Courtesy of Benzinga.

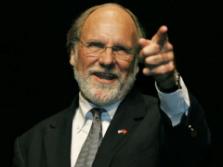

Former MF Global CEO Jon Corzine testified under subpoena on Thursday in front of a House Agriculture Committee Hearing. The executive apologized “to all those affected” by MF Global’s collapse and the subsequent discovery that $1.2 billion in customer funds are missing. He said, “I simply do not know where the money is, or why the accounts have not been reconciled to date.”

Corzine, who is also a former Governor and Senator from New Jersey as well as the former co-chairman of Goldman Sachs (NYSE: GS), oversaw a disastrous bet on European sovereign debt which ended by bringing down his firm. He told the panel that he did not know if there were “operational errors at MF Global or elsewhere, or whether banks and counterparties have held onto funds that should rightfully have been returned to MF Global.”

Today’s proceeding is the first of three for which Corzine has been subpoenaed to testify. Speaking about MF Global’s collapse, Corzine struck a defensive tone. He said that the brokerage firm’s bankruptcy was due in large part to a $119.4 million write-off of tax benefits that could no longer be classified as assets while at the same time calling his $6 billion leveraged bet on shaky European sovereign debt “prudent.”

He added that while he accepted responsibility for the investments, they had been approved by the firm’s board of directors and were disclosed to both MF’s top brass as well as investors. “As of today, none of the foreign debt securities has defaulted or been restructured.”

While technically this view is correct, the fact remains that MF Global was done in as a result of a loss of confidence on the part of investors, analysts, customers, and regulators. This loss of confidence was directly a result of the firm’s leveraged exposure to European sovereign debt. His view on what brought down his company appears to be highly self-serving in the face of evidence to the contrary.

Furthermore, his statement that he doesn’t know where the missing client money went suggests that he is either extremely incompetent or possibly lying. In the latter case, Corzine may end up being held criminally liable in relation to the missing funds.

In any event, he ended his appearance on a conciliatory note, although given his earlier statements, one has to be skeptical. Corzine said, “I sincerely apologize, both personally and on behalf of the company, to our customers, our employees and our investors, who are bearing the brunt of the impact of the firm’s bankruptcy.”

For more Benzinga, visit Benzinga Professional Service, Value Investor, and Stocks Under $5.