders do sign a promissory note, which is a promise to pay. But the contract explicitly details the penalty for nonpayment — surrender of the property. In some states, lenders also have recourse to the borrowers’ unmortgaged assets, like their car and savings accounts. A study by the Federal Reserve Bank of Richmond found that defaults are lower in such states, apparently because lenders threaten the borrowers with judgments against their assets. But actual lawsuits are rare.

25% of all homes are underwater and if you have a $600,000 mortgage ($5,000 a month) on a home that is worth $400,000 and you don't think it's coming back in the next 10 years and you can rent an equivalent propert for $3,000 a month then it's simply a poor business decision to remain in your home. If this turns into a trend (look for infomercials on TV), then the banks are going to be very screwed. As it is 10% of the homes in this country are unoccupied.

I don't know if you can trust the Sun (a UK tabliod) but this is wild: The 23-year-old Londoner was attacked by a waiter in a hotel toilet after celebrating her engagement to her boyfriend with drinks. But after she admitted boozing and sharing a hotel room with her fiancé, cops in the strict Islamic state arrested her for "illegal drinking" outside licensed premises and having sex outside marriage. Her 44-year-old fiancé, also from London, was charged with the same offences. And both were thrown in police cells by officers who paid little heed to the rape.

I found this great greeting on the Tea Party Nation web site, maybe Cap can use it for his site too:

New growth business to keep an eye on: Denver has more medical-marijuana shops than Starbucks locations. Denver is legalizing the shops in order to tax them and California is voting on a similar measure on Tuesday. Illinois is leaning that way too.

We have hearings coming up from the Financial Crisis Inquiry Commission, which is headed by Phil Angelides, the former California treasurer who is not too happy with the way California lost tens of Billions of dollars in AAA investments that were recommended to them by their highly paid advisors at GS, MS et al. He says he wants to examine the financial sector’s “greed, stupidity, hubris and outright corruption” — from traders on the ground to the board room. “It’s important that we deliver new information,” he said. “We can’t just rehash what we’ve known to date.” He understands that if he fails to make news or to tell the story in a way that is comprehensible and compelling enough to arouse Americans to demand action, Wall Street and Washington will both keep moving on, unchallenged and unchastened. Among the big-name witnesses that the Angelides commission has called for this week is Goldman’s Blankfein. Geithner, Paulson and Bernanke (who now blames "weak regulation" for causing the financial crisis) should be next.

We have hearings coming up from the Financial Crisis Inquiry Commission, which is headed by Phil Angelides, the former California treasurer who is not too happy with the way California lost tens of Billions of dollars in AAA investments that were recommended to them by their highly paid advisors at GS, MS et al. He says he wants to examine the financial sector’s “greed, stupidity, hubris and outright corruption” — from traders on the ground to the board room. “It’s important that we deliver new information,” he said. “We can’t just rehash what we’ve known to date.” He understands that if he fails to make news or to tell the story in a way that is comprehensible and compelling enough to arouse Americans to demand action, Wall Street and Washington will both keep moving on, unchallenged and unchastened. Among the big-name witnesses that the Angelides commission has called for this week is Goldman’s Blankfein. Geithner, Paulson and Bernanke (who now blames "weak regulation" for causing the financial crisis) should be next.

Related news item: "Though it got off to a slow start, the Financial Crisis Inquiry Commission starts its public hearings with a bang, calling in Jamie Dimon (JPM), Brian Moynihan (BAC), John Mack (MS), Lloyd Blankfein (GS) and the FDIC's Bair to testify this week. Up at bat later in the year will be Bernanke and Geithner, with subpoenas as needed."

From the Daily show (good clip): "As you've heard, after promising numerous times on the campaign trail to broadcast Senate health care negotiations on C-SPAN, President Obama is now blocking the network's cameras from the chambers. Of course, this is really in the best interest of C-SPAN, who would be heavily fined by the FCC if they aired all those Senators giving sloppy blowjobs to the insurance companies."

Hey, there is some integrity in Washington after all, or at least in Alabama as Parker Griffith, the Democratic Congressman who flipped parties, lost his entire staff as they all quit in protest.

Very good article in the Atlantic about "How America Can Rise Again" with great observations from Jim Fallows, who just got back from 3 years in China: "The idea of “finally” going to hell is a modest joke too. Through the entirety of my conscious life, America has been on the brink of ruination, or so we have heard, from the launch of Sputnik through whatever is the latest indication of national falling apart or falling behind. Pick a year over the past half century, and I will supply an indicator of what at the time seemed a major turning point for the worse. The first oil shocks and gas-station lines in peacetime history; the first presidential resignation ever; assassinations and riots; failing schools; failing industries; polarized politics; vulgarized culture; polluted air and water; divisive and inconclusive wars. It all seemed so terrible, during a period defined in retrospect as a time of unquestioned American strength."

![[ABREAST]](http://s.wsj.net/public/resources/images/MI-BA727_ABREAS_NS_20100110174913.gif) WSJ says Q4 earnings should be great with the following outlook:

WSJ says Q4 earnings should be great with the following outlook:

In large part that outsized gain reflects the fact that results in the fourth quarter of 2008 were crushed by an economy then in free-fall. Consumer discretionary, materials and financial companies are expected to show the biggest bounce.

But the profit recovery will also likely reflect the potent combination of aggressive cost cutting and an economy that, while far from healthy, is growing. Multinationals such as industrials, global consumer-goods producers and technology companies will likely see a boost from last year's decline in the dollar, which inflates the value of foreign profits. And, as has been the case recently, especially strong results are expected from firms with big exposure to faster-growing emerging-markets economies, particularly among technology names and materials producers.

Very green shoot: The government will be hiring 1.2M census takers in the first half of the year so about 200,000 a month should guarantee us positive employment numbers from here on out. Predictions are that corporate America will add 1.1M jobs this year so 300,000 jobs a month should be expected although I wonder what number we'll see when those 1.2M census takers are done (or maybe they'll find a way to make those jobs permanent?). The census has already hired 200,000 people in 2009 (didn't help much) but now the real work begins. This is, by the way, 3 times more people than were hired in 2000.

Very green shoot: The government will be hiring 1.2M census takers in the first half of the year so about 200,000 a month should guarantee us positive employment numbers from here on out. Predictions are that corporate America will add 1.1M jobs this year so 300,000 jobs a month should be expected although I wonder what number we'll see when those 1.2M census takers are done (or maybe they'll find a way to make those jobs permanent?). The census has already hired 200,000 people in 2009 (didn't help much) but now the real work begins. This is, by the way, 3 times more people than were hired in 2000.

Robert Barbera and Charles Weise argue for a job-rich recovery, saying "jobless recovery" adherents misunderstand why employment collapsed: "The drastic reduction in inventories and payrolls was not a result of restructuring: it was symptomatic of panic, the same panic that caused the massive sell-off in equities, corporate bonds and mortgage-backed securities."

Quick list of good reads from Seeking Alpha's Market Currents this weekend:

- Roger Nusbaum considers whether infrastructure can be considered a cohesive enough asset class to be suitable for ETF investing.

- It's only slightly cheaper to insure against a U.K. default in the derivatives market than it is to insure against Portugal's default, leading Jim Jubak to think the unthinkable: Anarchy in the U.K.? (And then, why not the U.S.?)

- Venezuela's Chavez announced a major currency devaluation late Friday in an attempt to shore up government finances and rev up the economy ahead of key elections this year. The devaluation could add five percentage points to the country's 27% inflation rate, already one of the highest in the world.

- Noting banks seem to be more willing to take on risk, FSB's Mario Draghi urges prudence: "Bankers should be aware of the fragilities in the system. They should have in mind that there are many fragile sides to this beginning of the recovery."

- iSuppli's teardown of Google's (GOOG) Nexus One pegs its base cost (BOM) at $174.15. Firm says the Nexus One has "the most advanced features of any smartphone ever dissected… a remarkable feat given the product's BOM is similar to comparable products introduced during the past year."

- Goldman Sachs (GS) has a new enemy, with Hank Greenberg urging Congress to investigate the degree to which Goldman contributed to AIG's (AIG) near-collapse. And Goldman fires back, ridiculing Greenberg's reliance on news reports to form his opinion.

- Very green shoot: China's imports surged 56% to a record in December while exports rose for the first time in 14 months, climbing 17.7% Y/Y. If the numbers are correct, China's economy is doing much better than expected and consumer spending among China's trading partners, especially the U.S., looks like it's on the mend. (ETFs: PGJ, FXI)

- Americans sent a record $64B into foreign mutual funds last year, and Barron's thinks the trend will continue in 2010. Despite strong growth in emerging market equities, those stocks still aren't overly expensive and foreign markets present a nice diversification away from a potentially vulnerable dollar.

- Sure, this was a bad recession, but fundamentally it wasn't any different than the ones that came before, writes Accrued Interest. Which means if the Fed wants to maintain a stable monetary policy, it better start removing extraordinary market accommodations now.

- Boston Fed's Rosengren says he expects mortgage rates will rise up to 0.75 points in coming months as the Fed winds down its MBS purchase program. The Fed could extend the program if the economy deteriorates dramatically, but, "that's not in our forecast – that's not what we're expecting."

- An insider demystifies high-frequency trading.

- NY Fed's chief lawyer says no one told Tim Geithner about the Fed's efforts to muzzle AIG's (AIG) bailout disclosures because they "did not warrant" his personal attention. Rep. Darrell Issa calls the letter "staggering" and says it "raises more questions on the inner-workings" of the Fed.

So just the usual craziness this weekend. Should be a fun week ahead.