Courtesy of Benzinga.

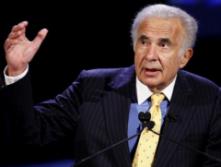

Commercial Metals (NYSE: CMC) announced today that its Board of Directors rejected a takeover bid from investor Carl Icahn, which had been valued at $1.73 billion or $15 per share. The company generates its business primarily through the production and sale of steel and metal products. Icahn had desired a response by 9 AM this morning. Director Anthony Massaro explained the decision, stating “The CMC board believes that Mr. Icahn’s proposal substantially undervalues the company and is an opportunistic attempt to transfer the future value of CMC from its stockholders to Carl Icahn.”

CMC sent a letter to Icahn which detailed its concerns that the offer price was too much of a discount from its 52 week high of $18.09. The company has taken measures to improve its balance sheet and potentially draw a higher offer in the future. These measures include a reduction in the company’s workforce and closure of a mill as well as several production plants.

Icahn clearly does not believe that CMC’s board can create more value for shareholders. To accomplish this task, the billionaire investor could seek to combine the company with PSC Metals, his own metals recycling business and sell off any redundant assets. Commercial Metals was one of the first metals companies to adopt a semi-integrated strategy when expanded into European markets after buying scrapping capacity.

Icahn’s belief that the expansion strategy won’t bear fruit has validity. While the company has managed to succeed in its Polish investments, the planned closure of one of the company’s mills will take place in Croatia, where the company has suffered financial losses. As a result, it has decided that investing additional capital would not result in a turnaround.

Commercials Metals is a difficult stock to trade currently. The stock price jumped nearly 25% once news of Icahn’s offer was made public and it has yet to decline after the company rejected the offer. The company also faces industry risks as demand for steel as slumped and competitors are cutting supplies. The stock faces significant risk in both directions, as failure by Icahn to continue to pursue the company could result in a large decline in its price. Current shareholders continue to hope that Icahn increases his offer.

For more Benzinga, visit Benzinga Professional Service, Value Investor, and Stocks Under $5.