Island of Allan

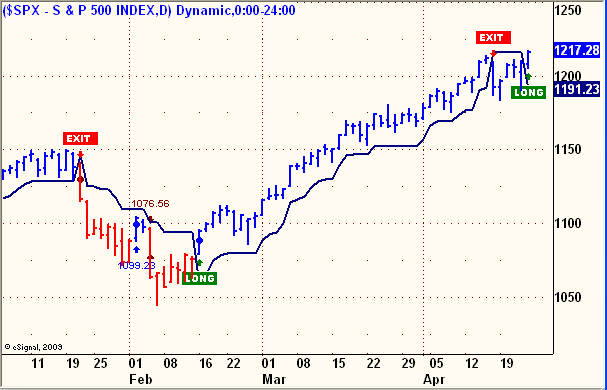

Here is chart of the SPX, which flipped back to the Long side Friday, after a brief, abortive Sell Signal April 16:

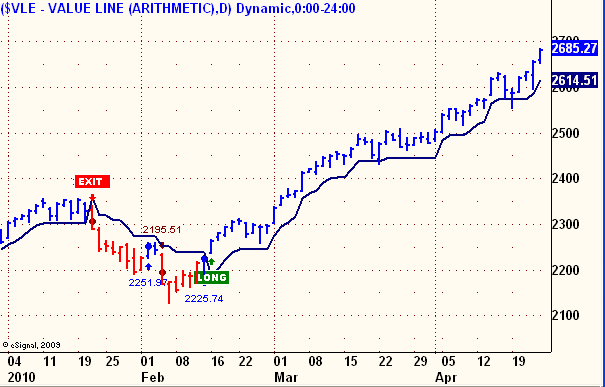

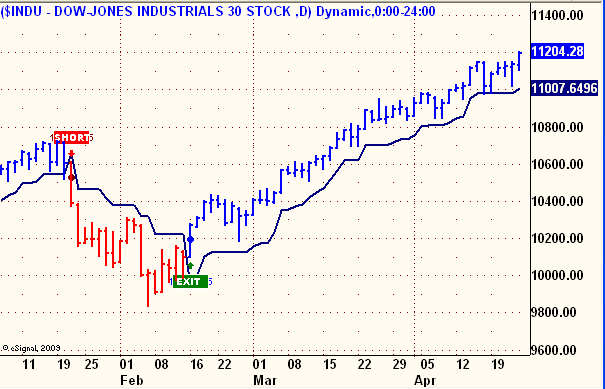

Note how the broader Value Line index and even narrower DJIA never confirmed last week’s SPX Sell:

In the solemnity of our national anthem, this collection of mostly immigrants were unaware that in their future would be a resounding Game 5 victory against a tough, agile and speedy upstart opponent.

In a similar fashion, we embark upon our own challenges, daily. In this spot, we are taking on the financial markets and in the spirt of Ed Koch, former mayor of NYC, "How am I doing?"

From a subscriber to my email list:

For months you’ve been offering a short opinion , while your system was predominately long and right! I think you are at odds with the purpose of a trend following system. Just for the record, your system has been right and profitable, your short opinion has been unprofitable and wrong.

And another, because it meant so much to me:

You are making a difference in my life, outlook, and confidence with regard to trading.

The support you provide, the tutorials, the advice, the lessons, the comment.

I call it the island of Allan in a troubled sea.

Somewhere between the Wings victory last night and these two emails, there is inspiration and penance. Despite occasional dalliances with Armageddon scenarios, my work here has uncovered and exploited the absolute truth of the market. It is not the future, nor the past that guides us, it is the now, a/k/a trend following.

If you’re going to follow something, follow #13 above, Pavel Datsyuk, as inspirational as they come, a Russian hockey player for the Detroit Red Wings, but more then that, a boy who loves his job, his work, his passion. It’s in his smile, his way, his karma. Fallen far from my own, last night I watched in awe as he mastered his game. Time to step up, Allan.

If you are looking for perfection, you will not find it here, nor in the Red Wings, nor in my writings, my life, or my trend tables. But as the subscribers above-referenced point out, there is value here, big value, but it comes with fallibility. Most of Datsyuk’s shots don’t go in the net, but of the ones that do, they make a difference, a consequential, almost eloquent difference, not only for Pavel, but for his teammates; not only for Allan, but for his teammates.

Thirteen is a Fibonacci number. Can we use this to make money in the markets? Yes, by discarding it in its entirety, it is just a number and tells us nothing about how to make money in stocks. One less piece of information to deal with in our work. Eliminate enough errant pucks and what we are left with is something that works; then we trade it.

From my stock trend tables sent out this weekend:

Daily Trends

TNA: Long; Bought 2/16/2010 @ 41.70; current 70.78

AAPL: Long; Bought 3/1/2010 @ 208.99; current 270.83

TZA: Short; Sold 2/12/2010 @ 10.13; current 5.41

Weekly Trends

SSO: Long; Bought 3/1/2010 @ 39.91; current 45.43

FAZ: Short; Sold 3/16/2009 @ 350.00; current 11.09

BIDU: Long; Bought 3/9/2009 @ 172.66; current 645.76

These are some of the trend table’s better trades, so don’t for a minute think they are all that good. In fact, the trend following service didn’t even exist last year, so those trades from early 2009 are all pro-forma, hypothetical, but nonetheless are based on the strict application of a rule-based trading system and methodology. The same rule-based system that is in use today, in real time and real money. A few of the above trades reflect real time application of the methodology.

My point, if there has to be one, is that the opportunity and potential to garner impressive profits from application of systematic approach to trading is there, imperfect as it may be. Throw enough pucks at the net and some are going to go in; just be sure that the ones that miss don’t come back to burn you, don’t go so far the other way as to score against yourself. Built into this system is a fail-safe trailing stop discipline that provides a guard against the risk of ruin; a lesson in life in and of itself.

There is more then a pristine beach to this Island of Allan. Call it a rugged outback, a insect invested swampland, an unbearable abyss of burden and failure. Its all part of the same asylum. You have to pick your spots, follow a trend and go with it. Above all, keep skating, keep you feet moving and don’t stop until you find something that works……….then trade it.

And always, always, beware of the dark side:

Finally, an excerpt from the Weekend Update sent out a few hours ago:

The question I pose up front in AllAllan is,

Why are you here?If the answer is to make money, or to improve your market results, or to find something that works, you are at the right place. Yes, I occasionally proffer market observations or opinions that stray from strict allegiance to the trend tables and the principles of trend following. But ask yourself this, how boring would this become if all I ever did was repeat the mantra, "Respect the Trends?"

My penance for such digressions (thanks again, "C" for your heads-up observations and email), is to devote an entire Weekend Update to illustrate the ease, elegance and efficiency of this trading system.

Enough words and explanations. Let’s get on to the Trend Tables. In the spirit of "C’s" observations, I will let the symbols, tables and trends speak for themselves this week. Instead of trying to figure out where the markets are going in the future, let us focus completely on what direction they are going now. That is clearly set out in the tables below, believe in what you see, it is the absolute, unbending, tough-love truth.

Allan’s newly launched newsletter, “Trend Following Trading Model,” goes with the trend-following trading system he’s been working on for years. Most trades last for weeks to months. Allan’s offering PSW readers a special 25% discount. Click here. For a more detailed introduction to the Trend Following Trading Model newsletter and trading system, read this introductory article.