Courtesy of Declan.

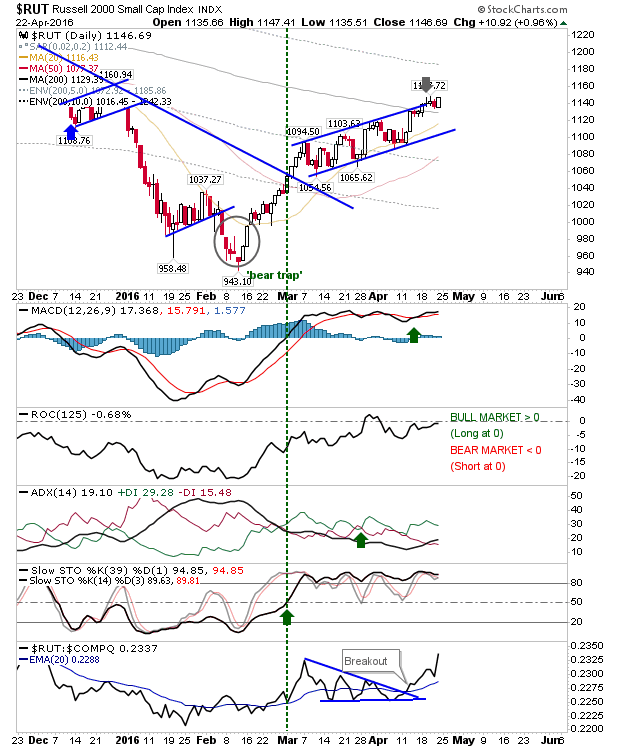

Small Caps were the chief winner on Friday with a near 1% gain. Such action will have pressured Shorts who may have jumped on Thursday’s selling from channel resistance. Rate-of-Change is still holding to the bearish side of the market, although other technicals are bullish; relative performance in particular.

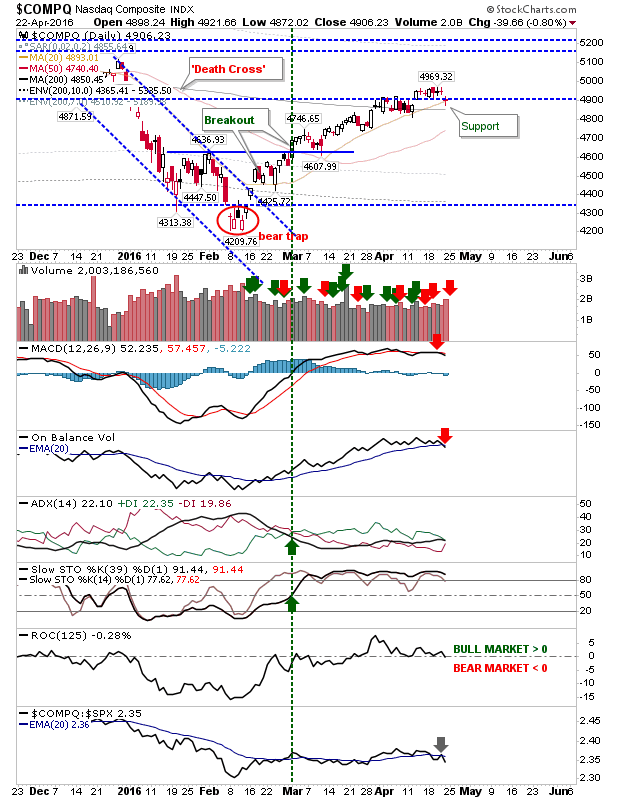

The Nasdaq gapped down to support and is close to confirming a ‘bull trap’. A loss on Monday (i.e a close below 4,900) would confirm. Bulls can look to the 20-day MA to mount a challenge. Bears have the benefit of a ‘sell’ trigger in MACD and On-Balance-Volume, along with continued relative underperformance.

The S&P found support and rebounded, but in the process of doing so maintained a MACD trigger ‘sell’. Also, from the end of April the S&P has been underperforming relative to the Russell 2000. This may be of greater benefit of bulls as money will eventually cycle from speculative (Small Cap) issues to more defensive (Large Cap) stocks.

For Monday, bulls can look to the Russell 2000, bears should watch for a confirmation of a ‘bull trap’ in the Nasdaq.

Long Term bulls should watch the S&P – it’s closest to all-time highs. Should this occur it would confirm the January/February swing low as a pullback in the 2009-present bull market, and not the start of a new bear market (2015-present).

You’ve now read my opinion, next read Douglas’ and Jani’s.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.