Well, on the bright side, what worse can happen?

Well, on the bright side, what worse can happen?

Both the ECB and the BOE left their rates unchanged (because Europe is fine, I guess) but we're still waiting for Draghi (8:05) to explain himself. Yesterday's Fed Beige Book indicated the US is still in a SLOW but steady recovery and we're waiting for Unemployment at 8:30 and Consumer Comfort at 9:45 but it's all about the Non-Farm Payrolls Tomorrow morning (8:30) as the key data-point for the week.

Unfortunately, according to the WSJ, at our present rate of job growth, it will take the US more than a decade to get back to "full employment," which is 4.5% Unemployment. Of course, the WSJ does need to be reminded that, at the Bush rate of job losses, no one in the country would have had a job by the end of the decade so, despite their concerns – we are a bit better off than we were 5 years ago. Slow and steady does indeed win the race, especially when the alternative is plunging headlong into the depths of Economic Hell…

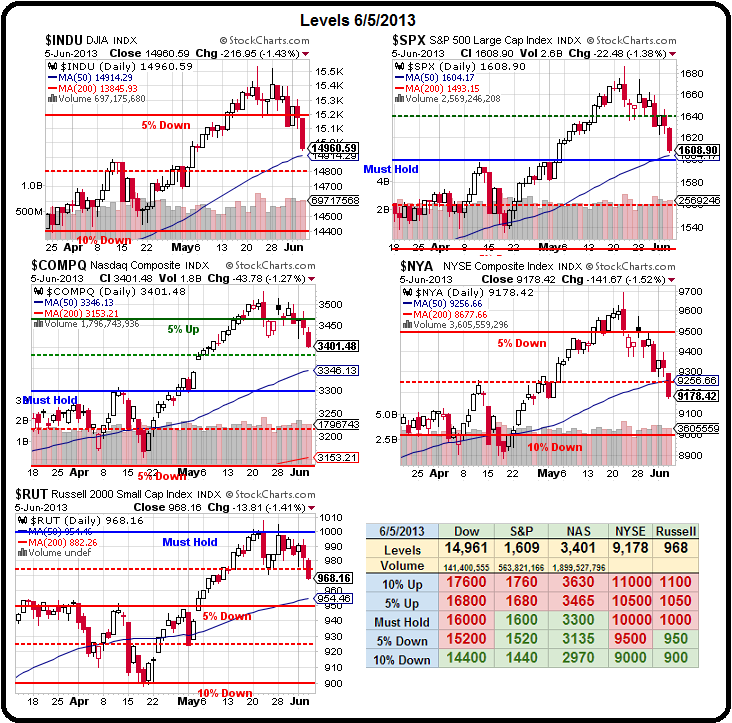

Speaking of plunging – as you can see from our Big Chart, we're hitting our predicted pullback targets (the 50 dmas) already so of course we expect a little bouncing action. As I noted to our Members yesterday, we expect at least weak bounce levels to be made on our indexes and those are, according to our 5% Rule® (see original comment for details):

- Dow 15,108 (weak bounce) and 15,216 (strong bounce)

- S&P 1,622 and 1,634

- Nasdaq 3,420 and 3,440

- NYSE 9,280 and 9,360

- Russell 975 and 981.40

Notice that Russell 975 was the breakdown line we predicted last Wednesday and now it's forming overhead resistance – so we'll be keeping a very sharp eye on that line for directional plays. Anything less than a weak bounce will keep us bearish this morning and, if we fail to retake those weak bounce lines today, nothing less than a strong bounce will get us off the bearish bandwagon we jumped on last week. Of course, we don't just talk the talk at Philstockworld, we also walk the walk and, over the weekend, I wrote "Hedging For Disaster – 3 More Option Plays that Make 300% if the Market Falls" (as we already had other bear plays from Member Chat) and, already, we can see some good results:

Notice that Russell 975 was the breakdown line we predicted last Wednesday and now it's forming overhead resistance – so we'll be keeping a very sharp eye on that line for directional plays. Anything less than a weak bounce will keep us bearish this morning and, if we fail to retake those weak bounce lines today, nothing less than a strong bounce will get us off the bearish bandwagon we jumped on last week. Of course, we don't just talk the talk at Philstockworld, we also walk the walk and, over the weekend, I wrote "Hedging For Disaster – 3 More Option Plays that Make 300% if the Market Falls" (as we already had other bear plays from Member Chat) and, already, we can see some good results:

- DIA June $148 puts at .60 (as low as .31 on Tuesday morning's move up), now $1.44 – up 140%

- DIA Aug $147 puts at $1.72, now $3.15 – up 83%

- TZA Oct $30/37 bull call spread at $2, now $2.30 – up 15%

- DXD July $35 calls at $1.20, selling July $38 calls for .55 for net .65, now .90 – up 38%

- TZA Oct $30/37 bull call spread at $2, selling Oct $24 puts for $1.05 for net .95, now $1.55 – up 63%

- SDS July $37 calls at $3.30, selling July $41 calls for $1.40 and selling KO Jan $35 puts for .90 for net .90, now $1.59 – up 76%

So far, so good with those hedges (and yes, I know, there's 6 not 3 – I was very generous) and, of course, they are all capable of making 300% or more so, in general, they are merely "on track" with these fantastic 3-day gains. As usual, the longer bull call spread on TZA has the least movement but TZA is at $33.13 so the spread is $3.13 in the money and only showing net $2.30 because the caller still has premium and we KNOW that eventually wears down. It's good to layer combinations of short and long-term hedges as we can take off the quick profits and let the slow ones ride. As noted above, those weak bounce lines make for easy stops for early profit taking – especially for direction bets like DIA, that are already up 100% (shame on you if you leave 100% short-term gains on the table!).

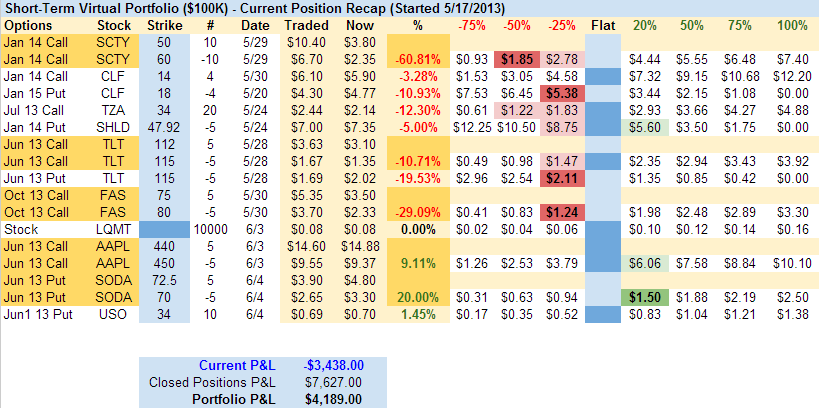

Meanwhile, our virtual Short-Term Portfolio is flying with a $4,189 gain as of yesterday's open (as always, we've made changes in Member Chat since), which is really good in less than 3 weeks! We had a little scare with SODA flying up pre-market on complete BS rumors that PEP was going to buy them (we entered the trade on BS rumors that KO would buy them) and it's amazing how many legitimate news sources picked this story up as if it were a fact:

Meanwhile, our virtual Short-Term Portfolio is flying with a $4,189 gain as of yesterday's open (as always, we've made changes in Member Chat since), which is really good in less than 3 weeks! We had a little scare with SODA flying up pre-market on complete BS rumors that PEP was going to buy them (we entered the trade on BS rumors that KO would buy them) and it's amazing how many legitimate news sources picked this story up as if it were a fact:

- PepsiCo in Talks to Buy SodaStream: Calcalistat Bloomberg (Thu 1:59AM EDT)

- Sodastream Surges in German Trading on PepsiCo Takeover Reportat Bloomberg (Thu 3:15AM EDT)

- PepsiCo in talks to buy SodaStream for $2 bln -reportat Reuters (Thu 3:18AM EDT)

- Sodastream Could Be a Threat to 'Big Soda'TheStreet (Thu 6:00AM EDT)

- PepsiCo reportedly sets sights on SodaStreamat MarketWatch (Thu 6:33AM EDT)

- PepsiCo CEO says SodaStream talks 'completely untrue,' CNBC reportsat theflyonthewall.com (Thu 7:17AM EDT)

My comments in early morning Member Chat while this was going on say it all:

My comments in early morning Member Chat while this was going on say it all:

Son of a bitch! The hot rumor on Tuesday was that Coca-Cola in interested in buying SodaStream (SODA); today's hot speculation is that PepsiCo (PEP) is in negotiations to acquire the Israeli company for $2B or more, well above its market cap of $1.43B. PepsiCo could even be willing to pay as much as $95 a share, or 37% more than SodaStream's close of $69.35 yesterday. However, the latter also wants to check its options with Coca Cola. – This story is from The Calcalist, the same Israeli business magazine that said FB was buying Waze, which turned out to be totally untrue. Our move will be to buy back the short puts in the STP and keep our long puts, most likely as this is the same nonsense as KO was a couple of days ago – I wish I could short them now ($89).

SodaStream (SODA +26% to $87.01) shares froth effervescently following a report that PepsiCo (PEP) is in negotiations to acquire the Israeli company for $2B or more and is willing to pay up to $95/share. Barclays says that a deal would be "earlier cycle than we would have thought." – What idiots! They don't have the balls to say "this sounds like BS to us!" I can't believe what passes for news these days. Of course, no arrests will be made.

Yes, very sadly, no arrests will be made. That's the second time this week the same Israeli magazine has pumped up the share price of an Israeli company on COMPLETELY FALSE rumors of the company being bought and NOTHING HAPPENS. Shame on the MSM and the way they run with this nonsense before confirming it – especially when the "news" is coming from such a questionable source. We jumped on the bear put spread in our Short-Term Portfolio when they floated the KO buyout rumor and, had the rumor persisted into the morning, we would have bought back the short puts we sold and kept or even rolled up the long puts we owned to take advantage of that nonsense. That's the difference between Fundamental and Technical trading!

Speaking of BS rumor-driven rallies – TSLA – enough said…

As it turns out, it doesn't look like we'll be stopping out any of our bearish bets this morning as the Futures have turned negative as Draghi's commentary did nothing to inspire the bulls with that Central Bankster saying the ECB is "technically ready" to use negative rates, but sees no reason to act right now. No reason??? Greek unemployment is at 26.8% and he sees no reason???

Amazingly, no arrests will be made…