CGTS: IT WAS A CAUTIONARY TALE (STOCKS CURRENTLY SCREAMING ‘CAUTION’)

Courtesy of Michael Clark

“By a continuing process of inflation, government can confiscate, secretly and unobserved, an important part of the wealth of their citizens.”

— John Maynard Keynes

THE CORRECTION THAT WASN’T THAT STILL MIGHT BE

Last week we suggested that stocks were in a ‘cautionary’ phase — we were expecting some selling to come in. Selling didn’t come in. And it looked like market momentum was turning back up. Then came the SEC uppercut to the jaw of Goldman Sachs. Stocks fell back. Warren Buffet apparently lost 1 billion dollars on the decline of GS alone.

Then came the Black Swan from Iceland, not in the form of default or a referendum not to repay loans to European banks but in the form of a volcanic tantrum. Ash has blanketed European skies for a week, cancelling thosands of flights, costing airline companies somewhere in between $60 and 200$ million a day (depending upon who is reporting). Already airline companies have their weeping cloths out and are beginning to beg their governments for a bailout. If this continues, we’ll need to nationalize every large company in every large nation and declare them all too big to fail, even if God strikes them with a volcano. "Please give us money, Mister Sugar Daddy, so we don’t fail and force the layoffs of thousands of workers." It sounds as much like extortion as merely pathetic groveling. In that case, I guess we just need one national airline, if the government is going to have to fund it through bad times. Why have so many airlines, if they are not going to complete, and either succeed or fail within the limits of the capitalist context?

Is this a top? It smells like one. I’m saying be cautious. Usually tops have pretty ferocious battles between buyers and sellers, before the buyers eventually capitulate. In terms of poetic justice, GS taking a torpedo the bow should be the end of this rally as GS manipulations were certainly present at the beginning of this rally.

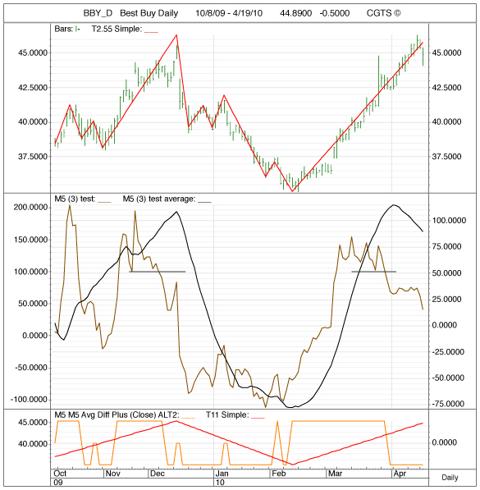

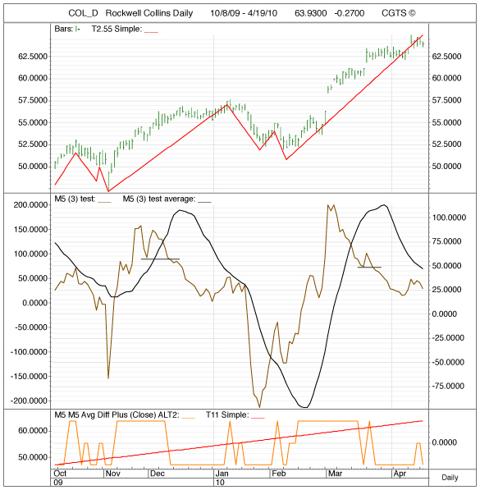

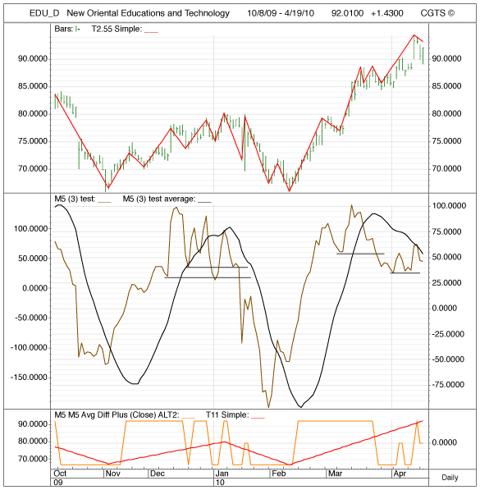

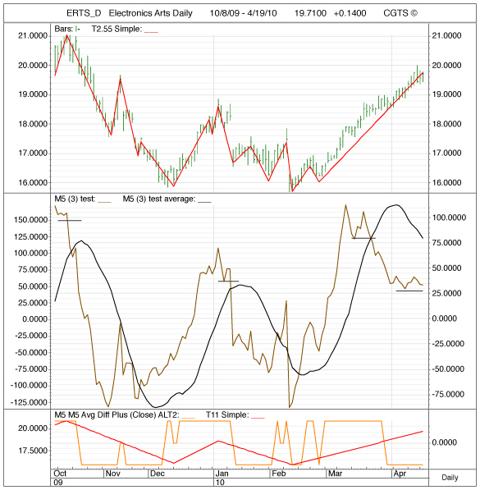

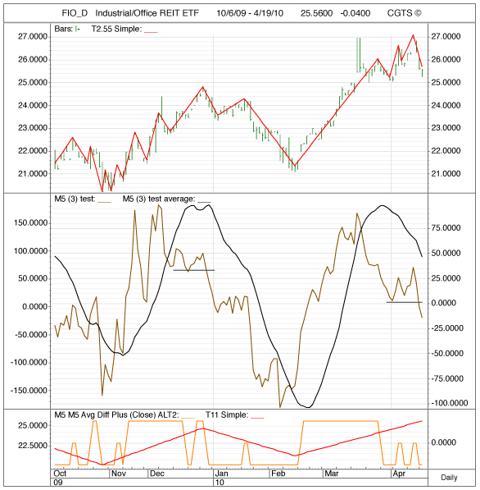

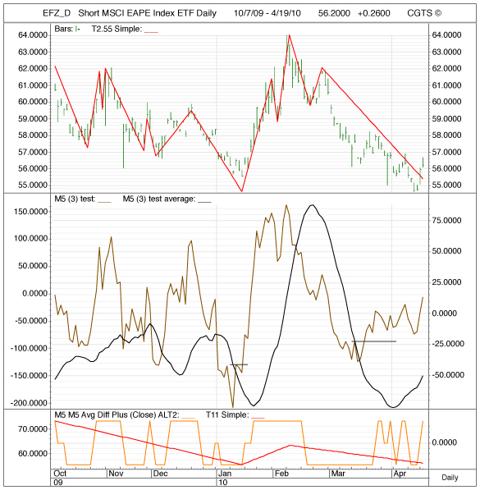

We say watch out for stocks and be liberal about taking prophets. Here’s some stocks that look like they definitely deserve a big red ‘caution’ flag.

Here’s a ‘reverse’ ETF that makes money when stocks go down. It looks to be making the reverse, bottoming, pattern.

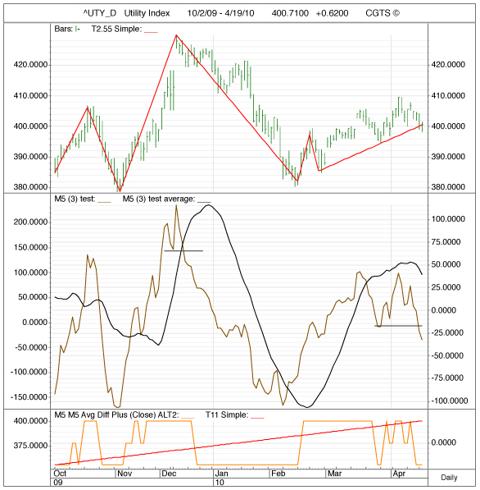

INDEX VIEW

Ok, how do indexes look now?

BKX has broken down it’s short-term trend (red line, top pane). First, momentum breaks down (second pane), then the trends go negative (first, short-term, then intermediate (red line, 3rd pane). So, BKX is indicating more selling in the bank stocks is coming.

Drug stocks are breaking down and should go lower. The gravy train days of price fixing and congressional pandering may be over.

CAC is fighting the good fight, digging in at the trenches. Don’t forget Greece, just because Iceland has taken over the front page. It’s funny: the EU condemns Greece for having too much debt, and then requires them or at least encourages them to take on more debt. What is wrong with this picture?

The Germans are angry with Greece extorting billions from German taxpayers — now the whispering is ‘let’s let the Americans do it’. The IMF? Didn’t the EU want to prove it could take care of its own business and didn’t need Americans hovering around with their bags of money and their ‘I told you so’ attitude?

Hang Sang: a sudden down-draught. Can it hold 20659 support?

Gold stocks look to be in a normal, healthy pull-back. This, too, is worth watching.

Korea seems to be breaking down again.

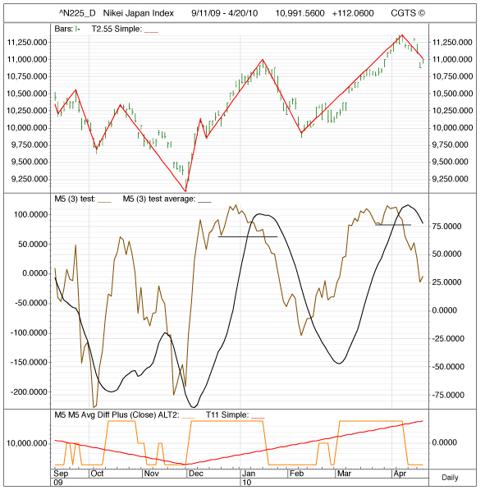

Nikkei similar to Korea: topping.

Shanghai has already broken down and is pushing toward near-term support at 2977.

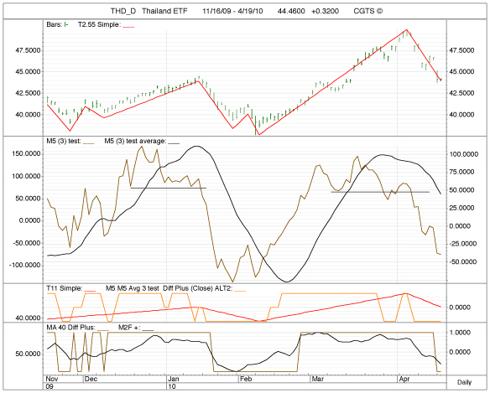

Thailand has the kind of problems the world had in the 1960’s and 70’s. The Reds are taking to the streets by the thousands (rural poor). The Yellows are now threatening to take to the streets as well (urban rich) to oppose the Reds. Look out below.

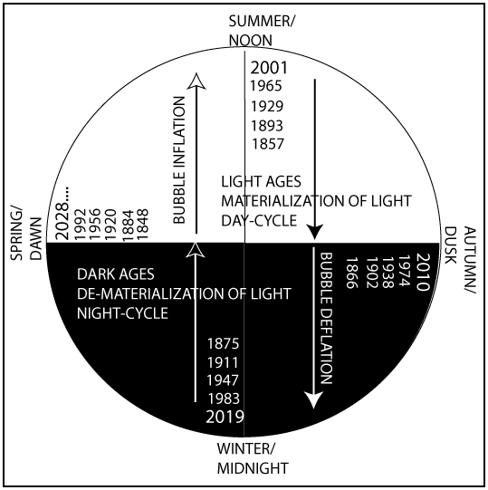

This is a typical Night-Cycle scenario. The current government really needs to step back and begin to reform and include the rural poor in its government, or the lid might blow off a really wonderful country. The Reds are demanding a democracy — the Yellows are apparently concerned that a democracy might take power away from their monarchy. Actually, a rich urban plutocracy now runs the government. Does that sound familiar?

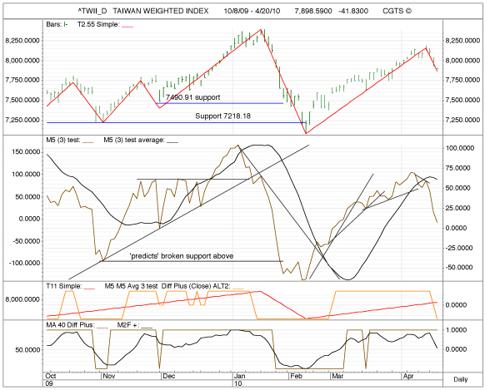

Taiwan is breaking down, after NOT making a new high.

Is the OEX ready to slink back toward reality? Is Dr. Ben still spending our money to see that it doesn’t? (Where is that ‘let’s audit the Fed’ bill, anyway?)

The Swiss Index has really resisted selling. But the momentum decline seems to be in place, even after a valiant recent attempt to reverse the trend.

Be cautious. Things might get ugly for awhile.

More information on this system can be found at

home.mindspring.com/~mclark7/CGTS09.htm

A draft of the book Turn Out the Lights can be found at the website below. This book is a description of the metaphysical causes of the economic cycles of expansion (Day) and contraction (Night).

www.hoalantrangallery.com/Turnoutlights.htm

Michael J. Clark’s Gate Timing System

Hanoi, Vietnam

Disclosure: The author does not own issues he mentions in this post.