Courtesy of Declan.

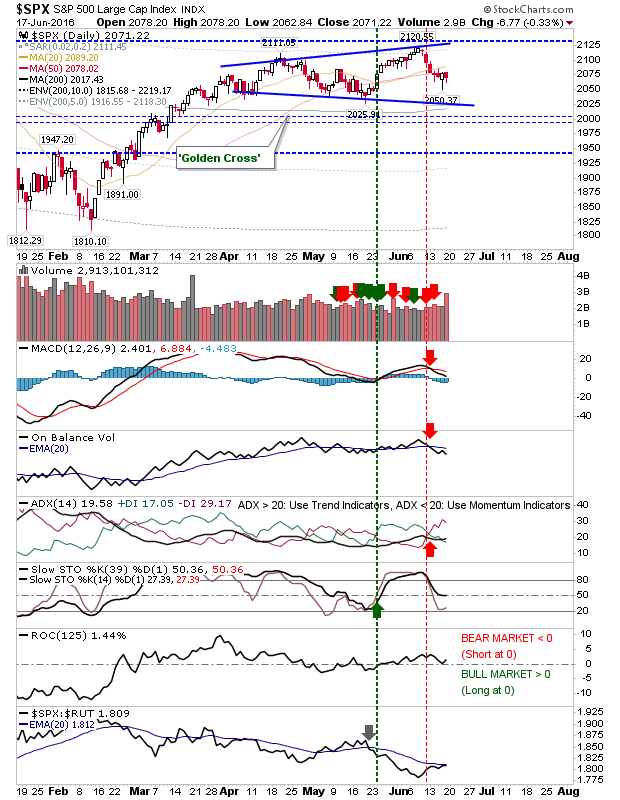

Bears returned on Friday, but weren’t able to undo the action of bulls from Thursday. Volume did climb, registering as distribution, but Thursday’s lows held.

The S&P turned net bearish with stochastics [39,1] crossing below the mid-line. While relative strength (to the Russell 2000) improved.

The Nasdaq returned below its 200-day MA as technicals also returned net bearish. Of the indices, it’s the one most feeling the pressure from sellers. Keep an eye on the broadening wedge; despite Thursday’s positive period of buying, it occurred well away from what looks like should be support.

The Russell 2000 didn’t lost too much ground, although it was worrying to see Friday’s action close near the lows with a small upper shadow denoting failed buying pressure – it’s likely this index will see a test of Thursday’s low.

Bulls can look to the Semiconductor Index. Where bearish pressure in other indices suggests more to follow on Monday, the Semiconductor Index did manage a positive test of 685 with a bounce higher. Technicals are not as weak as they are for other indices (although still not great either!).

For Monday, look for sellers to continue their work from Friday. If bulls are able to offer something from the start, then the Semiconductor Index is likely to be the index to benefit most (with the Nasdaq and Nasdaq 100 closely following suit).

You’ve now read my opinion, next read Douglas’ and Jani’s.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.